Latest information on Bitcoin liquidations and leverage ranges reveals distinctive worth discovery exercise as longs and shorts are being cleared from the market. Bitcoin's risky worth actions within the U.S. market final week led to many leveraged positions being unwound.

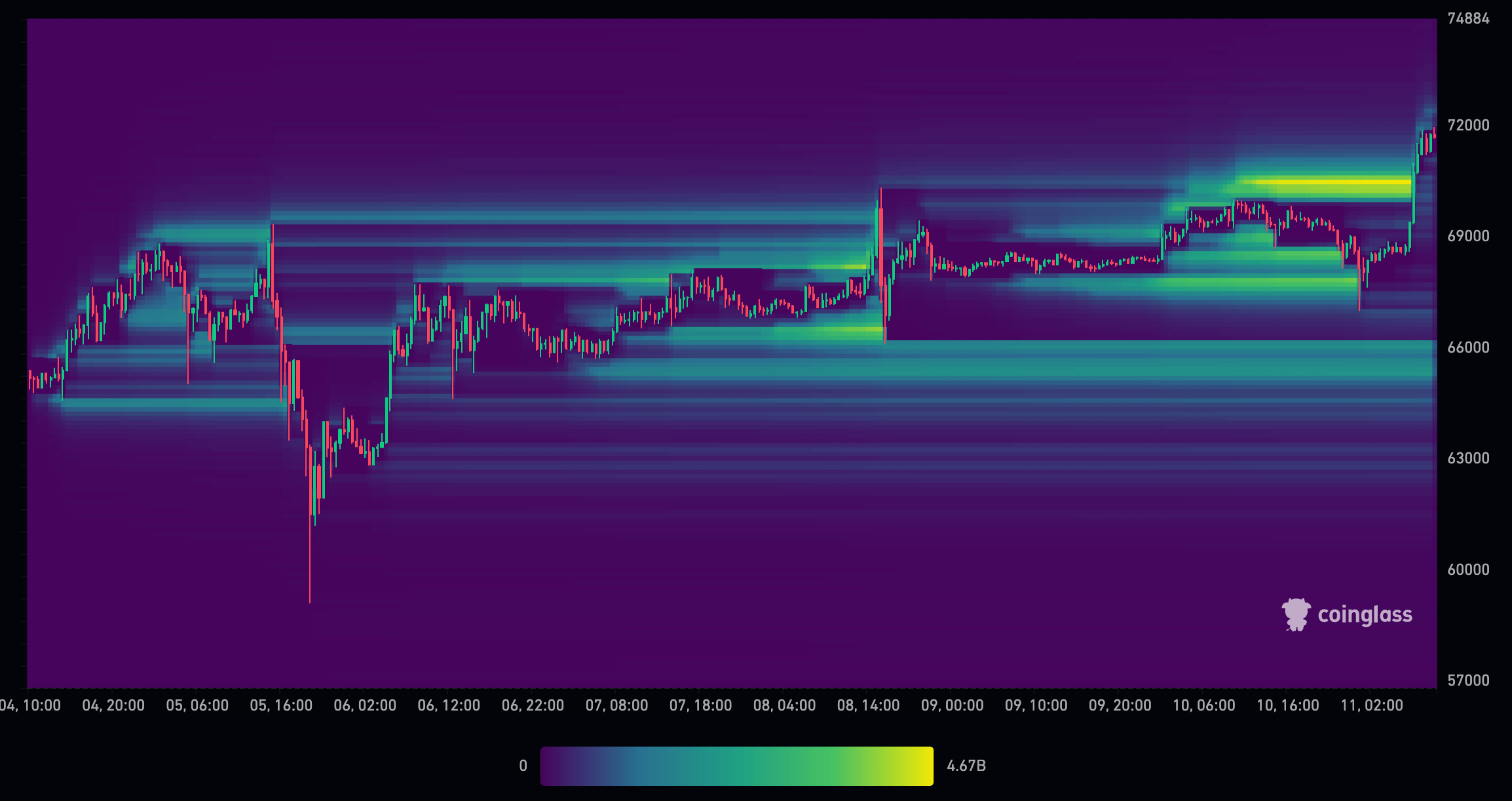

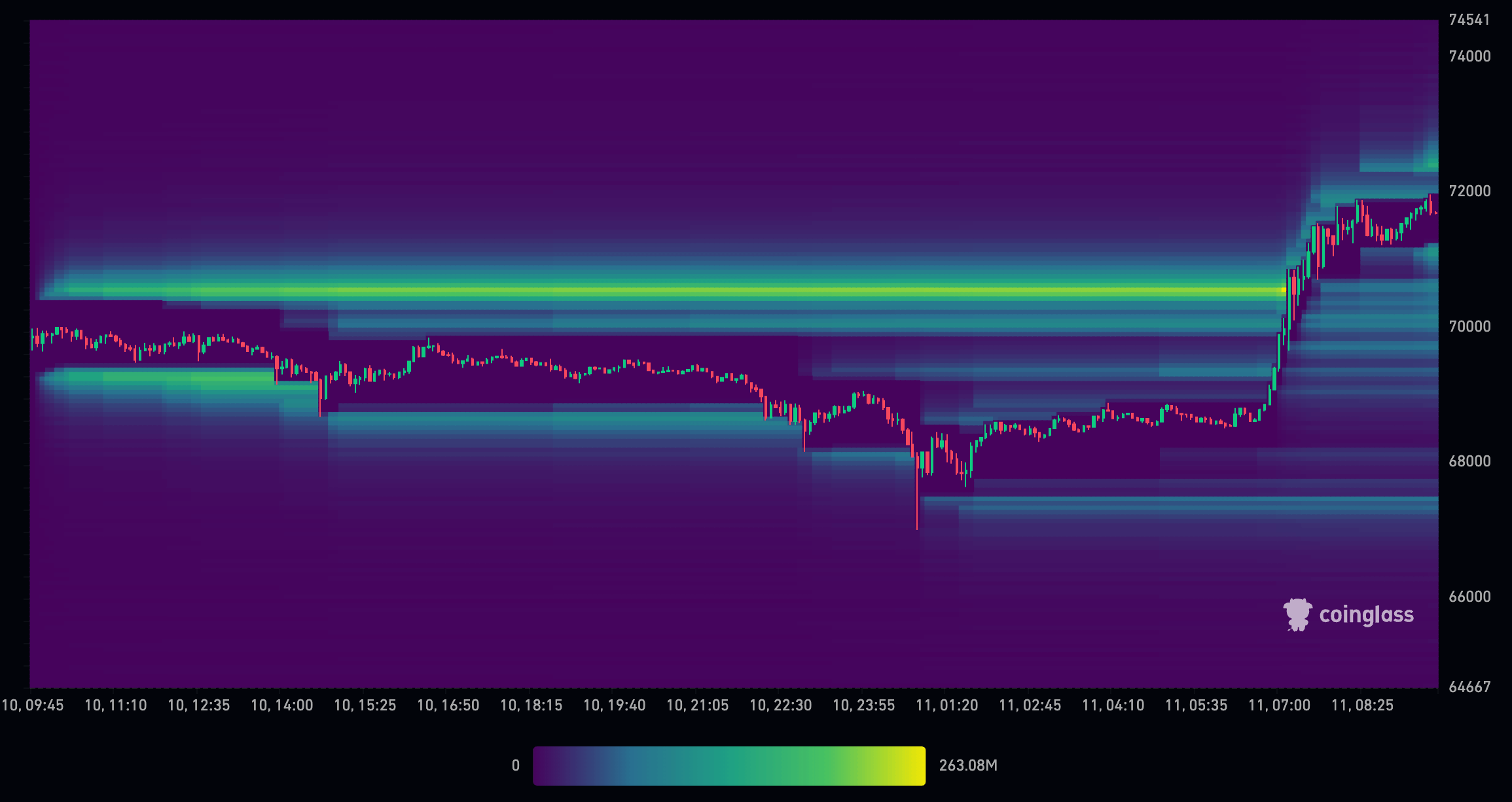

The CoinGlass liquidation chart under reveals how buying and selling exercise round 2:30pm GMT (US market open) on March fifth and eighth led to massive scale liquidations of each lengthy and quick positions. is proven. A rise of roughly 2% was adopted by a decline of over 10% on March fifth, which swept the order guide and washed away all leverage to $60,000.

The following speedy V-shaped restoration resulted in extra leverage positions of roughly $70,000 and $66,000. The market opened on March eighth and canceled these out, leaving little leverage above $66,000.

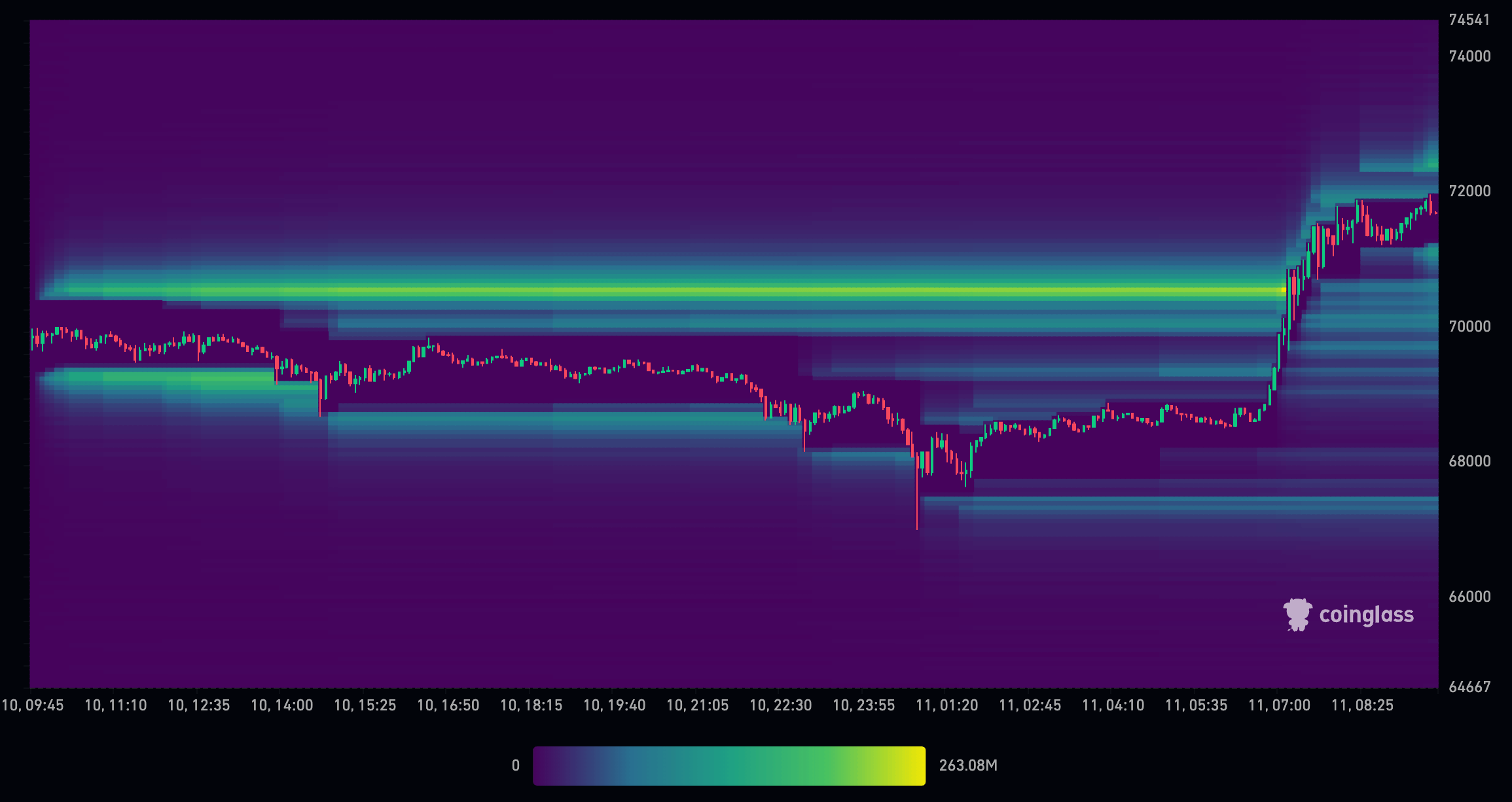

As of March eleventh, the decline to $67,000 and subsequent rally to new highs close to $71,500 as soon as once more eradicated most leveraged positions above $66,000 and set a powerful ground. On account of these strikes, Bitcoin is now free to make pure worth discovery above $66,000.

In contrast to the 2021 bull market, which was closely influenced by extremely leveraged positions, the present cycle seems to have shed leverage earlier than inflicting vital volatility. Moreover, main institutional traders and market makers could also be concerned in paving the way in which for Bitcoin worth discovery by means of large-scale buying and selling exercise.

The function of market makers in worth discovery

Market makers and extra lately ETF accredited individuals make a huge impact finance market, administration Buy move and promote order precisely and is answerable for Offering liquidity,it’s the lifeline of Marketplace for any asset.To cite the continuation Bid worth and asking worththey purpose to revenue from Though it has unfold, their Increasing function excess of simply Producing earnings.

In periods of excessive volatility, market makers have interaction in a strategic maneuver referred to as “sweeping” the order guide. This includes putting numerous orders at varied worth ranges to research the depth of the market and confirm the true steadiness of provide and demand. This wide-ranging motion examines the present state of the market, catalyzes worth discovery, and divulges the extent of willingness of market individuals to commerce in massive portions.

The latest improve in leverage within the Bitcoin market has had a big affect on the worth state of affairs. The elimination of leveraged promote orders has decreased downward strain available on the market, permitting for a extra natural worth discovery course of. That is characterised by the market being much less influenced by the amplified bets of leveraged merchants and extra influenced by the true sentiments and valuations of individuals.

Because the market adjusts to a brand new equilibrium free of the burden of leveraged positions, the worth of Bitcoin is extra more likely to mirror its precise market worth. This doesn’t imply that the trail will probably be linear or that there will probably be no variability. The digital foreign money market is understood for its speedy worth fluctuations. Nonetheless, present circumstances recommend that circumstances are ripe for a extra sustained upward pattern.

Benefit from reductions and vital reductions in buy orders beginning in December

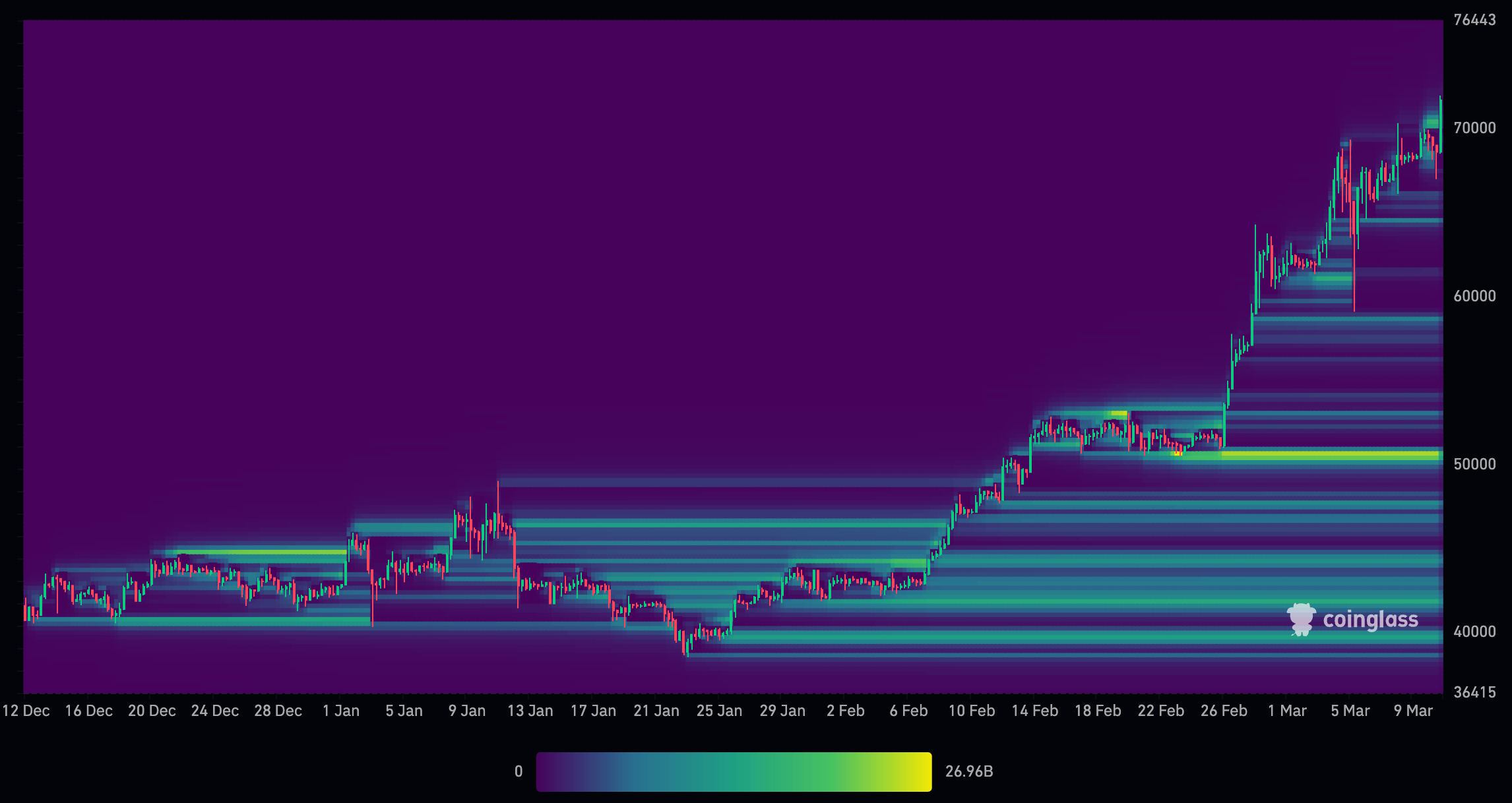

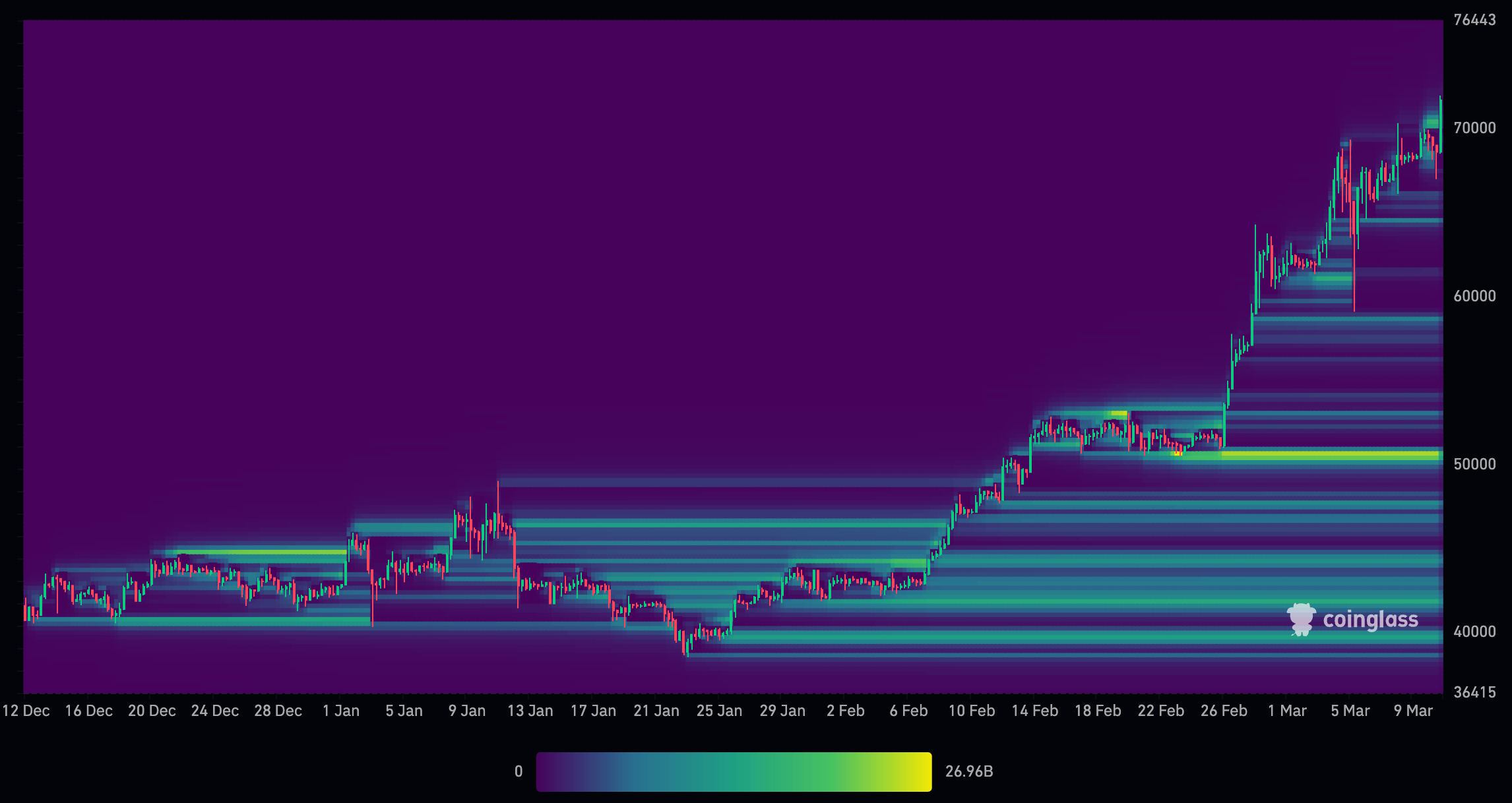

A more in-depth have a look at market forces from December 2022 to March 2023 explains additional worth discovery and the trail to a brand new $50,000 ground.

In December, the market noticed a big liquidation of leveraged positions, with many longs liquidating simply above the $41,000 stage and shorts liquidating across the $45,000 stage. As Bitcoin approached ETF approval on January eleventh, many shorts had been opened across the $45,000 stage and remained so whilst the worth fell to round $40,000. Curiously, there aren't many longs at this stage, suggesting the worth is being supported by holders and common worth discovery reasonably than leveraged positions.

As Bitcoin rebounded from $40,000 and rose towards $45,000 by early February, a number of shorts had been liquidated alongside the way in which. Longs had been positioned between $40,000 and $50,000 as Bitcoin continued its upward trajectory. By the point Bitcoin reached $50,000, there have been vital leveraged positions, amounting to roughly $27 billion. Nonetheless, as costs rose, the quantity of leveraged positions above $50,000 decreased considerably.

Worth motion in early March noticed Bitcoin soar to $70,000 inside a single candlestick after which plummet to $59,000, successfully wiping out almost all leveraged positions available in the market. Though there was some leverage round $70,000, the vast majority of leveraged positions at the moment are concentrated under $50,000.

The liquidation of leveraged positions resulted in a extra balanced distribution of longs and shorts, leading to a extra clear market construction. This growth might pave the way in which for a extra natural worth discovery course of, pushed by real market demand reasonably than counting on hypothesis.

Latest liquidations and reductions in leveraged positions within the Bitcoin market sign a possible shift to a extra fundamentals-driven market. With the vast majority of leveraged positions presently concentrated at lower cost ranges, there may be room for upward strain available on the market as real demand and adoption drives costs greater.

Eliminating extreme leverage will set the muse for more healthy market dynamics, with worth discovery guided by elementary components resembling elevated mainstream acceptance, regulatory readability, and technological developments within the blockchain area.

Latest liquidation and leverage information supplies a compelling case for a possible uptrend resulting from natural worth discovery.

(Tag Translation) Bitcoin