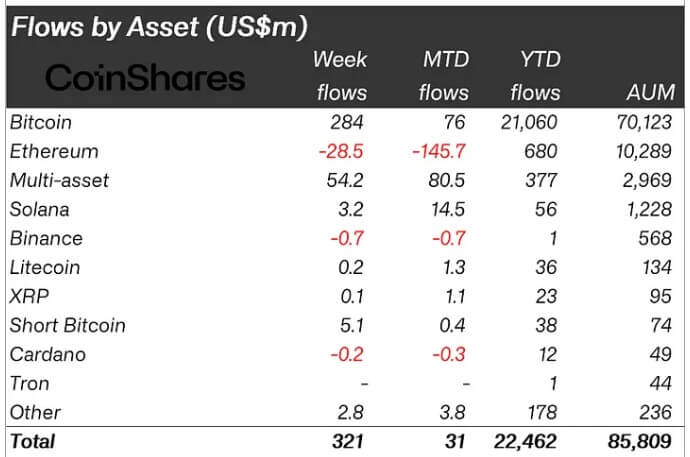

Digital asset funding merchandise noticed inflows for the second consecutive week this month, with buyers pouring $321 million into the business, in line with CoinShares' newest weekly report.

The inflows helped crypto exchange-traded funds (ETPs) enhance their complete property underneath administration (AuM) by 9%, bringing their complete to $85.8 billion, whereas buying and selling quantity throughout all funding merchandise additionally grew to round $9.5 billion.

CoinShares head of analysis James Butterfill linked this optimistic development to the Federal Reserve’s current determination to chop rates of interest by 50 foundation factors, explaining:

“The surge was probably pushed by the Federal Open Market Committee's (FOMC) feedback final Wednesday that had been extra dovish than anticipated, together with a 50 foundation level fee reduce.”

Bitcoin and the US dominate inflows

Breaking down the inflows, Bitcoin-based funding merchandise led the best way, producing $284 million in web good points worldwide final week. Notably, main crypto funds akin to BlackRock, Bitwise, Constancy, ProShares and 21Shares contributed to the restoration, rising web inflows by a mixed $321 million.

Bitcoin's upward momentum has additionally attracted bearish buyers, who allotted $5.1 million to a Bitcoin quick fund.

Ethereum has seen outflows for the fifth consecutive week, totaling $29 million. The development is pushed by continued withdrawals from Grayscale’s ETHE product and dwindling curiosity in new choices.

In response to Farside information, ETHE skilled outflows of between $13 million and $18 million over three consecutive days final week, overshadowing smaller inflows from different merchandise, together with Grayscale’s MiniTrust.

In the meantime, Solana has maintained its present optimistic development, including $3.2 million in inflows final week, which can even be linked to the bulletins of a number of conventional monetary establishments asserting plans to launch monetary providers on the community throughout the newest Solana Breakpoint occasion in Singapore.

Different giant altcoins together with XRP and Litecoin noticed inflows totalling $300,000.

Regionally, the US was the biggest supply of inflows, as anticipated, with $277 million in inflows final week, adopted by Switzerland with $63 million.

In distinction, Germany, Sweden and Canada noticed outflows of $9.5 million, $7.8 million and $2.3 million respectively.