- Bitcoin and digital belongings ETP face report leaks amid market instability.

- The US Spot Bitcoin ETF noticed its withdrawal of over $1 billion on February twenty fourth.

- The XRP ETP confirmed resilience with an influx of $308 million regardless of the market droop.

Digital Asset Trade Commerce Merchandise (ETPs) and Bitcoin-specific funds have lately seen outflows, with Bitcoin and different cryptocurrencies feeling the influence of market volatility.

James Butterfill, head of analysis at Coinshares, famous that the $2.6 billion outflow this week represents the biggest leak on report for Bitcoin and digital asset ETP. Nonetheless, he factors out that gross sales look like cooling as commerce is rewind.

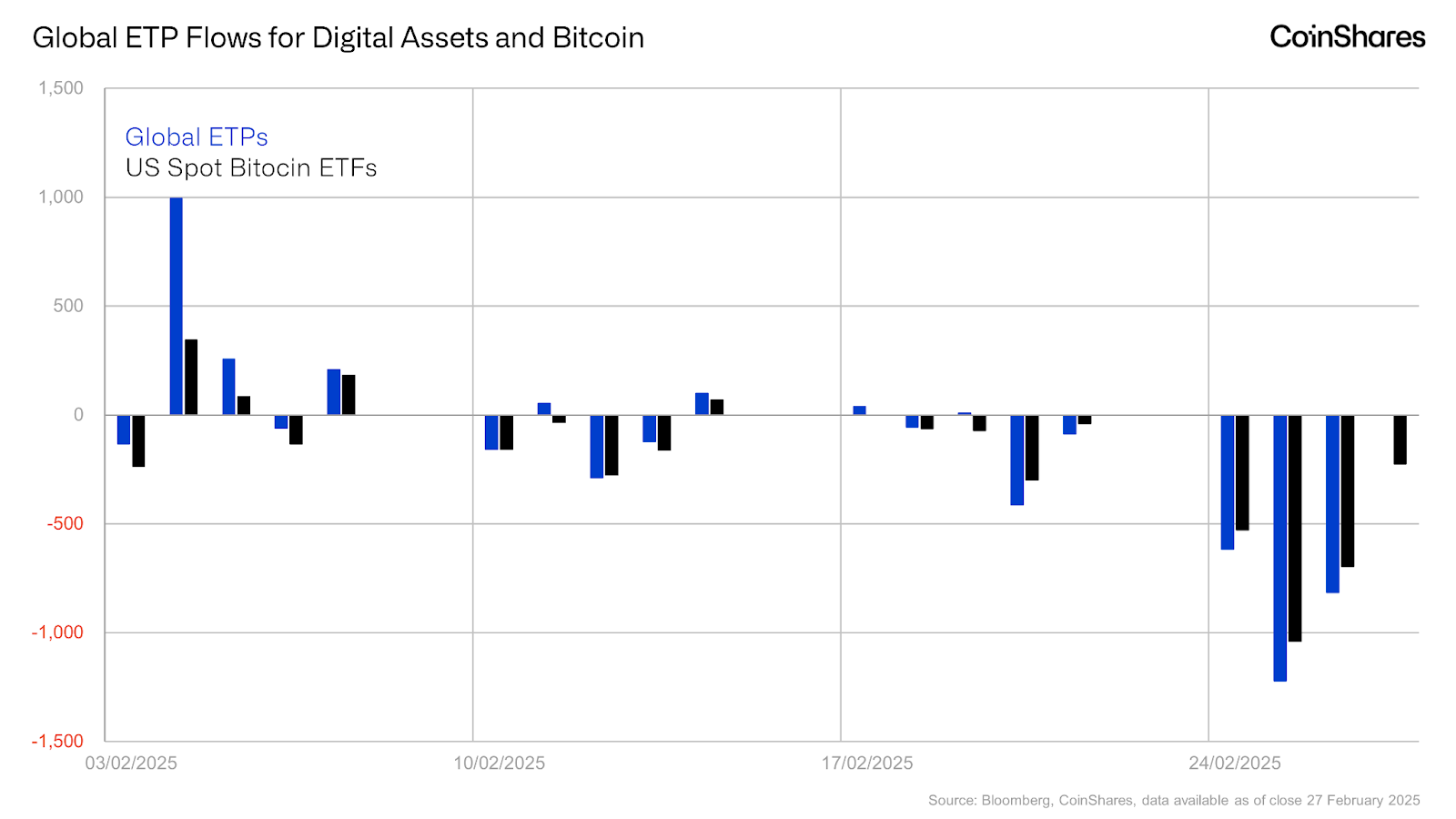

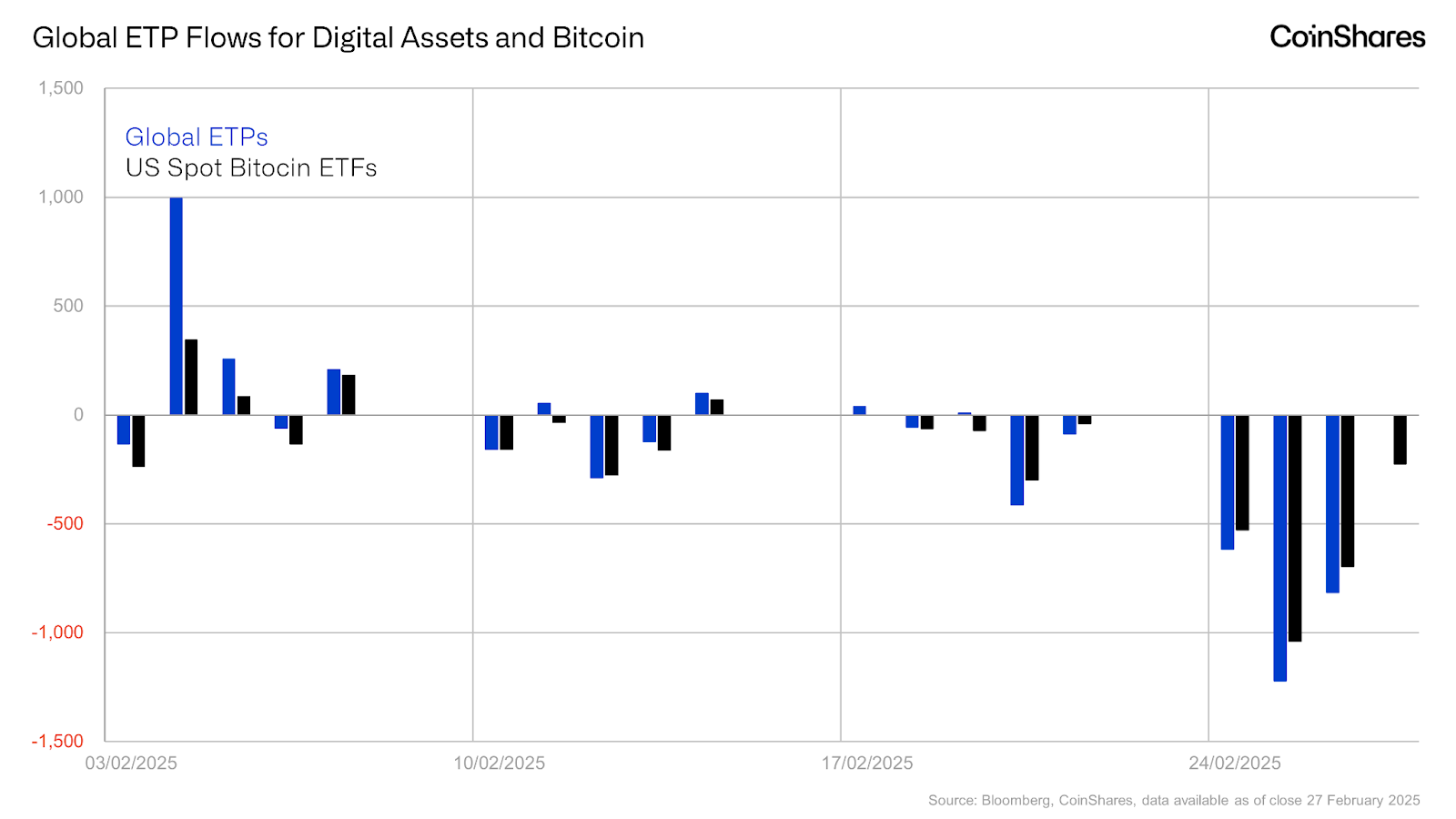

From February third to February twenty fourth, 2025, there was appreciable fluctuation within the world ETP marketplace for digital belongings, together with Bitcoin. The market has skyrocketed, with world ETP displaying inflows of over $1 billion. This peak was adopted by a decline within the subsequent few weeks, together with notable dips on February tenth and seventeenth.

Though there was extra motion within the basic market, US spot Bitcoin ETFs maintained steady efficiency throughout this era. Nonetheless, probably the most notable occasion occurred on February twenty fourth, when Bitcoin ETF noticed the leak, displaying a shift in traders’ sentiment regardless of rising financial uncertainty.

Associated: Crypto Big Coinshares reduces Bitcoin ETP administration charges

Spot Bitcoin ETFs endure large losses

The US Spot Bitcoin ETF, a part of an 11-second permitted Bitcoin fund, recorded the largest ever leak on February 24, with over $1 billion in investments withdrawn in 24 hours.

This uncommon selloff marked the worst day for Bitcoin ETFs since its introduction final yr, surpassing earlier report, when Outflows hit $672 million in December.

Associated: Spot Bitcoin ETF Surge Sette To Eclipse $50 Billion Crypto ETP Market

Bitcoin ETF leak: financial issues and market pressures

These withdrawals got here six days after the funds misplaced greater than $2 billion in worth.

This large exit follows issues about US financial coverage, notably commerce tariffs, inflation and the current inauguration of the US president. These elements put stress on the crypto market and have continued to decrease digital asset costs.

XRP ETPS sees inflow contrasting Bitcoin developments

Moreover, the leak focuses on Bitcoin, the main cryptocurrency, accounting for $571 million. In distinction, Altcoin ETP, which incorporates XRP, confirmed extra resilience. XRP ETPS has recorded an inflow of $38 million and continues the investor optimism pattern, fuelled by the idea that the Securities and Trade Fee (SEC) may quickly drop the lawsuit in opposition to Ripple. Since November 2024, XRP ETP has seen an influx of $819 million.

The decline in Bitcoin costs displays challenges within the broader market. Since early February, Bitcoin has fallen under $85,000 from greater than $100,000 on account of US commerce coverage, high-profile hacks from Crypto Trade Bybit, and numerous Memecoin scandals.

Disclaimer: The data contained on this article is for info and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version isn’t responsible for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.