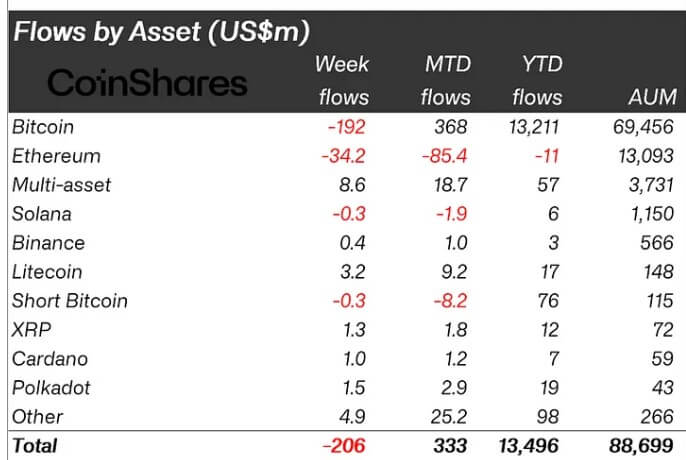

In response to CoinShares' current weekly report, crypto-related funding merchandise have been outflowed for 2 consecutive weeks in April, with roughly $206 million leaving the market.

Regardless of Bitcoin's current halving, which often causes pleasure available in the market, investor curiosity within the main digital asset stays subdued, as evidenced by complete outflows of $192 million.

Conversely, short-term traders took benefit of the chance introduced by the halving occasion to strengthen their positions and injected $300,000 into the market.

What’s driving the outflow?

Throughout this week, crypto slate The US-based Bitcoin (BTC) exchange-traded fund (ETF) has skilled capital outflows for 5 consecutive days. These leaks have been primarily brought on by Grayscale's GBTC, ProShares BITO, and Ark 21 Shares' ARKB.

James Butterfill, head of analysis at CoinShares, defined that these outflows point out that curiosity from ETP/ETF traders is waning. The pattern stems from hypothesis that the Fed might delay additional price cuts.

Moreover, Butterfill famous that ETP buying and selling quantity has declined as effectively, with buying and selling quantity reaching $18 billion final week. He highlighted that these volumes now account for a reducing proportion of his complete BTC buying and selling quantity, altering from 55% a month in the past to twenty-eight%.

Altcoins entice consideration

Buyers are more and more preferring lesser-known altcoins over main cryptocurrencies resembling Solana and Ethereum.

Altcoins resembling Chainlink, Polkadot, Litecoin, Cardano, and XRP collectively attracted greater than $7 million in inflows final week, in accordance with the report.

In the meantime, Ethereum continues its downward pattern, with final week seeing a complete of $34 million in outflows for the sixth consecutive week. Month-to-date move stays unfavorable at $85 million, and year-to-date move can also be in unfavorable territory, at $11 million.

Whereas Solana's outflow was comparatively modest at $300,000, the blockchain inventory recorded its eleventh consecutive week of outflows, reaching $9 million.

Butterfill attributed the outflow from blockchain shares to investor considerations in regards to the influence of the mining halving on mining corporations.

talked about on this article

(Tag translation) Bitcoin