Bitcoin surged over $87,000 throughout early Asian buying and selling on Monday, extending income as wider markets reopened after buying and selling flat by way of Easter vacation closures.

The digital belongings motion coincided with a record-breaking rally of greenback weak point and gold following three classes of broad integration.

BTC/USD rose from round $84,450 to an intraday excessive of almost $87,650 in below three hours, surpassing the falling wedge sample over a number of days. Bitcoin was traded almost $87,640 on the time of publication, based on TradingView information.

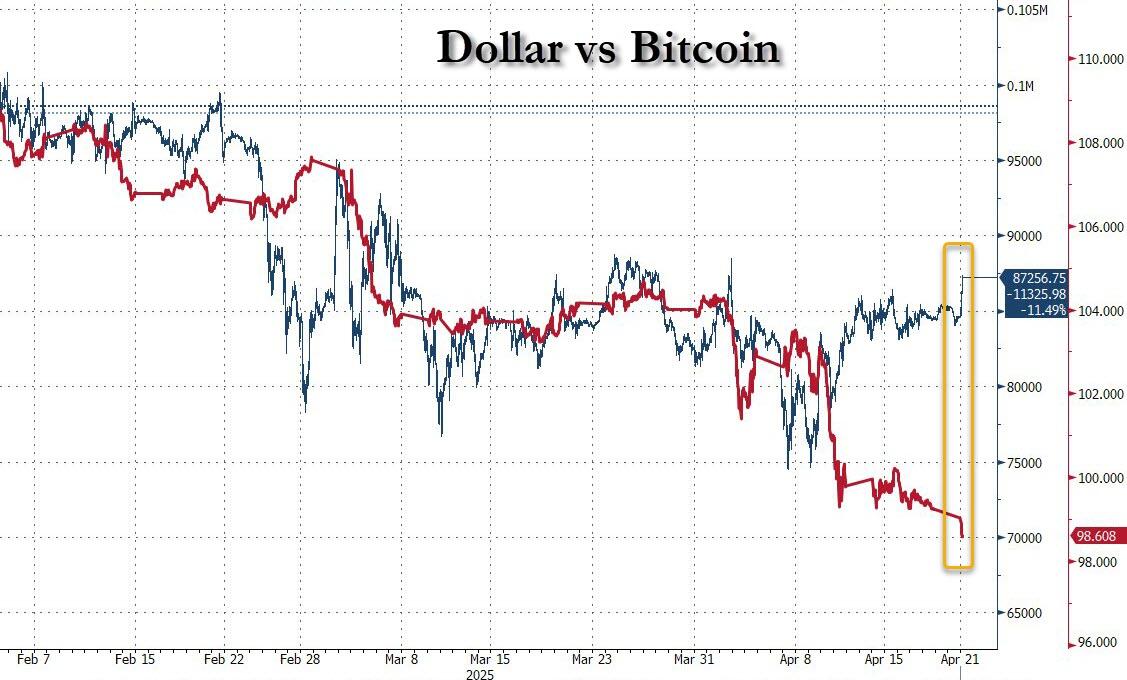

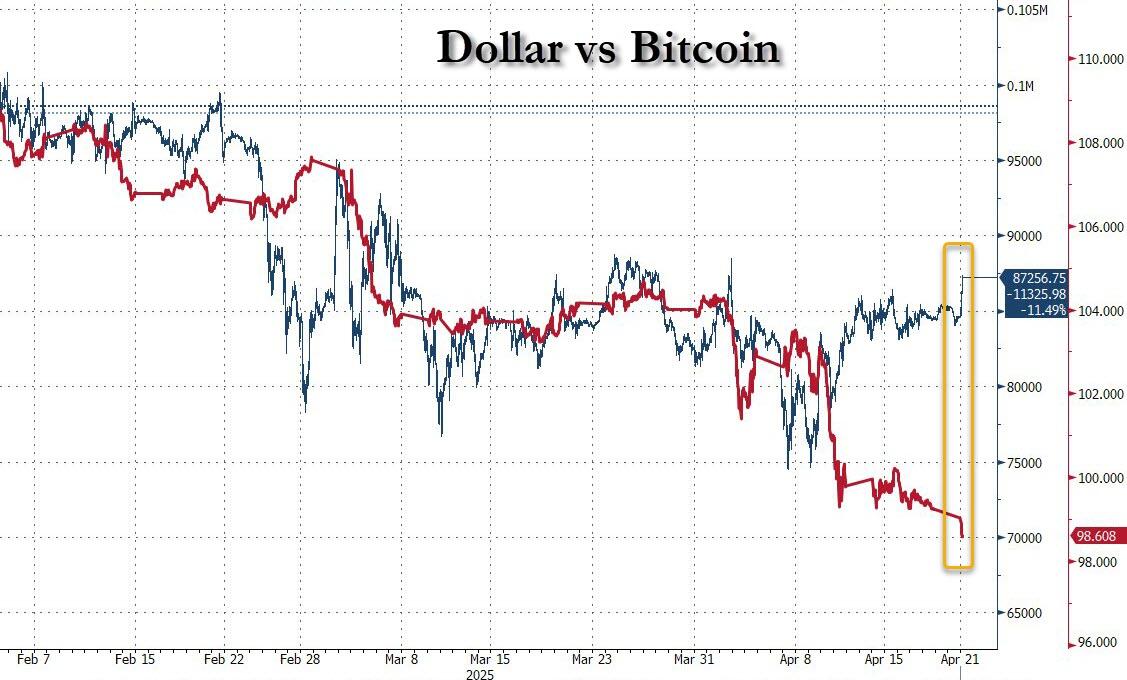

The breakout has been deployed throughout low liquid circumstances early in Asia, with the Greenback Index (DXY) falling to the bottom degree since 2021.

This coincided with rising hypothesis in regards to the potential removing of Federal Reserve Chairman Jerome Powell.

As Zerohedge reported, feedback made by Nationwide Financial Council director Kevin Hassett on Friday mentioned “the president and his staff will proceed to check,” however choices on Powell’s place cited merchants as a catalyst for the greenback’s decline.

The weak point of the greenback causes a energetic life.

The fast decline within the greenback occurred whereas a number of world markets remained closed, boosting demand for conventional and digital valued storage models.

Gold costs surged to an all-time excessive of $3,391.62 throughout the identical session, recording a revenue of two.4%. On a per Reuters foundation, the transfer marked the metallic’s most substantial day gathering in months.

Digital gold within the type of Bitcoin rose in tandem, branching out from latest actions when each belongings had been inversely proportional to US Treasury payments for a decade. Particularly, bond costs fell on Monday. The US10 and CN10 plots on the chart signify bond costs reasonably than yields, which means a simultaneous rise in yields over the long run.

Kobeissi’s letter reported,

“Each gold and Bitcoin tales are in alignment for the primary time in years.

Gold and Bitcoin say the US greenback is weak and extra uncertainty is ongoing. ”

The mix of greenback declines, mountaineering yields, and rising gold presents a situation wherein Bitcoin is being re-ricked in mild of the perceived instability of conventional monetary merchandise.

As Zero Hedge framed it, the alignment of gold and Bitcoin energy through the Fiat Stress interval may mirror a “regulation shift” wherein digital belongings are more and more handled as monetary hedges.

A wider market divergence

The fairness market has been weakly open regardless of the energy of the haven. The S&P 500 futures fell 1.54% within the preliminary session on Monday, eliminating income after the week. The oil market additionally fell, with WTI crude down greater than 3%, buying and selling almost $62.83 at Session Low.

This distinction between conventional threat belongings and different reservoirs of worth noticed throughout different intervals of economic uncertainty.

Gold and Bitcoin are rising collectively, suggesting placement on interest-sensitive belongings and merchandise perceived as politically insulated whereas bond costs fall and inventory indexes slip.

With each zero hedge, the greenback descent doesn’t instantly stabilize. If central banks just like the Financial institution of Japan and the European Central Financial institution reply with mitigation measures to counter their foreign money energy, they might create further greenback stress.

On this surroundings, Bitcoin may proceed to separate from rate-based gadgets and proceed to trace bodily items similar to gold in a extra carefully.

Structural which means

The correlation breakdown between Bitcoin and conventional macro proxies raises questions on portfolio allocation and asset classification.

As bond costs and shares weaken whereas gold and bitcoin outperform, merchants might start to reassess how digital belongings are categorized in a cross-asset framework.

This transfer follows a couple of weeks of mild slash correlation between Bitcoin and DXY, as noticed with a 30-day rolling correlation metric.

If this continues, Bitcoin will lose recognition as a dangerous asset alongside know-how, turning into a monetary hedge with product-like properties.

The political aspect can also be approaching a significant development. Whereas earlier episodes of the tensions Trump raised precipitated momentary volatility, the present episode introduces direct discourse on potential adjustments in Federal Reserve management. This might have an effect on market pricing for future charge choices and broader financial coverage expectations, each of which may spill over the crypto market.

As buying and selling is absolutely reopened throughout the area, Bitcoin’s actions, near the $88,400 resistance band, may turn out to be much more clear. Sustained depth above this degree can entice systemic circulate and result in the acquisition of algorithms. On the similar time, if you cannot maintain it above the breakout zone, your belongings might be uncovered to a return in the direction of medium distance ranges.

For now, the efficiency of belongings in a combined macro surroundings mixed with separation from shares and bonds locations it on the coronary heart of post-holiday buying and selling narratives.

(tagstoTranslate)Bitcoin