Analyzing the rise and fall of futures contracts between exchanges can present precious perception into the general market outlook. The state of open curiosity and the ratio of lengthy to brief positions in Bitcoin futures helps decide whether or not the market is bullish or bearish and predict potential worth actions.

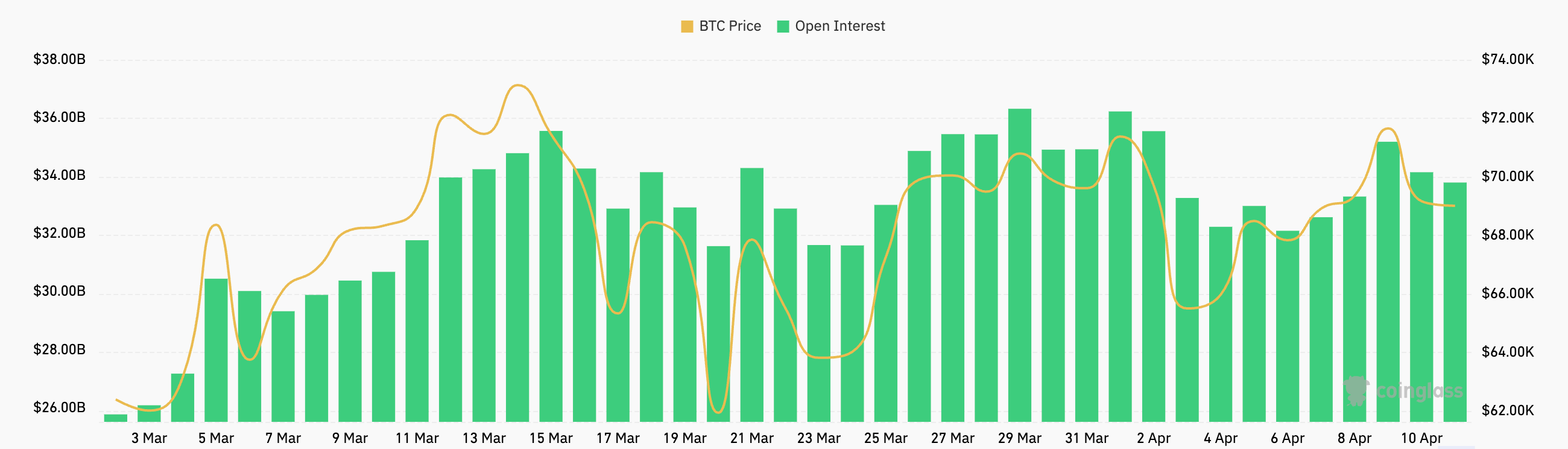

Within the 24-hour interval from April ninth to April tenth, the futures market skilled a small however noticeable change. Open curiosity, which measures the overall variety of excellent futures contracts, fell from $35.17 billion to $33.77 billion. This decline in open curiosity, together with lengthy positions down 4.55% to $39.65 billion and brief positions down simply 0.38% to $37.31 billion, signifies a cautious retreat in market participation. ing. These numbers recommend that dealer sentiment has turned barely bearish over the previous 24 hours.

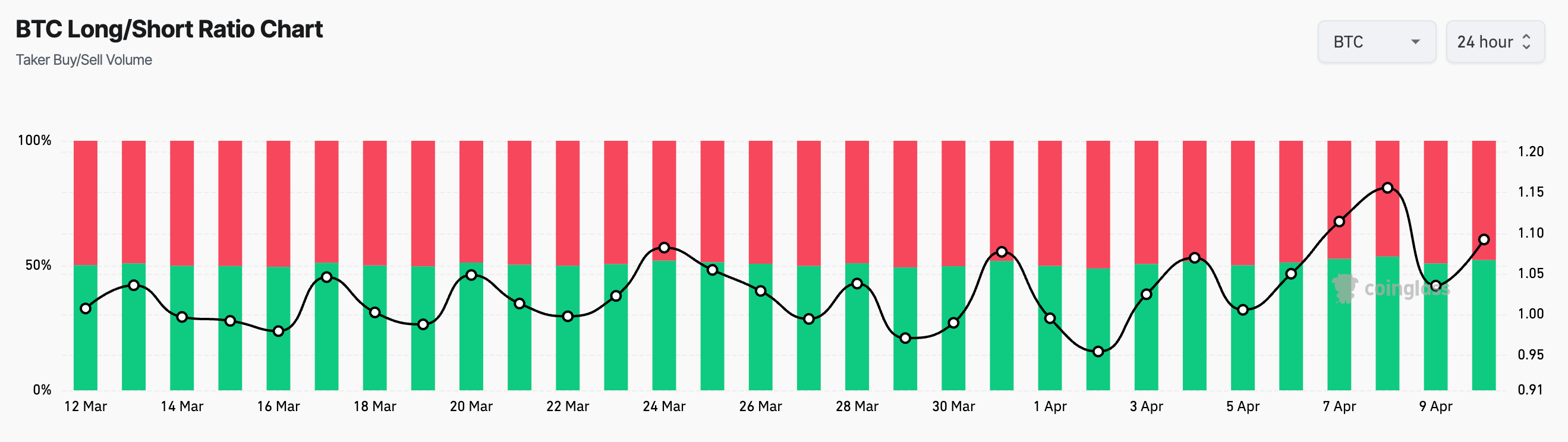

Adjustments within the lengthy/brief ratio of futures over the previous few weeks point out how the market has felt. Though the ratio has fluctuated, it has usually remained constructive, clearly indicating that the market is leaning in direction of a bullish stance. Nonetheless, the extent of belief has modified in response to Bitcoin worth fluctuations. The height of 1.1561 on April eighth correlates with a pointy enhance within the adjusted worth of Bitcoin, whereas the decline to 0.9712 on March twenty ninth is a bearish transfer after BTC failed to satisfy market expectations. It mirrored a wave of sentiment.

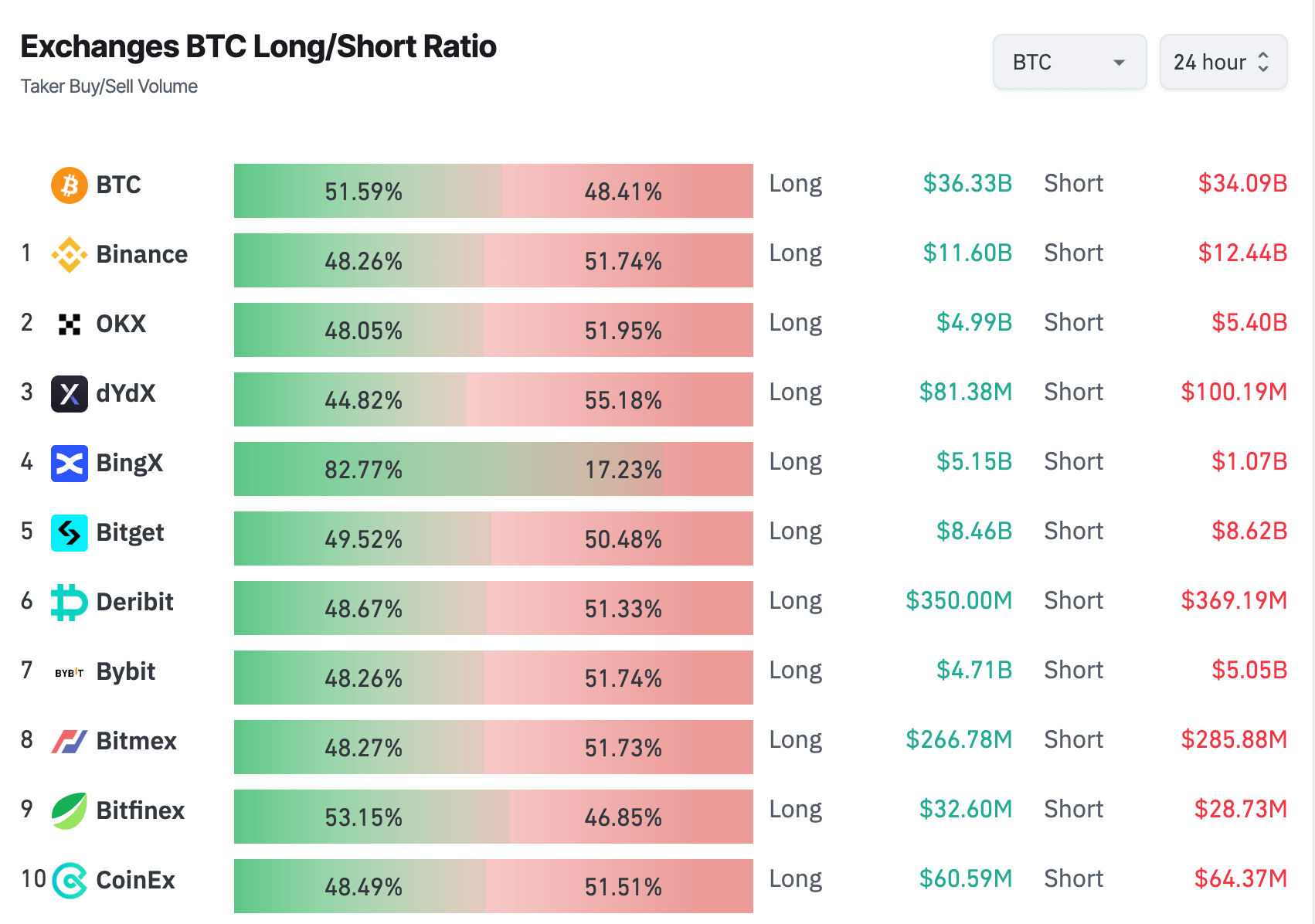

A more in-depth have a look at the distribution of lengthy and brief positions throughout completely different exchanges reveals a extremely numerous image of dealer sentiment and methods. For instance, BingX has a considerably greater proportion of lengthy positions (82.77%) than brief (17.23%), indicating notably bullish sentiment amongst its person base or strategic positioning of the trade's merchants.

Platforms like Deribit and Bitget, however, have a ratio hovering round 50%, indicating a extra even market outlook. The distinction between Binance's overwhelming brief place bias (51.74%) and BingX's bullish development reveals how numerous methods and perceptions are throughout buying and selling platforms, with the variety of brief positions on Binance exceeding that of BingX. Considerably outperforms lengthy bets.

The slight decline in open curiosity seen out there over the previous 24 hours means that the inhabitants is transferring in direction of warning. This might be brought on by quite a lot of elements, however general market uncertainty will be the greatest issue as Bitcoin continues to wrestle to get better above $70,000. The decline in OI might also replicate a broader reluctance amongst merchants to decide to long-term positions.

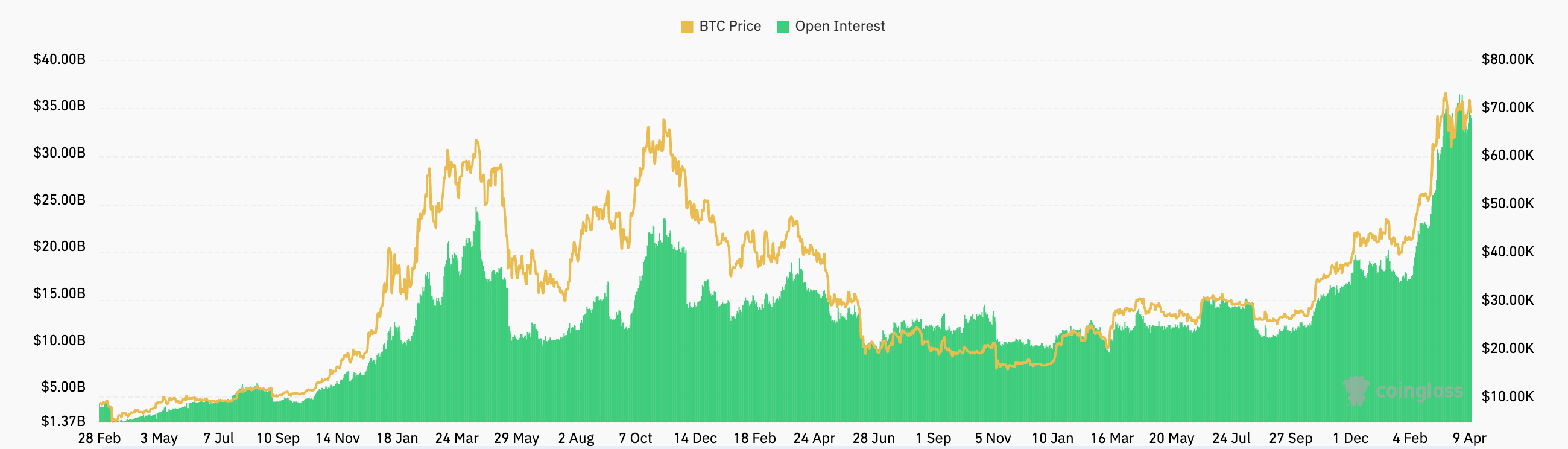

Nonetheless, it is very important word that the blended sentiment and cautious posture seen on varied exchanges is relative to the current OI highs seen out there. Regardless of the decline over the previous few days, the market remains to be in a derivatives cycle and has the very best open curiosity in Bitcoin historical past.

Which means that the cautiousness and indecision we’re at the moment seeing is severe and doesn’t symbolize the long-term traits we’ve got seen this 12 months. Components resembling macroeconomic developments, regulatory modifications, and inner traits within the crypto market resembling ETFs can affect this sentiment.

We count on present traits to alter because the market continues to digest these elements. You will need to hold an in depth eye on derivatives, as forward-looking statements and buying and selling methods shortly adapt to new developments out there.

The put up Bearish Slope in Bitcoin Futures as an Open Curiosity Contract appeared first on currencyjournals.