Bitcoin's liquidity provide and illiquidity provide are very fascinating and helpful metrics for understanding market traits. Liquidity provide refers back to the quantity of Bitcoin that’s available for buying and selling, which means it’s held in wallets the place frequent transactions happen. A subset, excessive liquidity provide, signifies Bitcoin that strikes much more often and is commonly utilized by merchants and exchanges. Conversely, illiquidity provide represents Bitcoin that’s held in wallets that hardly ever transfer cash, suggesting long-term holding conduct.

Analyzing these provides can present perception into market sentiment and doable future worth actions. A rise in liquid provide usually signifies elevated buying and selling exercise and doable promoting strain, whereas a rise in illiquid provide suggests accumulation and a bullish outlook as holders anticipate the worth to rise.

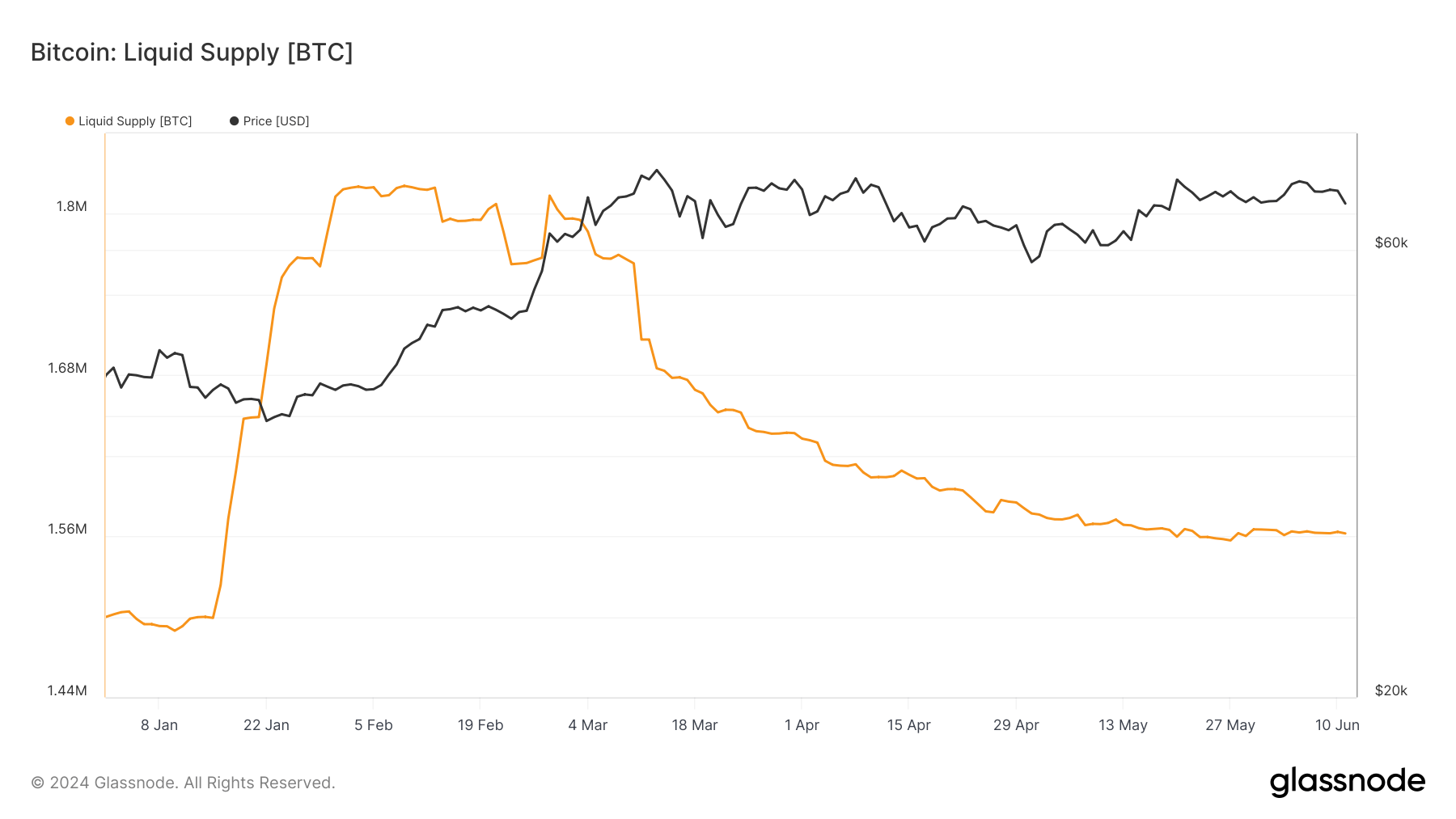

All through this yr, these provides have seen giant fluctuations, with the liquid provide rising from 1.501 million BTC on January 1st to 1.813 million BTC on February twenty eighth. Nevertheless, it has declined persistently since April, with the liquid provide dropping to 1.562 million BTC on June eleventh. This decline signifies much less Bitcoin obtainable to be traded instantly, suggesting much less promoting strain as fewer cash can be found for fast transactions.

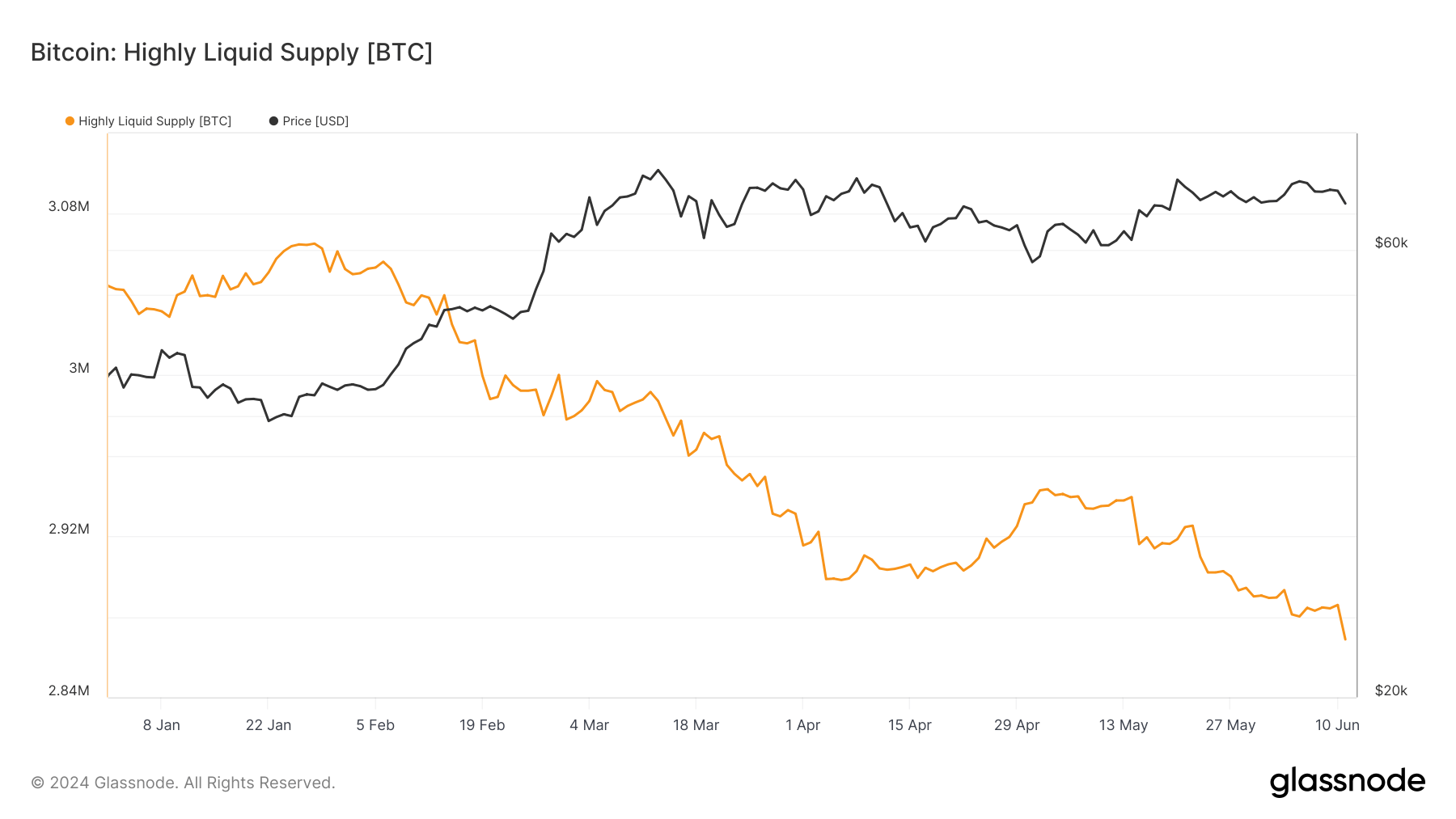

Liquid provide has additionally declined, ranging from 3.044 million BTC on Jan. 1 and reaching 2.868 million BTC on June 11. The constant decline over the previous few months highlights the decline in essentially the most accessible type of Bitcoin, which may imply that energetic merchants and exchanges are holding much less Bitcoin, probably because of a shift in direction of holdings or a drop in buying and selling exercise.

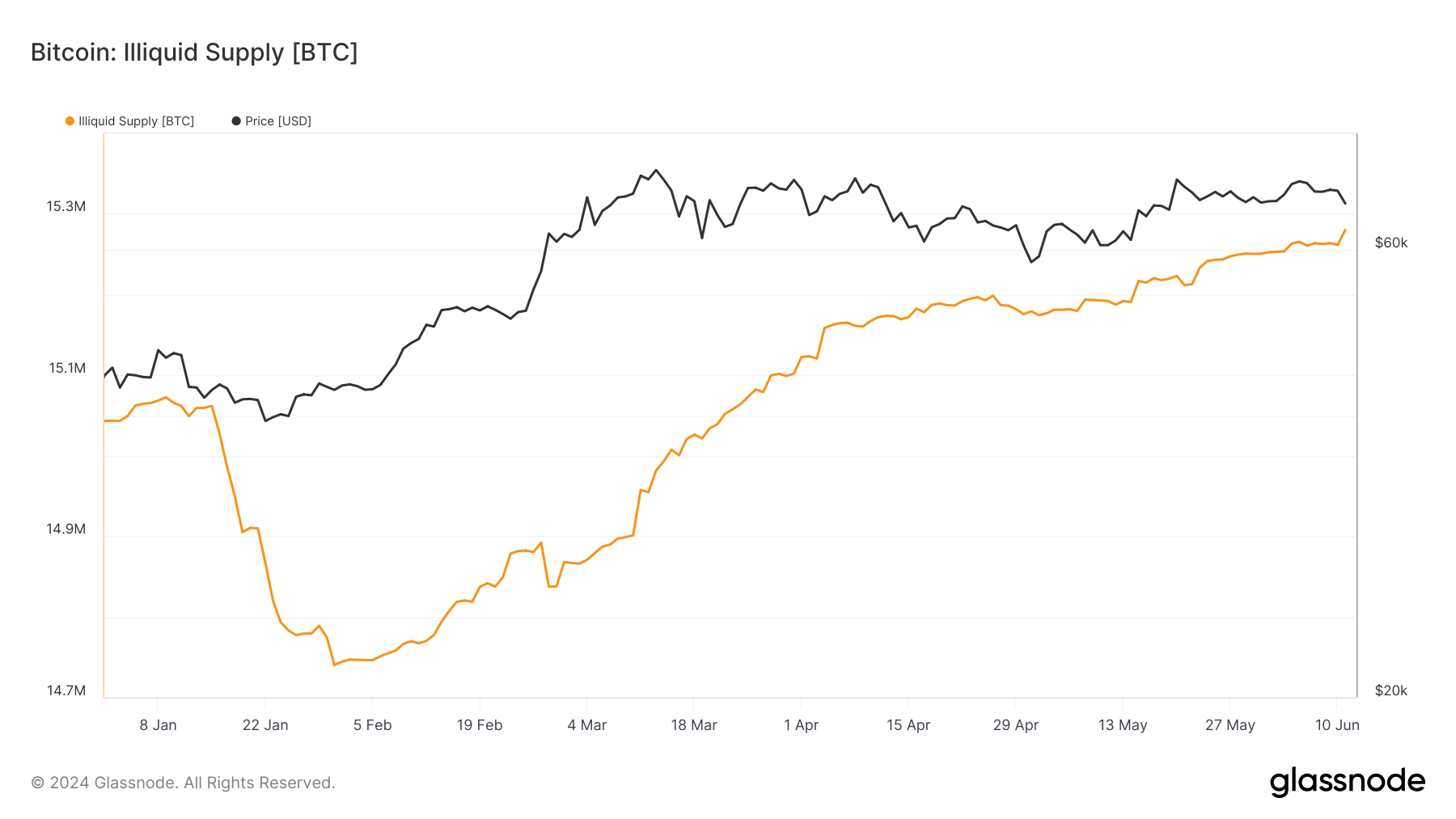

Conversely, the illiquid provide has been steadily rising, ranging from 15.043 million BTC on January 1st and rising to fifteen.28 million BTC on June eleventh. This rising pattern in illiquid provide signifies that extra Bitcoin is being moved into long-term storage, signaling a decline in confidence in Bitcoin's future worth and the rapid availability of cash for buying and selling.

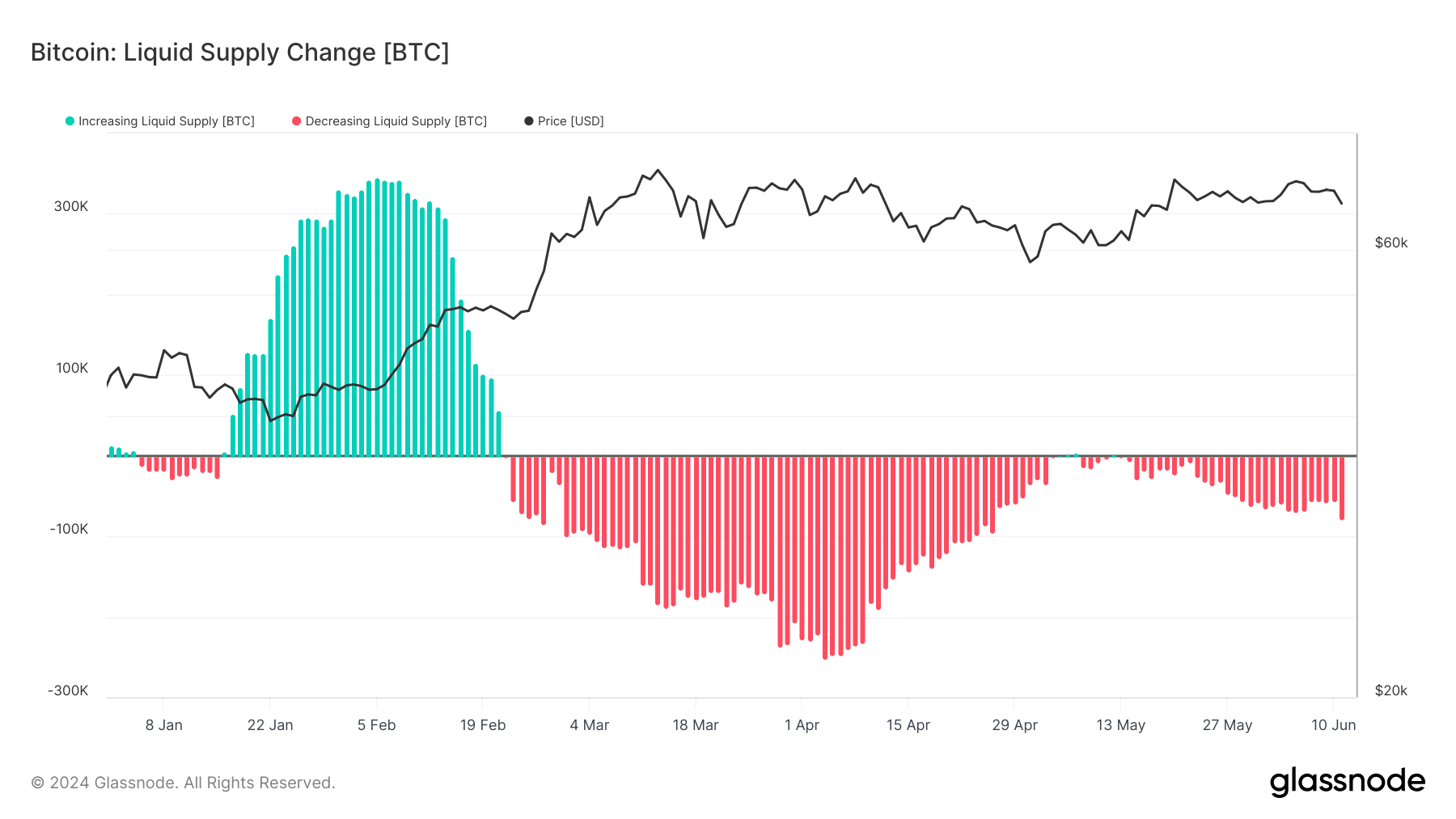

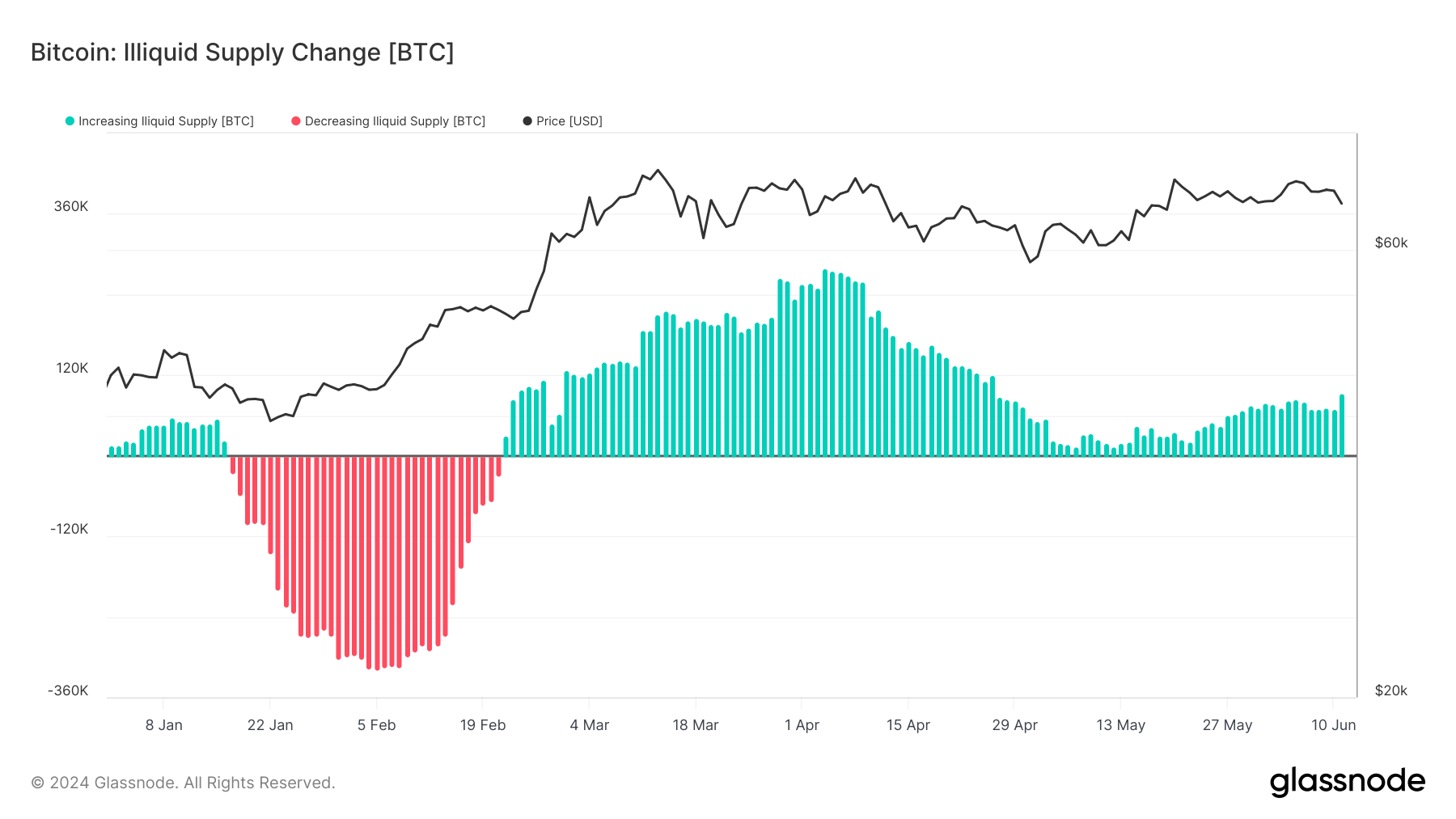

The 30-day internet change knowledge additionally helps these observations. Liquid and extremely liquid provide has been persistently damaging since February twenty second, with the biggest lower being 252,000 BTC on April 4th. As of June eleventh, the web change stays at -79,306 BTC. This persistently damaging change helps the concept that Bitcoin is frequently flowing out of liquid and extremely liquid wallets, lowering market provide.

In the meantime, the 30-day internet change in illiquid provide has been optimistic since February 22, reaching a peak enhance of 279,587 BTC on April 4. As of June 11, the web change is +92,834 BTC, indicating a gradual and continued accumulation pattern amongst long-term holders.

Evaluating the general yearly pattern with final month, the sample stays constant: liquid and illiquid provide proceed to say no, albeit at a slower tempo, whereas illiquid provide has been steadily rising. This continued divergence between liquid and illiquid provide factors to a market the place extra members are leaning in direction of holding slightly than buying and selling, reflecting bullish sentiment.

The submit Bitcoin Liquidity Provide Diminishes, However Confidence in Illiquidity Rise appeared first on currencyjournals