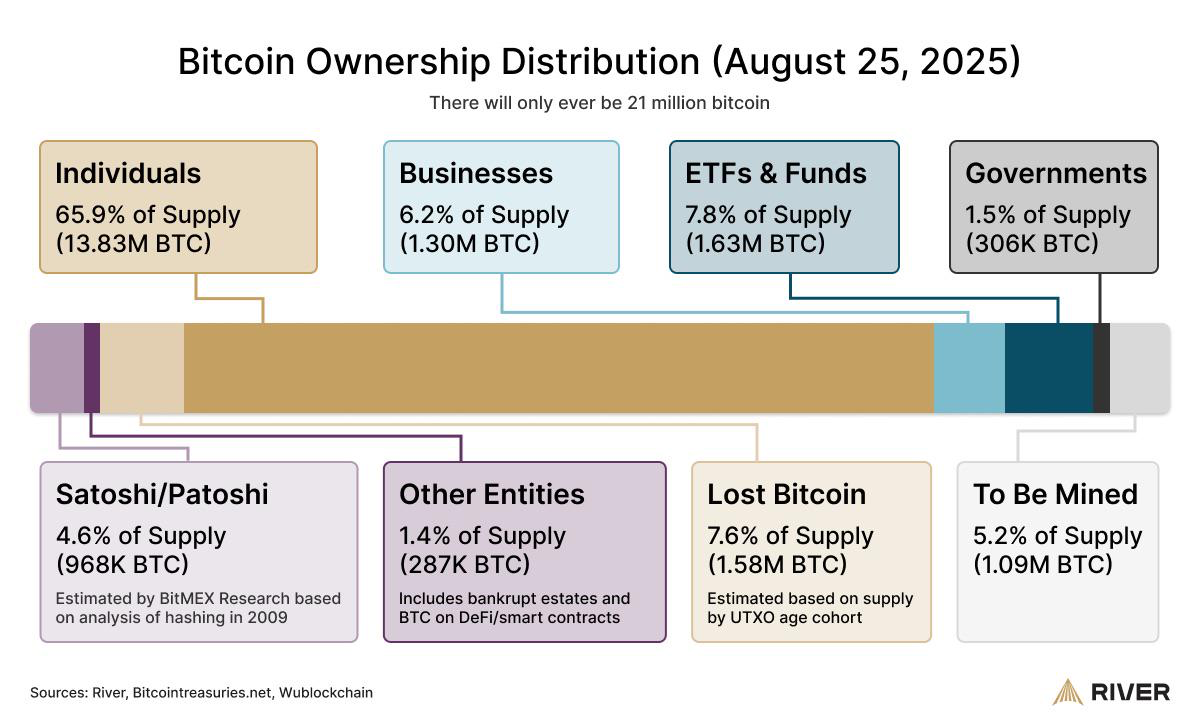

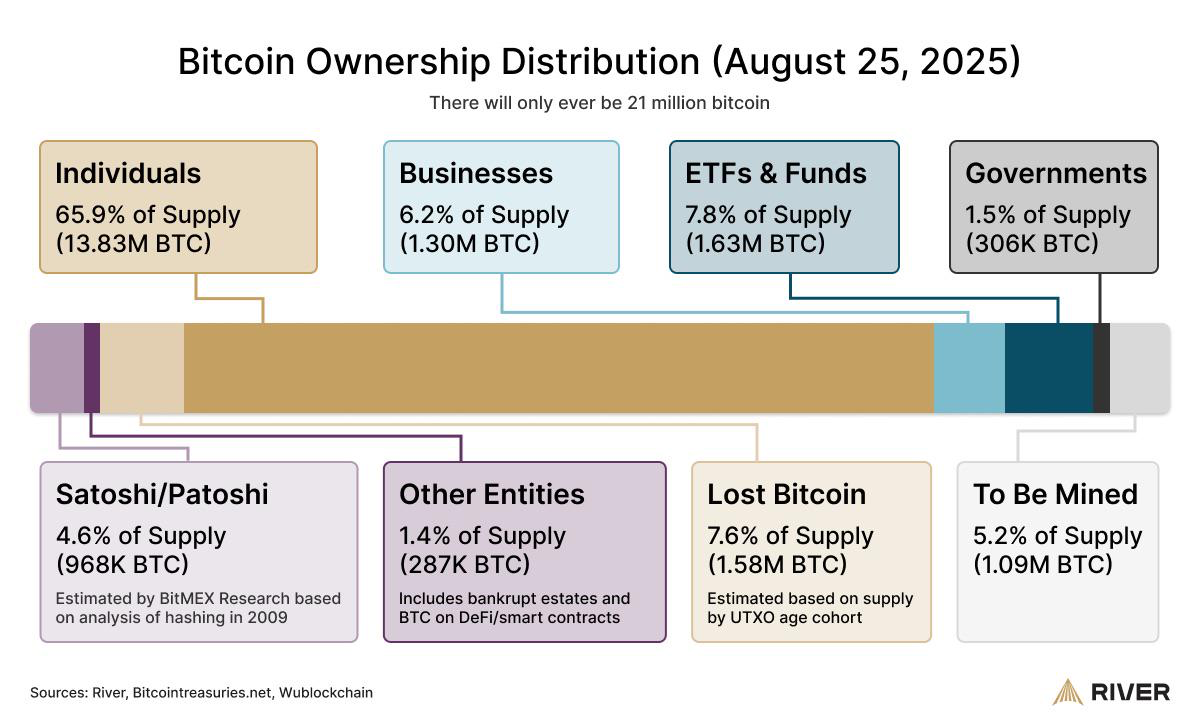

- Retail buyers nonetheless maintain a majority, however establishments and ETFs presently handle greater than 14% of all BTC

- This shift from early adopters to Wall Avenue creates new dynamics of everlasting and price-independent purchases

- Information on the chain exhibits that Satoshi holds 4.6% of the provision, however 7.6% of Bitcoin is misplaced perpetually

Bitcoin has moved from its early followers to Wall Avenue. As belongings mature, this shift in protecting BTC held by the house owners of a brand new class of homeowners is crucial pattern for future costs. On-chain knowledge exhibits precisely the place 21 million cash are.

Who truly has essentially the most Bitcoin right this moment?

Nearly all of Bitcoin provide continues to be within the palms of particular person retail buyers with virtually 1,383 million BTC (65.9%). The group is valued at over $1.52 trillion, representing the most important single slice of possession pie.

Nonetheless, Wall Avenue and Company America presently handle a complete of 14% of all Bitcoin, and its share is rising quickly.

- The brand new US Spot Bitcoin ETF, led by BlackRock, has already bought 1.63 million BTC (7.8%).

- The Company Treasury, the place Michael Saylor’s microstrategy leads the price, holds an extra 1.3 million BTC (6.2%).

The embrace of this establishment has been strengthened by main banks resembling Jpmorgan now claims that Bitcoin is a greater inflation hedge than gold.

Sato, the federal government, what in regards to the “misplaced” cash?

Past lively markets, a number of big swimming pools of Bitcoin are held by off-limits or distinctive entities.

- Misplaced perpetually: An estimated 1.58 million BTC (7.6%) is taken into account to be completely misplaced.

- Nakamoto Atoshi: The creator’s pockets has an estimated 968,000 BTC (4.6%).

- authorities: The US and different governments have seized a complete of 360,000 BTC (1.5%).

- Lock/Chapter: Roughly 287,000 BTC (1.4%) are sure by contract or chapter.

- Unstable provide: Solely 5.2% of all Bitcoin will likely be mined for the subsequent 100 years.

Why is that this possession necessary within the worth of Bitcoin?

This shift from retail to institutionalisation basically adjustments the Bitcoin market cycle. The outdated cycle was outlined by whales promoting to market-leading retail buyers. The brand new cycle is totally totally different.

Chain knowledge over the previous yr exhibits that companies and ETFs are continually accumulating Bitcoin, no matter worth. This everlasting price-independent buy creates a powerful demand ground.

That is the principle purpose analysts prefer it Fundstrat’s Tom Lee Now Challenge Bitcoin might attain $1 millionbecause the waves of the institutional capital are rising, lowering the provision of accessible cash.

Disclaimer: The data contained on this article is for info and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version isn’t chargeable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.