Bitwise Chief Funding Officer (CIO) Matt Hogan highlighted the numerous improve in institutional funding in Bitcoin exchange-traded funds (ETFs) within the second quarter, regardless of BTC’s worth dropping 12% over three months.

In an up to date investor be aware dated Aug. 20, Hogan highlighted the rising curiosity, saying:

“Bitcoin's worth fell 12% in Q2 2024, and plenty of had been involved that this is able to trigger institutional buyers to drag out of the market. The reply was a powerful 'no.'”

Previous adoption charges

Hogan emphasised that institutional adoption of Bitcoin ETFs is going on at an unprecedented tempo.

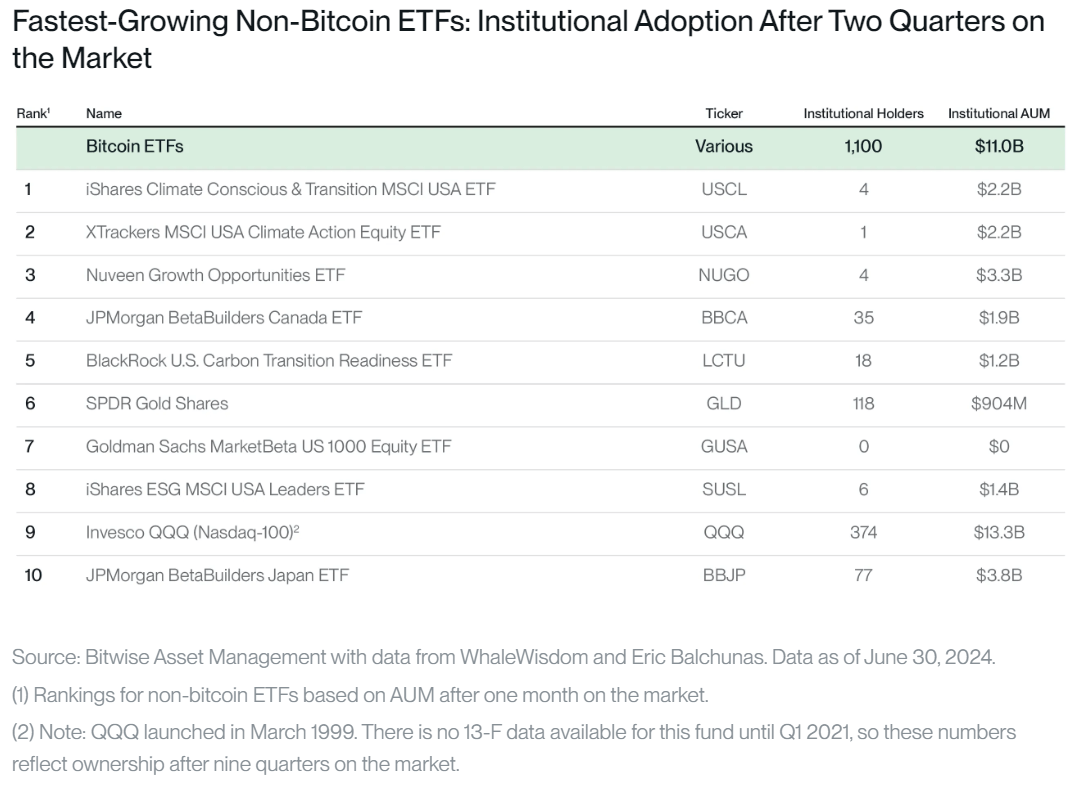

Based on him, the variety of institutional buyers holding Bitcoin ETFs elevated 14% from the earlier quarter to 1,100 from 965. These buyers now management 21.15% of Bitcoin ETF's complete belongings underneath administration (AUM), up from 18.74%. By the top of the second quarter, institutional holdings in Bitcoin ETFs totaled $11 billion.

Regardless of 112 buyers liquidating their Bitcoin ETF positions within the second quarter, 247 new companies entered the market, leading to a internet achieve of 135 institutional buyers.

Hogan famous that the extent of adoption of a Bitcoin ETF is corresponding to the early development of Invesco's QQQ ETF, which launched in March 1999. Notably, the BTC ETF attracted thrice as many institutional buyers in simply two quarters.

Hogan addressed issues about evaluating Bitcoin ETFs as a bunch versus particular person ETFs, saying the latter proceed to dominate. For instance, Bitwise's Bitcoin ETF, which ranked fourth by belongings underneath administration on the finish of June, had extra institutional buyers (139) than SPDR's GLD ETF (118) on the identical stage of growth.

Contemplating these figures, Hougan concluded:

“The historic adoption of a Bitcoin ETF by retail buyers shouldn’t obscure the truth that the Bitcoin ETF is gaining institutional help at a sooner tempo than every other ETF in historical past.”

Increasing the Portfolio

Bitwise's CIO predicted that institutional publicity to the flagship digital asset will improve within the coming years.

Based on him, the median institutional investor at present allocates simply 0.47% of their portfolio to Bitcoin, however this determine might exceed 1% inside a yr. He defined that skilled buyers have a tendency to extend their publicity to cryptocurrencies step by step, usually beginning at 1% or much less and finally growing it to 2.5% and even 5%.

Hogan added:

“The primary yr will be robust, however the momentum tends to select up within the second, third, fourth and fifth years. I'm hopeful the identical will occur right here.”