- That is the bottom bitcoin that has fallen since November 2024

- Trump’s commerce tariffs are prone to have an effect on crypto market costs as buyers look elsewhere and find yourself buying and selling

- Two crypto hacks aside two days have exacerbated buyers’ emotions

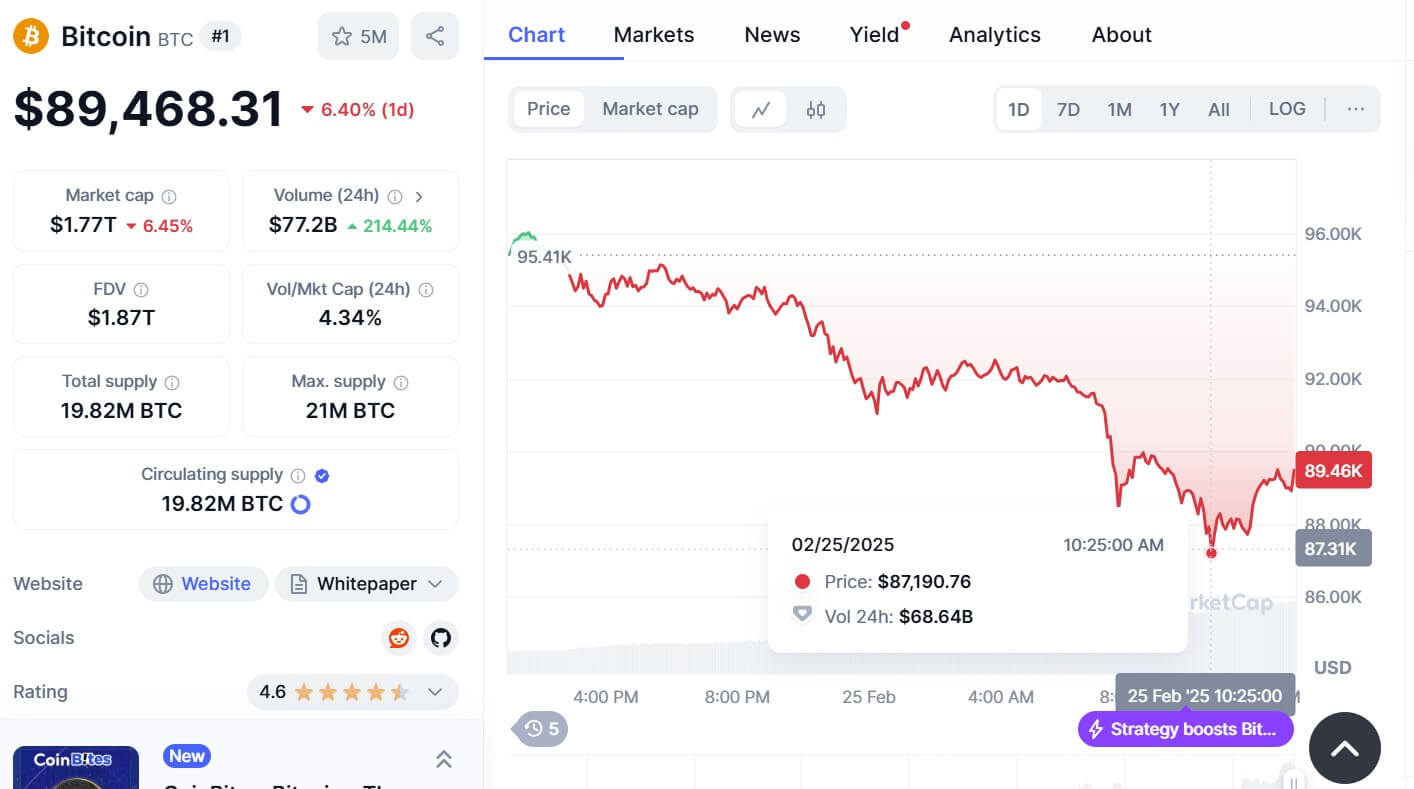

Bitcoin’s worth is beneath $90,000, indicating the bottom decline in primary crypto property since November 2024.

Bitcoin was buying and selling at round $87,190 at 10:25 UTC on February twenty fifth, in keeping with CoinMarketCap knowledge. On the time of publication, it has risen barely, however stays beneath $90,000. This is a crucial one that stays in bullish territory.

Bitcoin might drop to $70,000 if giant hedge funds are bought at Bitcoin Alternate-Traded Funds (ETFS), in keeping with Arthur Hayes, co-founder of Bitmex.

The impression of Trump’s tariffs

The decline in worth comes amid uncertainty about inflation, the insurance policies of US President Donald Trump, and geopolitical occasions.

Yesterday, Trump confirmed 25% commerce tariffs in Canada and Mexico, inflicting the market to react as buyers flip elsewhere to spend cash.

In response to James Tredano, COO of Unity Pockets, many believed that when Trump entered the White Home and added to the Coin Journal, Bitcoin costs would rise.

“However in actuality, costs are fearing maybe fearing the tariff commerce battle, fragile peace negotiations in Jap Europe, and the impression on the US expertise sector. Nonetheless, this additionally makes it attainable to pricing. It may very well be an instantaneous expiration of the rationale.”

Violation of safety with Bibit

Final week, Hong Kong-based Crypto Alternate Bybit was the goal of a serious hack, ensuing within the lack of round $1.5 billion value of Ethereum from one pockets.

Regardless of Bybit’s founder and CEO Ben Zhou, he stated he “closed the ETH hole utterly” and raised cash to lift funds and lift buyers’ belief.

Not solely that, Neobank Infini acquired a $50 million hack yesterday. Studies say Insider Entry can now manipulate good contracts on platforms developed after hackers retained administrative privileges unknown to Infini.

Following the theft, hackers transformed the stolen USDC to DAI, then bought 17,696 Ethereum.

“As well as, Bitcoin’s international macroeconomic uncertainty and recession are weighted by Bitcoin as threat property stay so delicate to exterior strain,” Toredano stated.

“It must be famous that the inventory market pioneer S&P 500 exceeded 4% final month and exceeded 2% within the final week alone. 2 and 4% factors make little sense within the crypto zone, however These numbers are notable in Tradfi when it comes to losses.”

(tagstotranslate) Market