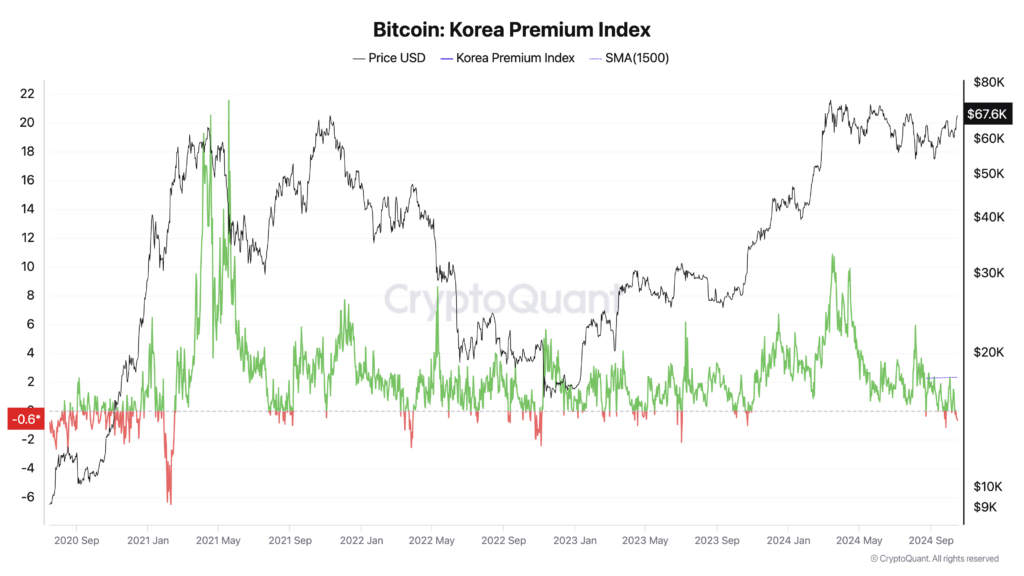

Bitcoin is buying and selling at a reduction on Korean exchanges, reversing the normal “kimchi premium” that has traditionally signaled bullish market sentiment. round korea instancesthe digital forex is priced roughly 700,000 gained ($511.73) cheaper domestically in comparison with world exchanges, with a unfavourable premium (low cost) of -0.74% as of Thursday afternoon.

This transformation appears to sign a bearish outlook for Korean traders. A excessive premium for kimchi usually signifies sturdy native demand and optimistic sentiment, typically pushing Bitcoin costs above world charges. In distinction, declining or unfavourable premiums replicate waning enthusiasm and lowered buying strain, which can sign a market correction or alignment with world valuations.

Analysts attribute this uncommon discrepancy to weak investor sentiment in South Korea and elevated demand for digital belongings on abroad platforms. KP Jang, head of Zangul Analysis, informed The Korea Instances that restrictions have prevented overseas and institutional traders from accessing home exchanges, amplifying the influence of the decline in demand from particular person traders. He mentioned that it has been executed.

Adjustments in dealer preferences in direction of altcoins are additionally impacting the market. As Bitcoin soars globally, South Korean merchants have begun accumulating within the undervalued different cryptocurrency in hopes of stable positive factors within the fourth quarter, the report mentioned. enterprise insider. These altcoins, together with Tao, sei Community, Aptos, Sui, NEAR Protocol, and The Graph, are perceived to supply increased returns and should draw consideration away from Bitcoin.

Declan Kim, a analysis analyst at DeSpread, additionally informed The Korea Instances that the altcoin market, which accounts for a good portion of home transactions, continues to battle within the transition part of recent rules. The implementation of the Digital Asset Person Safety Act is impacting market forces. Many altcoins stay unlisted on home exchanges in comparison with abroad exchanges, and the ban on market making makes it troublesome to safe liquidity.

Kimchi premium has traditionally been a characteristic of the Korean cryptocurrency market. In March, when Bitcoin exceeded the 100 million gained mark domestically, the premium rose to 10% at one level. A excessive premium usually signifies sturdy native demand and bullish sentiment, typically coinciding with or previous an increase in Bitcoin costs. Conversely, a low or unfavourable premium suggests bearish sentiment and lowered shopping for strain.

Information exhibits that Bitcoin-Korean Gained (BTC/KRW) buying and selling quantity has decreased considerably over the previous 40 days, reflecting a change in investor focus.

Analysts count on the reverse kimchi premium to be momentary. Chan expects this discrepancy to resolve quickly, as such premiums are unlikely to persist for lengthy. He mentioned continued discussions on a invoice that will enable corporations to spend money on crypto belongings may enhance liquidity on home exchanges and step by step slender the value hole with abroad markets.

The present buying and selling state of affairs displays a posh interaction of home rules, investor conduct, and world market traits, and alerts a significant shift in South Korea's crypto panorama. Though a unfavourable kimchi premium is uncommon, it aligns extra carefully with world digital asset valuations and will in the end result in a extra balanced and mature market.

The final time kimchi premium turned unfavourable was in October 2023, proper earlier than the Bitcoin ETF bull market.

(Tag translation) Bitcoin