Open curiosity, the whole variety of excellent derivatives contracts, is a key indicator for measuring market well being and sentiment. A rise in open curiosity means new cash is flowing into the market, indicating elevated buying and selling exercise and curiosity in Bitcoin. Conversely, a decline suggests closing positions and should point out a change in market sentiment or a consolidation section. Monitoring these traits is necessary to understanding market liquidity, volatility, and future worth expectations.

In bull markets, elevated open curiosity typically correlates with rising costs, suggesting new cash is betting on additional worth will increase. This situation sometimes displays robust market sentiment and investor confidence in Bitcoin's upward trajectory. Then again, in a bearish scenario, a rise in open curiosity might point out that buyers are hedging towards anticipated worth declines and should reveal a extra cautious or damaging market outlook.

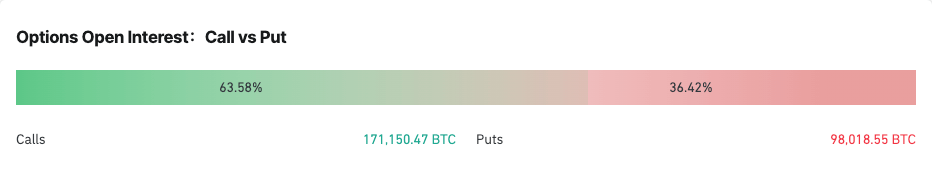

Moreover, the steadiness of name and put choices inside open curiosity supplies deeper perception into market sentiment. A predominance of calls suggests bullish market sentiment with many buyers anticipating costs to rise, whereas a majority of places might point out bearish expectations.

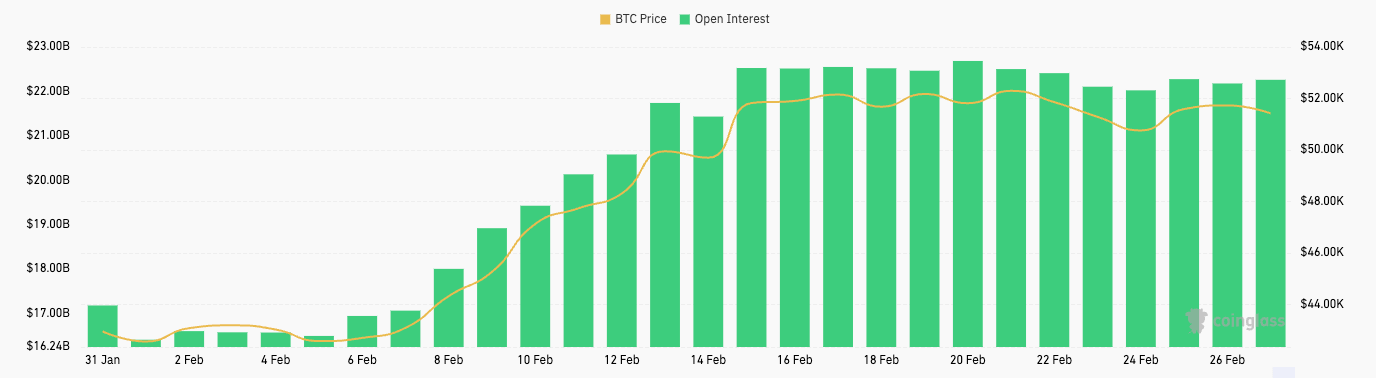

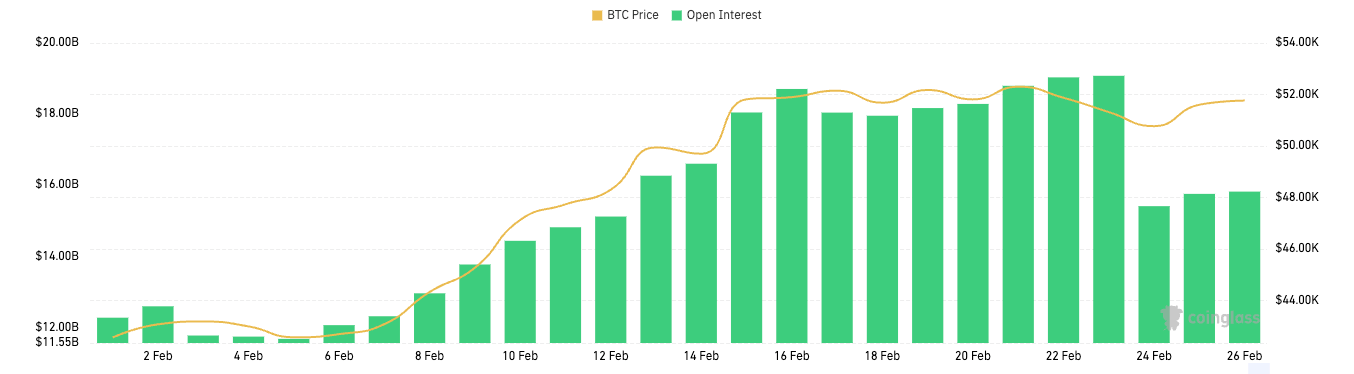

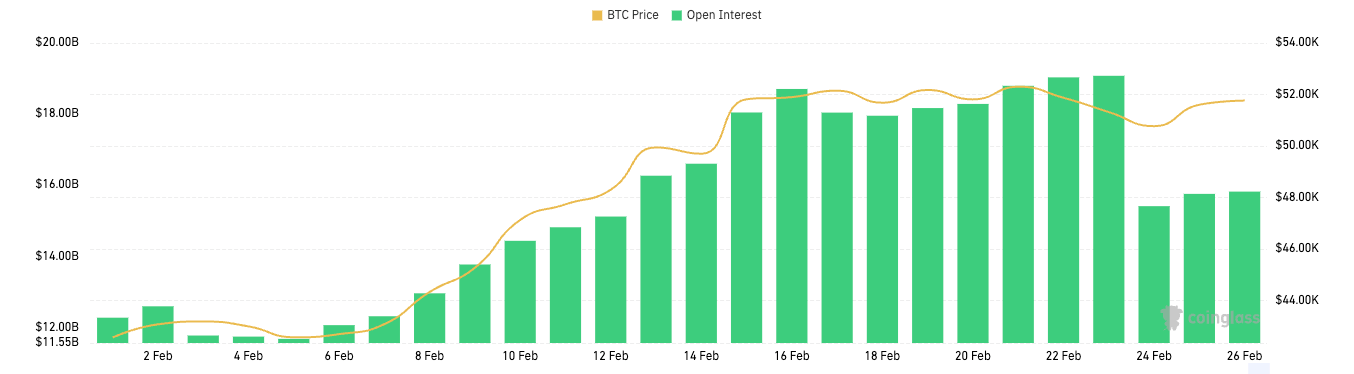

Open curiosity in Bitcoin futures and choices elevated considerably in February.

From February 1st to February twentieth, Bitcoin futures open curiosity elevated from $16.41 billion to $22.69 billion. This massive improve means that merchants are more and more getting into futures contracts in anticipation of upper volatility, or inserting directional bets on the Bitcoin worth. Curiously, this era coincided with a notable rise in Bitcoin worth from $42,560 to $52,303, suggesting bullish sentiment amongst futures merchants. Open curiosity by means of February twenty sixth decreased barely to $22.21 billion, and Bitcoin worth fell barely to $51,716, as some merchants took earnings or closed positions in anticipation of a consolidation section. It could point out that they’re settling or lowering publicity forward of potential volatility.

Equally, open curiosity in Bitcoin choices elevated dramatically from $12.27 billion in early February to a peak of $19.08 billion by February 23, earlier than returning to $15.82 billion in the direction of the top of the month. Choices present the holder with the fitting, however not the duty, to purchase (name choice) or promote (put choice) Bitcoin at a specified worth. It affords extra advanced methods for merchants to specific bullish or bearish views or hedge current positions. The preliminary spike in choices open curiosity displays robust engagement from buyers, who’re profiting from the choice to wager on the path of Bitcoin worth and safety towards potential declines.

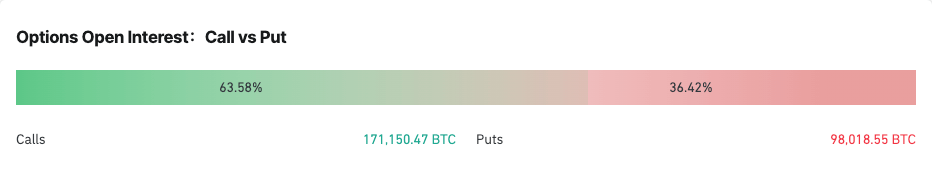

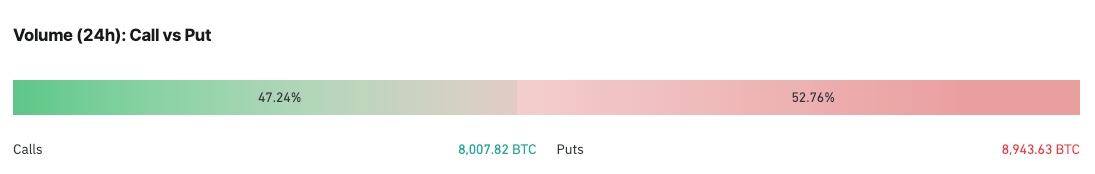

The decision to place ratio of Bitcoin choices supplies deeper perception into market sentiment and underlying expectations for the path of Bitcoin worth. The distribution of calls and places immediately signifies the bullish or bearish development of the market, with calls representing bets that costs will rise and places representing bets that costs will fall.

As of February 26, open curiosity in Bitcoin choices was skewed in the direction of calls, accounting for 63.76% of the whole, whereas open curiosity in places was 36.24%. This distribution reinforces the bullish sentiment noticed by means of the rise in choices open curiosity at first of the month. The predominance of calls in open curiosity means that a good portion of market contributors both anticipated Bitcoin costs to proceed rising or had been utilizing calls to hedge different positions. are doing.

Nevertheless, the 24-hour buying and selling quantity is somewhat completely different, with calls accounting for 47.24% and places accounting for 52.76%. This shift towards places in each day buying and selling quantity in comparison with total open curiosity might point out elevated short-term warning amongst merchants. It suggests a noticeable improve in defensive methods or bearish bets throughout the previous 24 hours.

The quick affect on Bitcoin worth is a possible improve in volatility. Bullish sentiment helps the continued optimistic outlook of many market contributors, as evidenced by elevated open curiosity and a excessive share of calls. Nevertheless, a latest improve in put quantity could also be indicative of upcoming worth actions as merchants alter their positions in anticipation of or in response to new data or market traits.

Given these issues, the market seems to be at a crossroads, with near-term warning tempering the robust bullish tone. This situation typically precedes durations of elevated volatility as conflicting expectations develop all through buying and selling exercise.

(Tag translation) Bitcoin