Bitcoin (BTC) is pegged to a slender buying and selling vary, fluctuating between $30,000 and $31,000. Some on-chain indicators level to this ongoing sideways motion being noticed previous to Bitcoin’s final bull run, however nothing signifies a serious shift might be imminent. Virtually by no means.

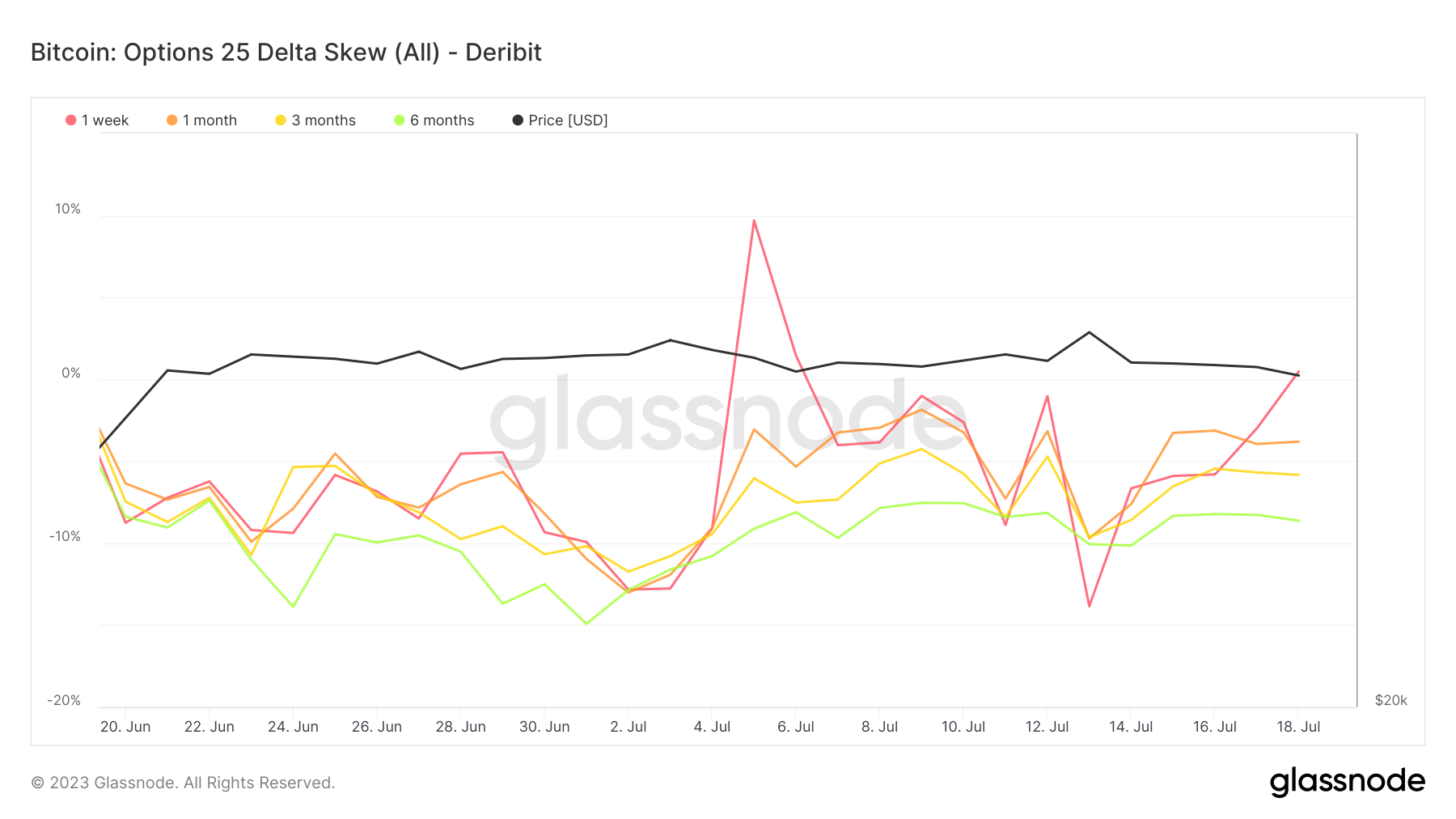

Derivatives markets, and choices markets specifically, have revealed that they’re divided over the efficiency of Bitcoin. This division is clear when analyzing Bitcoin choices delta skew. The delta skews for choice contracts expiring 1 week, 1 month, 3 months and 6 months from now are 0.48%, -3.8%, -5.83% and -8.62% respectively.

Delta skew, often known as ‘skew’ or ‘danger reversal’, is a measure of market sentiment usually used within the choices market. It measures the distinction in implied volatility between out-of-the-money (OTM) places and OTM calls.

When the market is bullish, merchants are prepared to pay more cash for the chance to purchase an asset, so an OTM name choice (an choice to purchase above the present value) turns into an OTM put choice (an choice to promote under the present value). ) has greater implied volatility than . Costs are anticipated to rise sooner or later. This case ends in optimistic delta skew.

Conversely, when the market is bearish, the implied volatility of OTM put choices is greater than OTM name choices, leading to unfavourable delta skew. On this case, the dealer expects the worth to fall and is due to this fact prepared to pay more cash for the prospect to promote the asset at a better value sooner or later.

The 0.48% delta skew for Bitcoin choices expiring in per week is barely optimistic, indicating a reasonably bullish to flat sentiment for Bitcoin within the brief time period. Nevertheless, choices expiring at 1 month, 3 months, and 6 months have unfavourable delta skews (-3.8%, -5.83%, and -8.62%, respectively), suggesting that long-term market sentiment is more and more instructed to be bearish. Merchants anticipate the worth of Bitcoin to fall and are prepared to pay extra for alternatives to promote Bitcoin at a better value sooner or later.

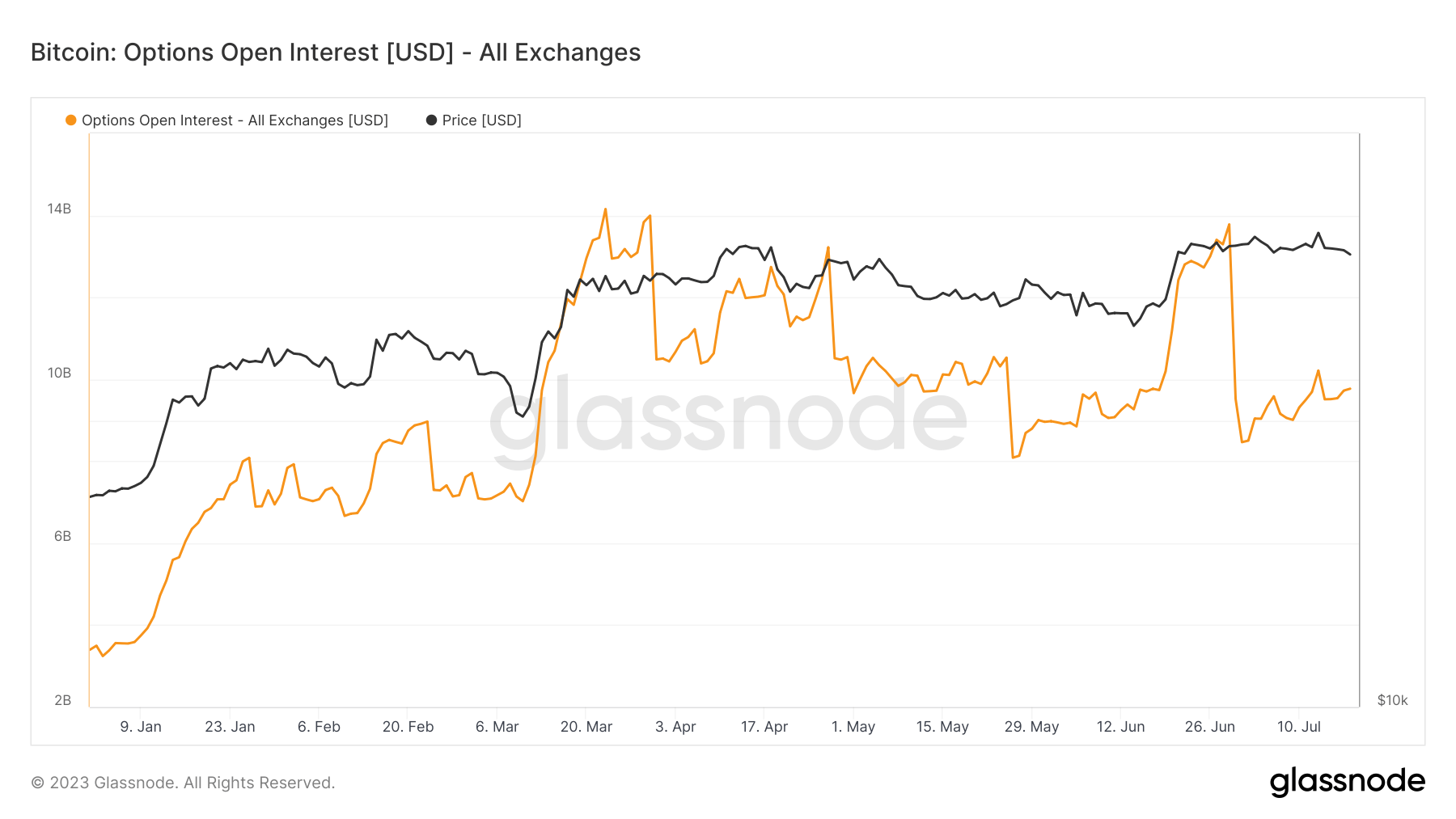

This cut up in opinion contrasts with the construction of Bitcoin name choices open curiosity, which stands at $9.7 billion. Open Curiosity refers back to the whole variety of excellent choice contracts that haven’t been settled. This is a vital indicator that displays the circulation of funds into the derivatives market.

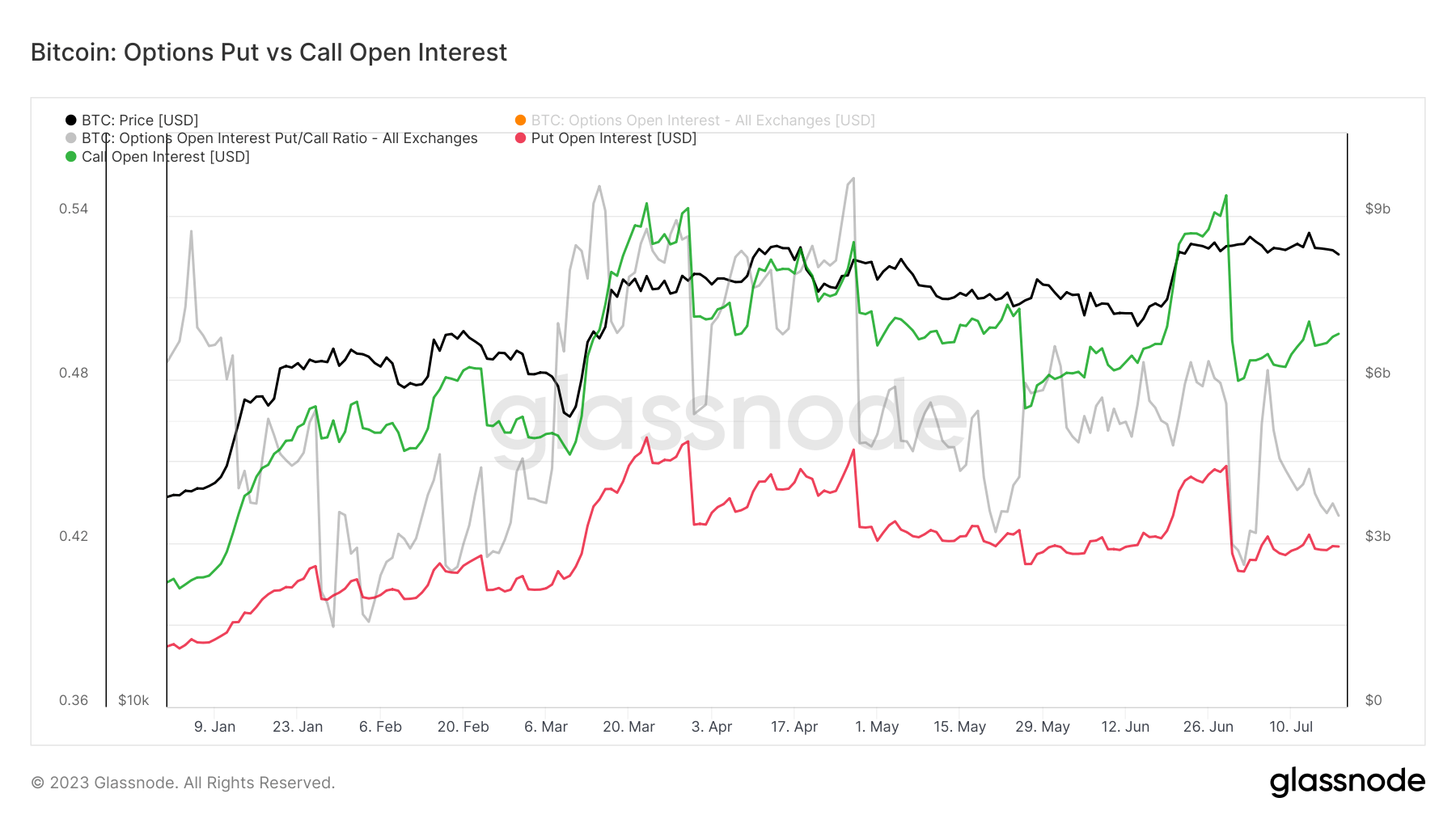

The whole open curiosity in Bitcoin calls is $6.93 billion, considerably greater than the open curiosity in places of $2.83 billion. This discrepancy might counsel that merchants are usually extra bullish on Bitcoin, anticipating the worth to rise and thus the variety of name choices.

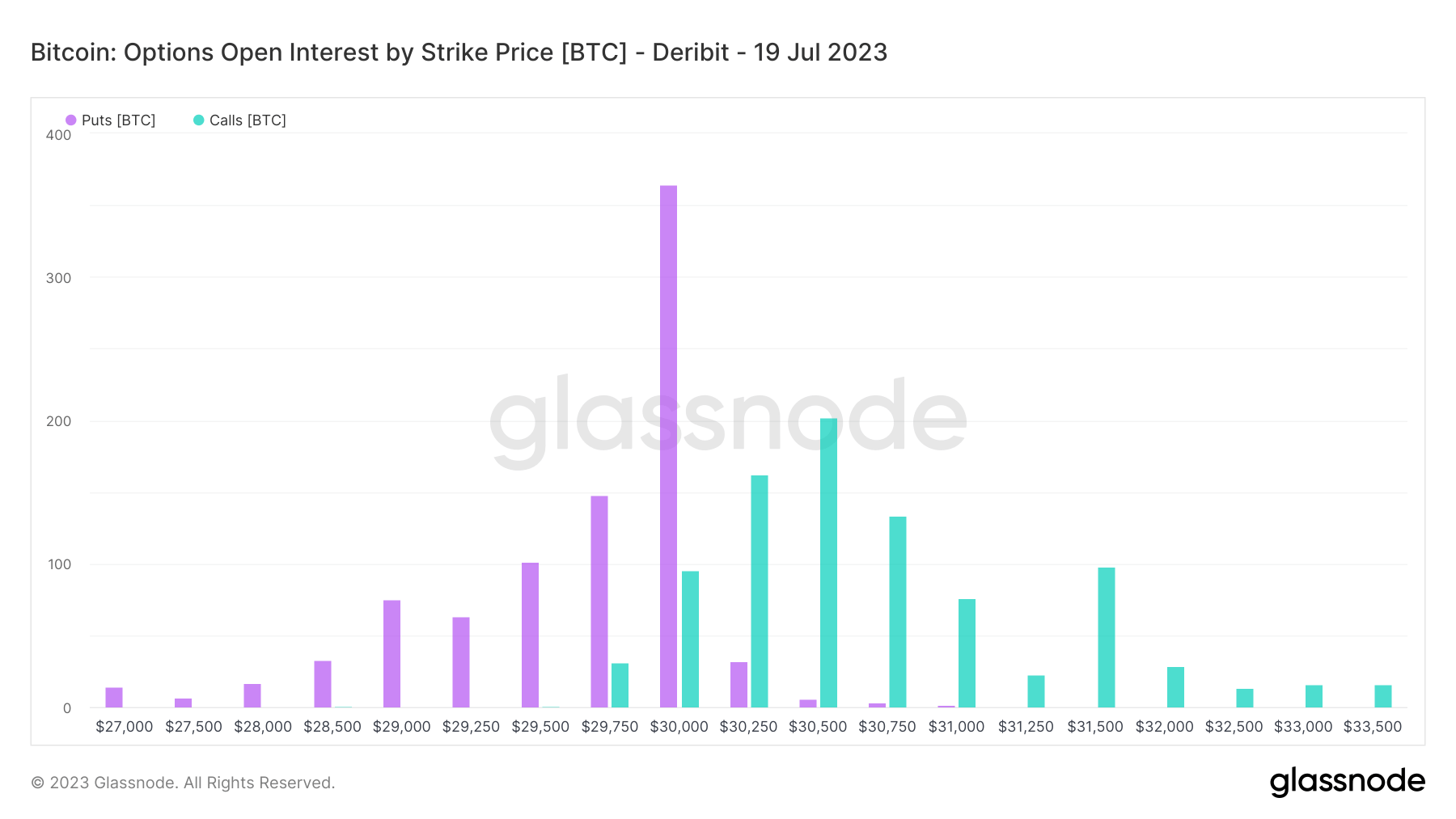

Nevertheless, open curiosity in name and put choices with strike costs on choice contracts expiring on July 19 presents a unique image. The identical open curiosity of 365.4 BTC is betting that BTC will fall under $30,000 and above $30,250-30,500. This curiosity steadiness displays the present value stage of Bitcoin and signifies that the market is stagnant.

In conclusion, the indecisive derivatives market is preserving Bitcoin flat. Some merchants are bullish, anticipating the worth to rise, whereas an equal quantity are bearish, betting on a value drop. The sector helps Bitcoin in a slender buying and selling vary and there are few indicators of main adjustments within the coming days.

In distinction to the bearish sentiment mirrored within the choices market, long-term forecasts by some specialists have instructed a extra bullish view, with merchants betting on future value features within the present sideways market. appears able to survive.

The publish Indecisive choices market retains Bitcoin sideways appeared first on currencyjournals.

Comments are closed.