- Bitcoin (BTC) specialists count on June to be bullish on the again of historic knowledge.

- In keeping with Willy Woo, June has traditionally been trending towards bullish motion.

- Consultants say the actual alternative is when the market returns to its common, not throughout excessive swings.

Bitcoin fanatics are hoping for a potential bull market rally in June, in keeping with analysts talking on Twitter. Bitcoin fundamentals knowledge analyst Willy Wu notes that regardless of the sometimes flat or bearish summer time market development, June has proven a constantly bullish development through the re-accumulation section. He recommended that previous knowledge confirmed. In the meantime, analyst “Colin Talks Crypto” added a twist, questioning the accuracy of sure indicators.

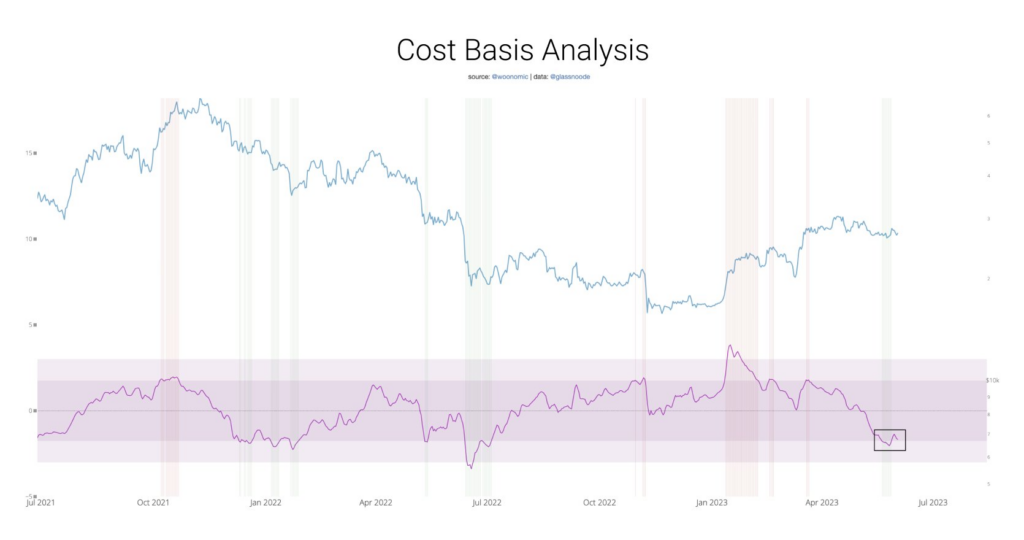

In a sequence of tweets, Willie Wu emphasised the significance of analyzing Bitcoin’s value base to gauge potential market strikes. He identified that the indicator in query, proven in purple on the chart, represents pricing relative to the fee base. Wu suggested in opposition to oversimplifying market dynamics and cautioned in opposition to blindly following a single sign in funding choices.

Increasing on Wu’s clarification, the intense pink areas on the chart signify excessive zones the place Bitcoin pricing deviates considerably from value norms. Nonetheless, these excessive deviations are inclined to provoke mean-reverting paths to the middle, presenting potential alternatives for market contributors.

CBBI and related indicators present precious perception, however analysts consider it is necessary to train warning when decoding their indicators. Wu clarified that these oscillators point out a chance when the market begins to mean-revert towards the middle, fairly than throughout an excessive transfer. This clarification highlights the significance of understanding the broader context and adopting a holistic strategy to analyzing Bitcoin’s market dynamics.

Because the Twitter dialog between these analysts continues, market contributors are wanting ahead to the anticipated “BTC crash window” in June. Bitcoin fanatics and traders are preserving a detailed eye in the marketplace as historic knowledge and cost-based evaluation affirm the bull market upside potential.

Comments are closed.