Crypto funding merchandise noticed a pointy restoration final week, with inflows reaching $436 million, partially reversing the $1.2 billion in outflows of the previous couple of weeks, in keeping with CoinShares' newest weekly report.

Regardless of the inflows, ETF buying and selling quantity remained regular at $8 billion, effectively beneath the annual common of $14.2 billion.

What induced the inflow?

CoinShares head of analysis James Butterfill attributed the change to altering market expectations concerning a 50 foundation level rate of interest minimize on Sept. 18.

This got here after former New York Federal Reserve Financial institution governor William Dudley made remarks on the Bretton Woods Committee's annual Way forward for Finance Discussion board in Singapore.

Dudley argued {that a} 50 foundation level minimize was justified, citing a weakening U.S. labor market. He highlighted that employment dangers outweigh inflation considerations as his justification for the minimize.

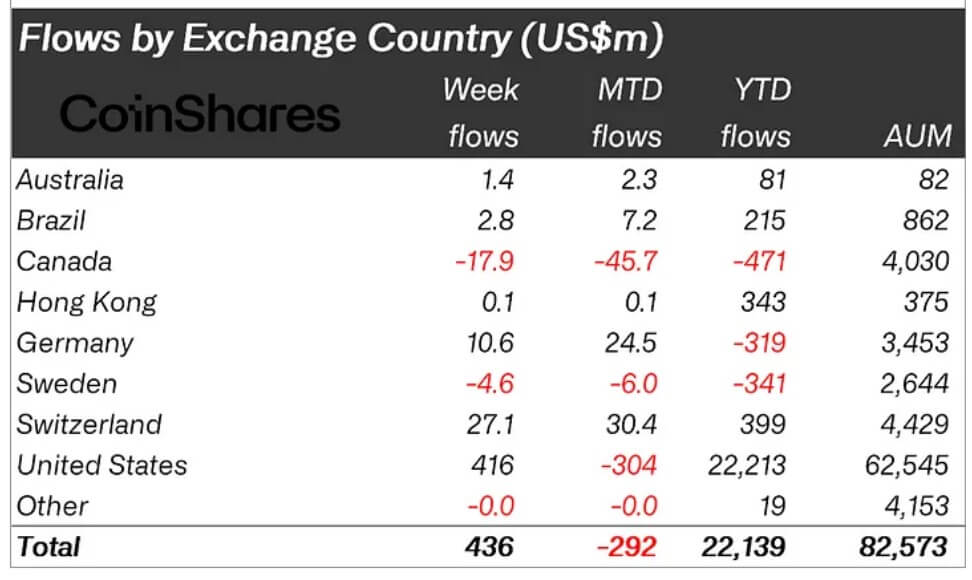

This modification in sentiment led to a complete of $416 million in inflows into america, with Switzerland and Germany seeing inflows of $27 million and $10.6 million, respectively.

In the meantime, Canada noticed outflows totalling $18 million through the interval.

Bitcoin surges, Ethereum struggles

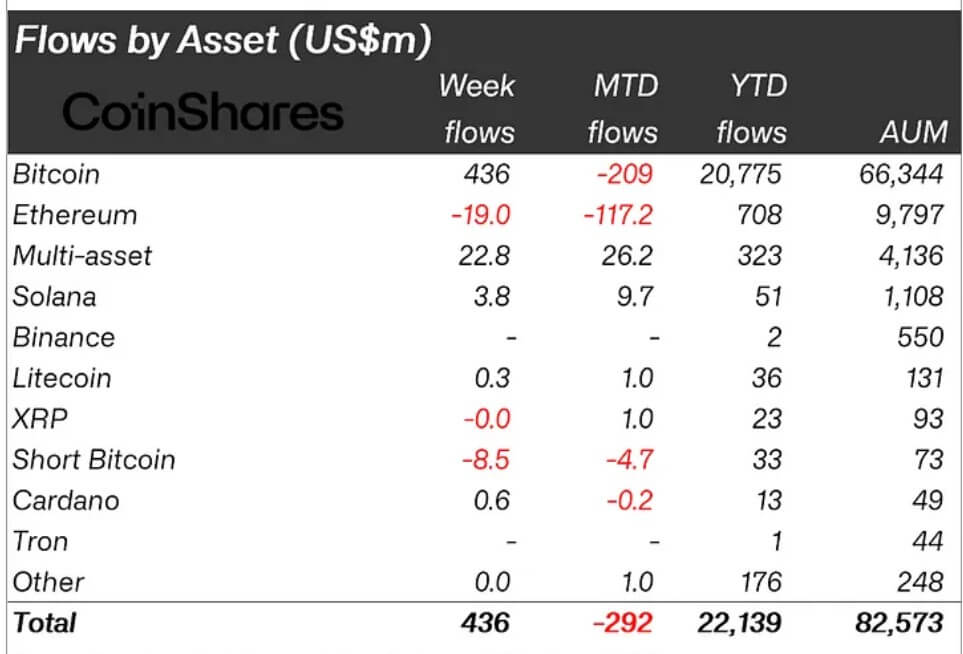

Bitcoin noticed the biggest inflows with $436 million, reversing a 10-day interval during which it noticed whole outflows of $1.18 billion. Conversely, Bitcoin quick merchandise noticed outflows of $8.5 million after three consecutive weeks of inflows.

Ethereum confronted $19 million in outflows. The decline stems from considerations over Layer 1 profitability following the Dencun improve in March. Market observers level out that Ethereum mainnet income has fallen by 99% since March 2024.

Decrease charges from the Dencun improve have boosted Layer 2 (L2) networks' recognition, making L2 options extra enticing. Analysts have warned that if this pattern continues, L2 networks may dominate and displace Ethereum mainnet, particularly in consumer-facing functions.

In the meantime, Solana recorded its fourth consecutive week of inflows, bringing in a complete of $3.8 million, whereas Litecoin and Cardano additionally noticed inflows, bringing in a mixed whole of round $900,000.

Moreover, blockchain shares noticed inflows of $105 million following the launch of a number of new ETFs within the US.