- The 30-year-old US Treasury Division has gained the spike at 4.98%, the very best in recent times.

- Bitcoin may face a $476 million liquidation with a liquidation of lower than $74,000.

- Roughly $1 billion in a weak quick place of over $78,000.

Bitcoin slid in direction of $77,000 on Friday after a speedy motion within the US bond market sparked considerations throughout dangerous belongings.

Traders fled the longtime Treasury ministry as 30-year yields rose to 4.98%, marking the most important soar of the yr.

Background: The stunning reintroduction of worldwide tariffs by US President Donald Trump. This rattles out a market already delicate to inflation and debt threat.

Analysts at the moment are warning of liquidity crunch if Bitcoin falls beneath $74,000.

Yield reached 4.98% because of tariff shock

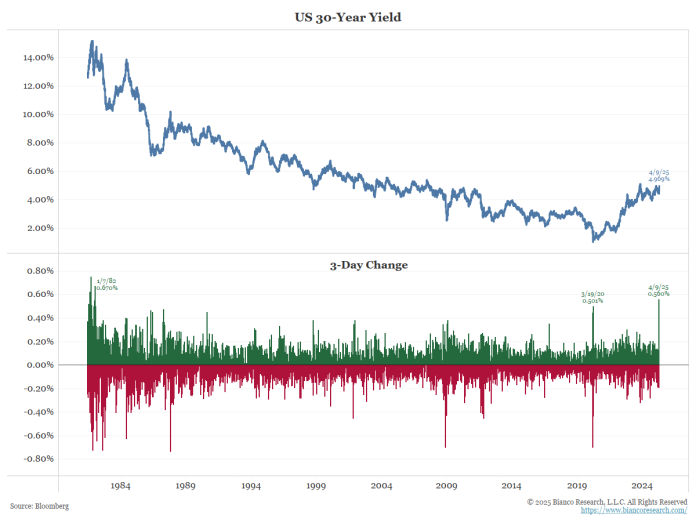

The US Treasury yields for 30 years jumped above 4.98% in response to Trump’s recent tariff announcement, curbing fears of rising inflation and financial instability.

The transfer represents one of many largest day by day yields since 2020.

The surge is as a result of traders worth the worth of a better authorities borrowing value and a extra protectionist US commerce stance.

The bond gross sales have been very sharp, and a few market watchers in contrast it to occasions within the early Eighties.

Well-known analyst Jim Bianco mentioned he noticed the most important transfer on X since 1982, since rates of interest have been a lot greater.

He urged that sudden spikes usually tend to be attributable to compelled liquidation of bond holdings by massive establishments fairly than pure buying and selling patterns.

Bitcoin faces a $476 million liquidation threat

Bitcoin, usually seen as a hedge in opposition to conventional monetary market turmoil, didn’t escape the fallout.

The world’s largest cryptocurrency fell by about 2% in 24 hours, buying and selling round $77,260 on the time of writing, with market capitalization all the way down to $1.53 trillion.

Supply: CoinMarketCap

In keeping with Coinglass knowledge, if Bitcoin falls beneath the $74,000 threshold, it may liquidate an extended place of round $476 million, doubtlessly triggering a cascade of margin calls.

Conversely, if Bitcoin recovers and exceeds $78,000, the quick vendor might be compelled to cowl his place, placing an estimated $982 million in threat of liquidation.

This tug-of-war between the Bulls and the Bears has made the market significantly delicate to exterior shocks, similar to coverage bulletins from bond markets and main economies.

Future volatility within the crypto market

Volatility is looming within the quick time period, however some crypto analysts stay cautiously optimistic.

Market individuals are intently watching the $74,000-$78,000 vary as any break can set off a sequence response within the crypto market.

Ryan Lee of Bitget Analysis predicts that Bitcoin may rise to $95,000-$100,000 by the top of 2025, as procrypt circumstances emerge and macroeconomic pressures change into simpler.

This can push the worldwide Crypto Market capital letters up once more, previous $3 trillion.

Within the meantime, the main target will probably be on how international traders will reply to new US tariffs and whether or not the Treasury continues to see gross sales strain over the long run.

A protracted-term surge in yields can imply broader risk-off sentiment, affecting not solely Bitcoin but in addition shares and commodities.

Macros create market strain

With rates of interest nonetheless rising and inflation not totally managed, markets change into more and more weak to coverage adjustments.

Current selloffs spotlight how weak traders really feel stays, particularly when main adjustments like tariffs reenter the equation.

Bitcoin’s efficiency is intently linked to those macro shifts.

Strikes beneath main assist may ship shockwaves by means of decentralized monetary markets and altcoins, which is able to rely upon Bitcoin stability to take care of bullish momentum.

On the similar time, the bond market not affords the security web it as soon as did.

As yields rise, bond costs fall. In different phrases, even so-called protected haven belongings may cause losses below sure financial circumstances.

Traders are navigating more and more harmful terrain as Bitcoin spans the Treasury, the place strain is underway.

For the subsequent few days, you may decide whether or not the $77,000 stage will probably be retained or in the event you make a bigger revision.

Publish-Bitcoin fell to $77K as bond yields first appeared within the Coin Journal as Trump’s tariffs jumped.