- IMF says fast-growing greenback stablecoins threat weakening rising markets’ financial sovereignty

- Tom Lee says IMF stablecoin report confirms robust momentum for international tokenization

- With the help of the US GENIUS Act and on-chain treasury tokens, the stablecoin market exceeds roughly $312 billion

The Worldwide Financial Fund (IMF) issued a stern warning to the world’s central bankers on December 5, clearly warning that the $312 billion stablecoin market is a direct menace to the financial sovereignty of rising nations.

In that report, Understanding stablecoinsThe fund acknowledged that whereas a digital greenback would streamline funds, it might additionally speed up “cryptocurrency” and cripple weaker nations’ means to regulate their very own capital flows.

Associated: FDIC units December deadline for federal stablecoin licenses. Capital guidelines to comply with in 2026

IMF highlights alternatives and challenges for stablecoins

likelihood: Clean funds with USD-backed tokens

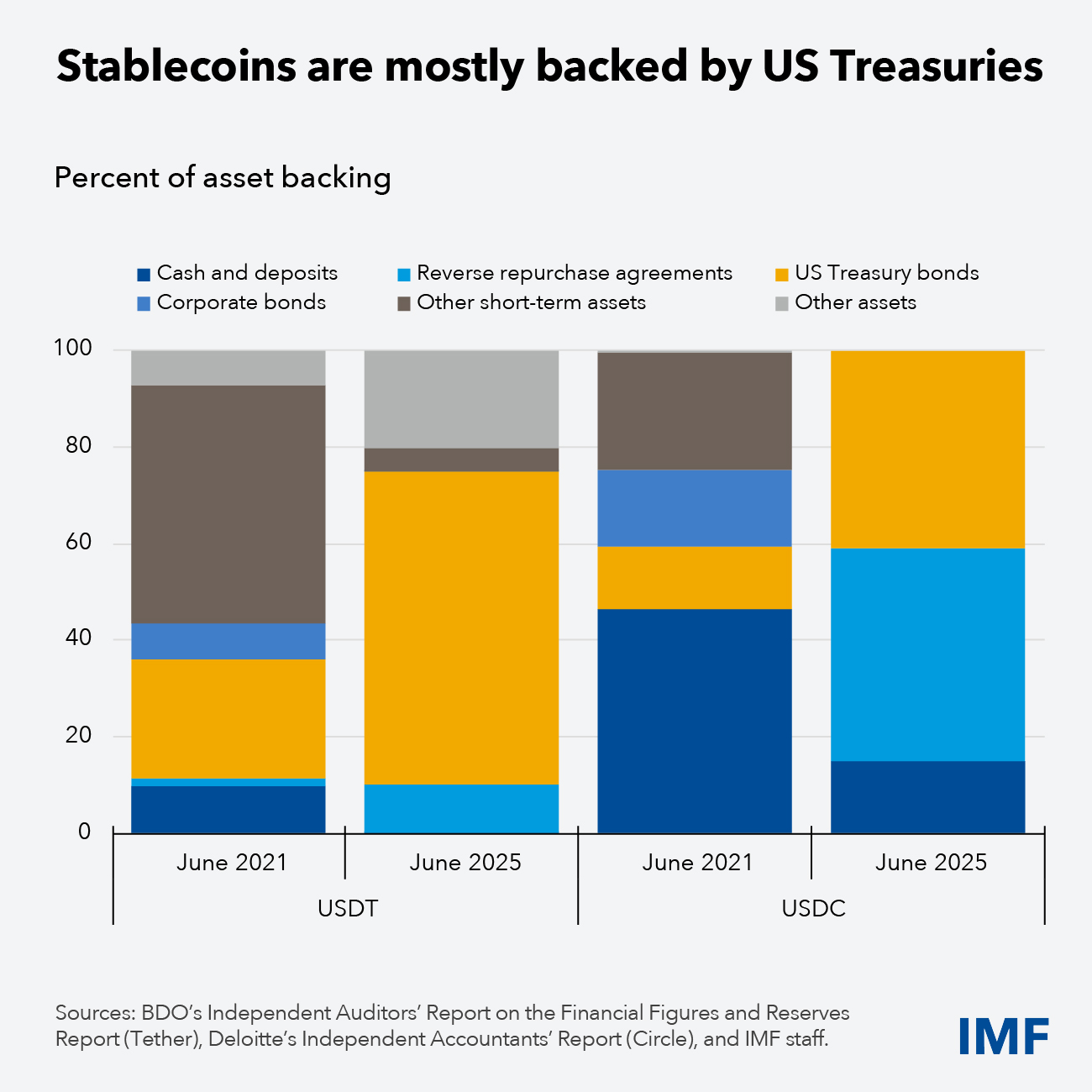

The IMF reported that stablecoins may revolutionize cross-border funds. The tokenization of prime authorities bonds on the blockchain has diminished friction in funds, particularly in nations affected by years of excessive inflation.

Moreover, stablecoin adoption has greater than doubled prior to now two years and stays at roughly $312 billion on the time of writing. Stablecoin development has accelerated prior to now few months, fueled by the implementation of the GENIUS legislation in the USA.

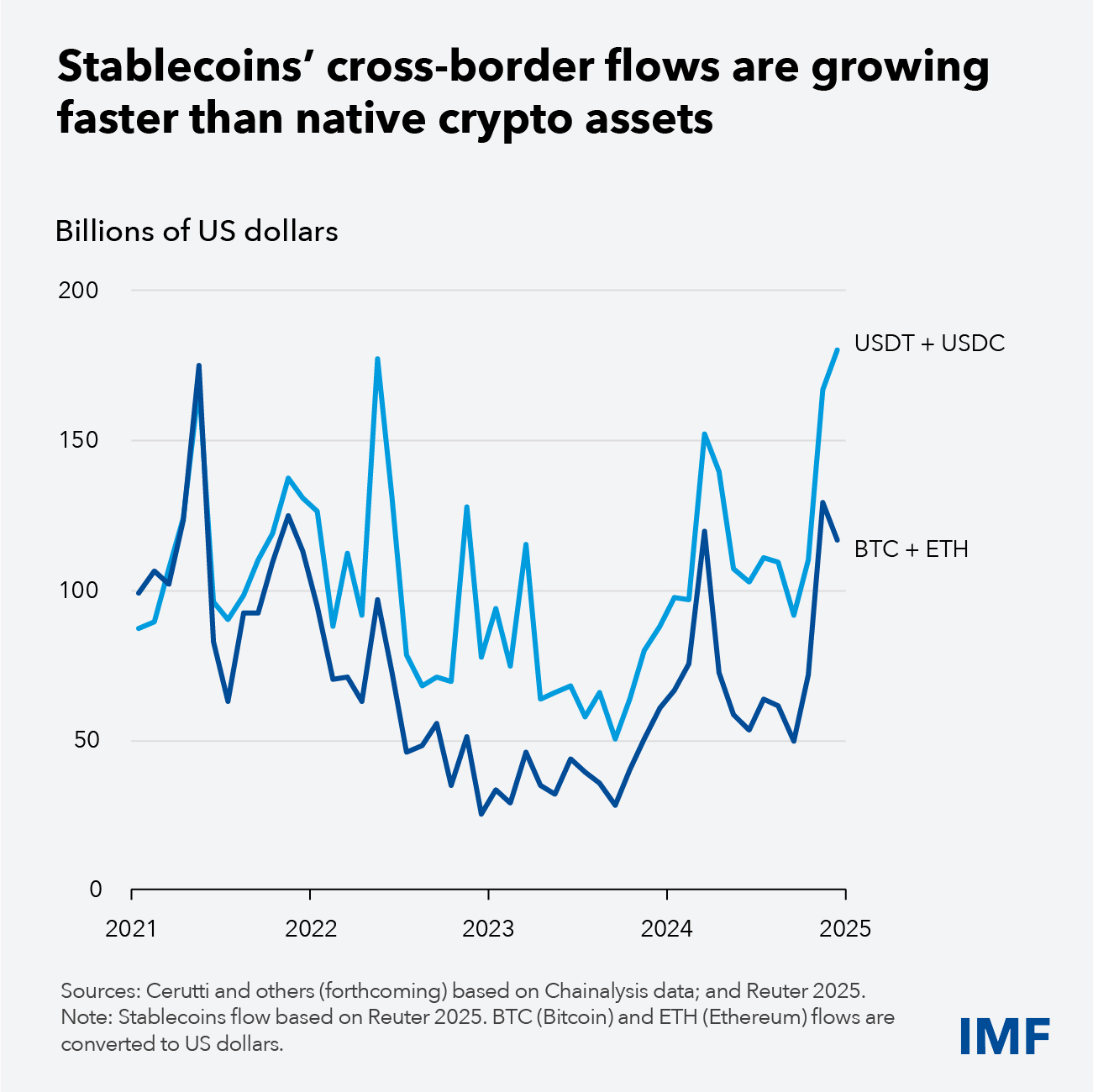

As such, the IMF famous that USD-backed stablecoins lead cross-border funds even in comparison with native crypto belongings. The report notes that USD-backed stablecoins enabled greater than $170 billion in cross-border funds in 2025, in comparison with round $125 billion for Bitcoin (BTC) and Ethereum (ETH).

International Threat: Violation of Financial Sovereignty

Nonetheless, the IMF harassed that the rising use of stablecoins is regularly undermining financial coverage in rising markets. Moreover, international central banks with USD-backed stablecoins have much less affect over their very own currencies.

“Stablecoins additionally carry important dangers associated to macro-financial stability, operational effectivity, monetary soundness, and authorized certainty.Stablecoins can contribute to forex substitution and enhance the volatility of capital flows,” the IMF report stated.

For instance, high-inflation nations resembling Lebanon, Nigeria, Turkey, and Argentina have seen a surge in the usage of USD-backed stablecoins. In consequence, the respective native currencies additional depreciated.

In consequence, the IMF warned that stablecoins undermine financial sovereignty. The IMF, in collaboration with the Monetary Stability Board (FSB), has issued complete coverage suggestions to the world’s central banks on strategy stablecoins.

Market response: Tokenization is right here to remain

The IMF report sparked a heated public debate led by X and the press. In response to BitMine Chairman Tom Lee, the IMF report additional validates the mainstream adoption of stablecoins, significantly on the Ethereum community.

The mainstream adoption of stablecoins has helped institutional traders use crypto belongings in a regulated method and tokenize real-world belongings. Moreover, stablecoins are a serious supply of liquidity for a broader vary of risky crypto belongings, particularly in bear markets.

In response to Marcelo Sacomori, CEO of Brazil’s Braza Financial institution, stablecoins will evolve from a distinct segment product inside two years.

Associated: 10 largest European banks type “Kivalis” to interrupt USD’s 99% dominance in stablecoin market

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version isn’t chargeable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.