- BTC worth is close to $30,000 and the bulls could battle to defend it.

- Bitcoin’s historic volatility will attain its lowest degree in 2023.

- A brief-term bullish goal is probably going above $34,000, whereas the principle assist is close to $28.2,000.

Bitcoin’s worth remains to be above $30,000 as of Monday, however with “notably low volatility.” A key technical evaluation indicator for this indicator means that the value is tightening and a breakout in both route is more likely to be giant.

Bitcoin Value Outlook: Bollinger Bands

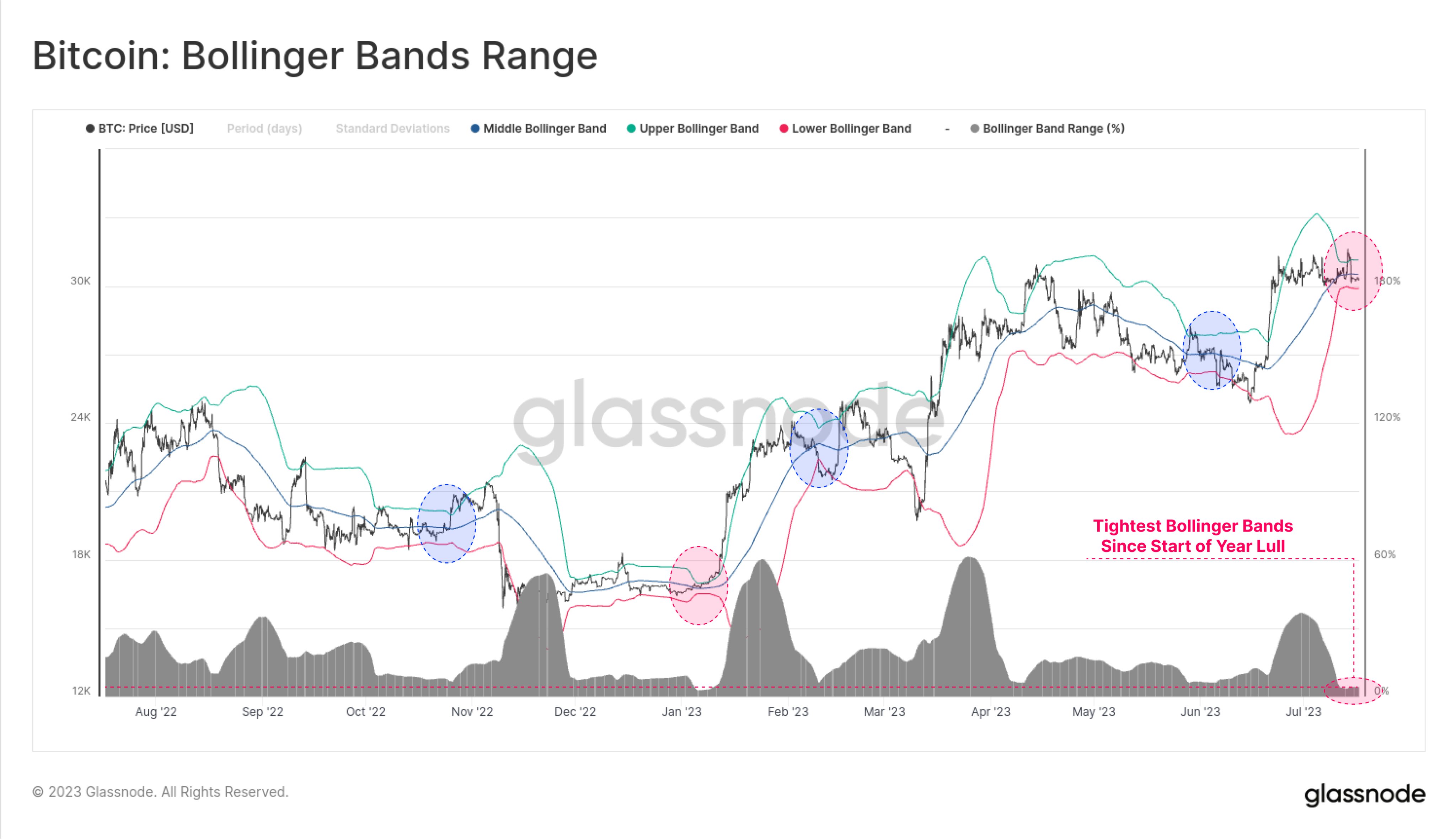

In response to on-chain information and analytics supplier Glassnode, the Bollinger Bands are tightly squeezed, with solely 4.2% separating the higher and decrease ends of the value vary. The platform notes that the outlook has put Bitcoin in its quietest state since early January.

“The digital asset market stays remarkably low in volatility, with the basic 20-day Bollinger Bands beneath excessive strain. Solely 4.2% separates the highest and backside of the Bollinger Bands, making it the quietest #Bitcoin market since his early January lull.Analyst at Glassnode tweetedshare the chart beneath.

Bitcoin worth bollinger band vary. Supply: his Glassnode on Twitter.

Bitcoin worth bollinger band vary. Supply: his Glassnode on Twitter.

In technical evaluation, the Bollinger indicator offers a chart outlook the place worth developments replicate market volatility. Merchants use this indicator to determine overbought or oversold market situations.

Bitcoin lately broke out of the higher band and is at present buying and selling beneath the center trendline. The decrease assist of the Bollinger Bands is close to the important $30,000 degree.

BTC worth fell from a late Sunday excessive of $30,400 earlier than hitting an intraday low of $30.079 on Monday morning, in accordance with information. At present at round $30,180, the highest cryptocurrency by market capitalization is down about 0.5%.

The buildup close to the present costs is spectacular, however the bulls want to remain above this psychological assist base. If not, the bears may first push the decrease aspect earlier than a brief squeeze can push BTC/USD to new year-to-date highs of $34,000. The important thing draw back ranges to look at within the brief time period are $28,200 and $25,600.

(Tag Translation) Market

Comments are closed.