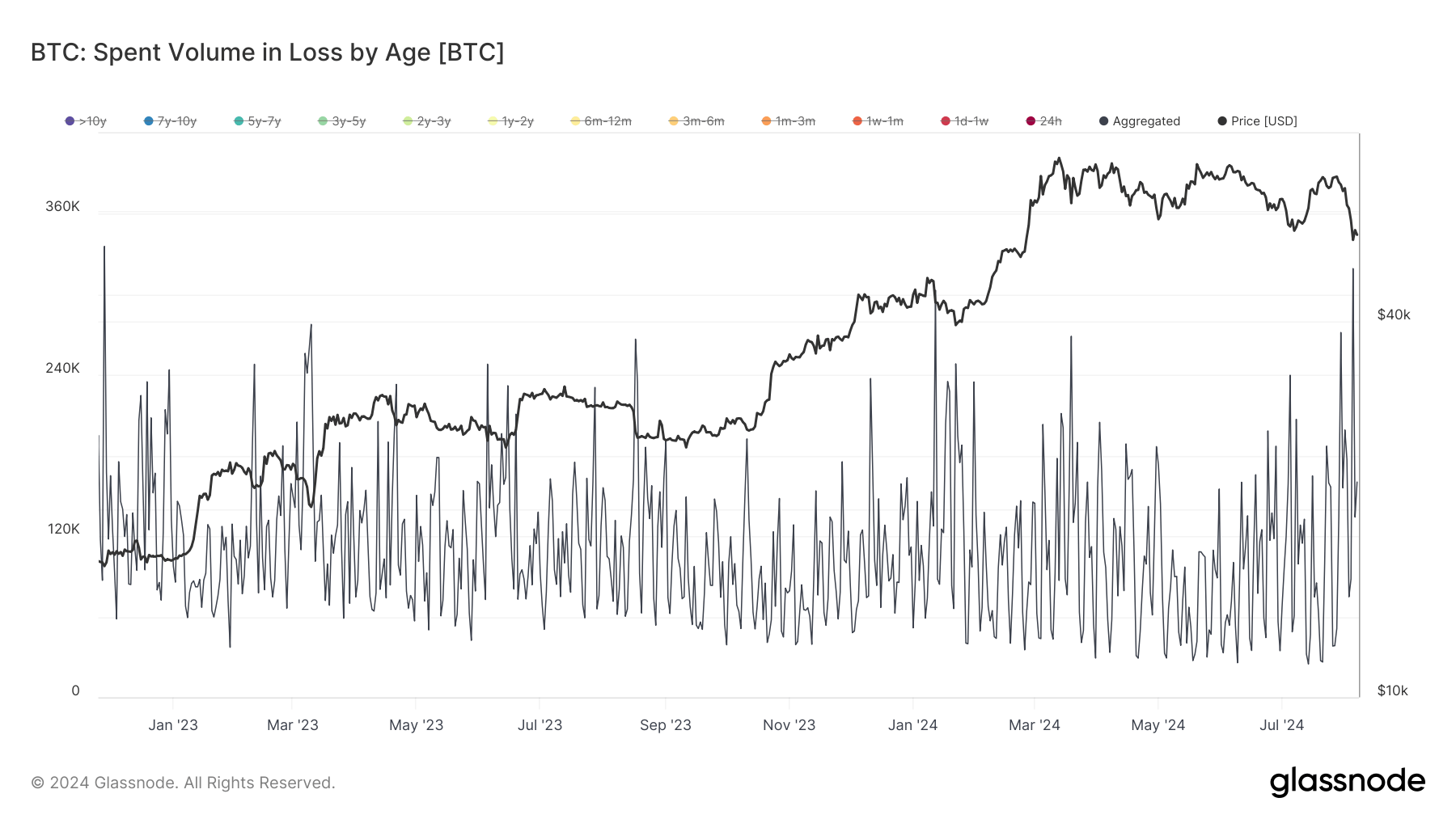

Throughout instances of maximum value volatility and large market-wide losses, it is very important perceive the place most of those losses are coming from. Whereas earlier currencyjournals evaluation has targeted on the variations in habits between long-term and short-term holders, on-chain knowledge provides one other layer of depth that may present a deeper understanding of market sentiment.

One in all these metrics is the quantity spent at loss, which calculates the entire quantity of Bitcoin bought beneath the acquisition value. By breaking down this quantity of loss by age group and pockets measurement, we are able to higher perceive the distribution of loss actions throughout totally different investor demographics and time frames.

Bitcoin losses elevated considerably because the cryptocurrency fell from $60,000 to $54,000 between August 3 and August 5. Losses rose to simply over 74,890 BTC on August 3 and surged to 319,290 BTC on August 5, the very best loss since November 28, 2022.

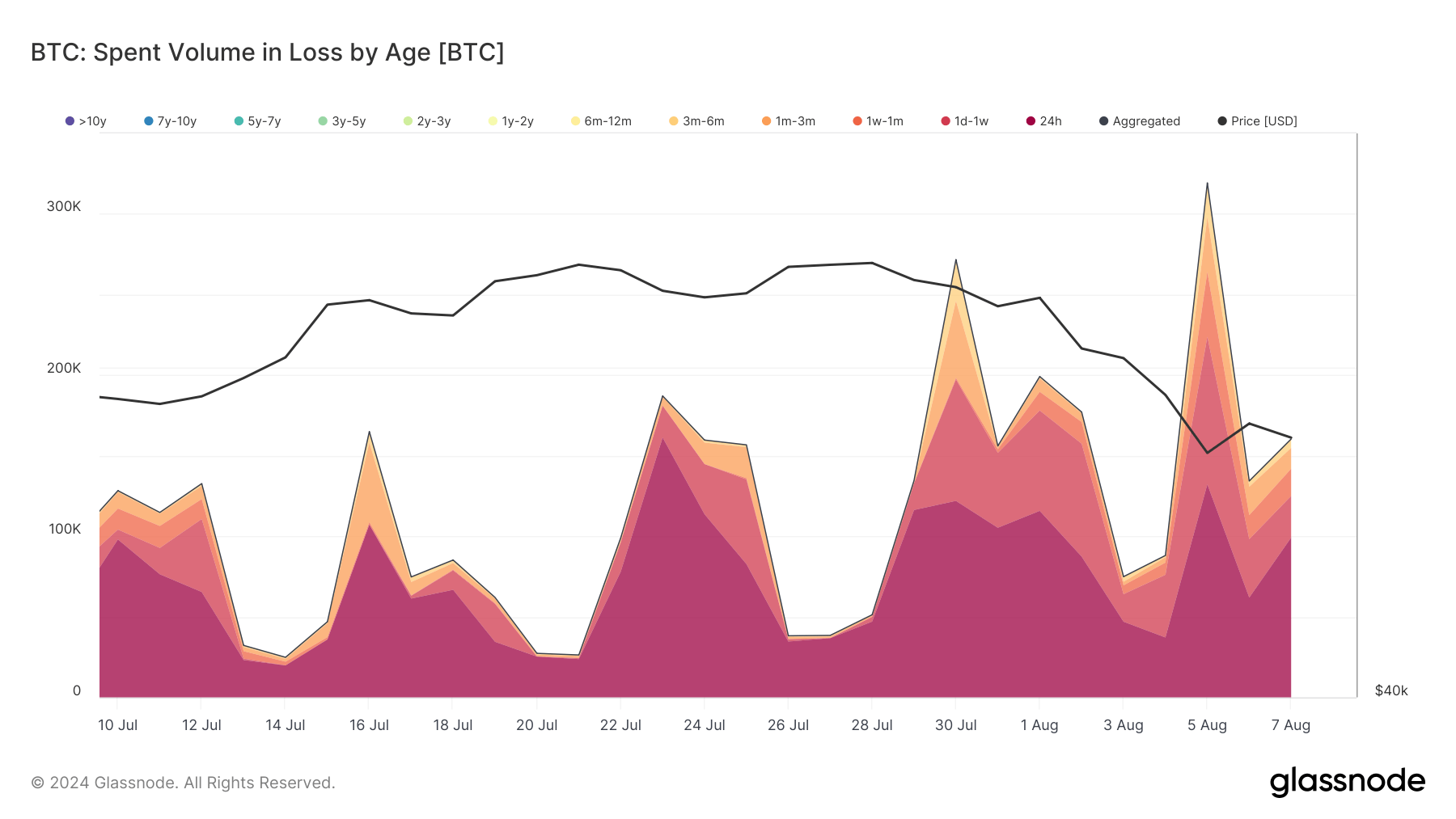

By age group, nearly all of misplaced quantity got here from wallets that held BTC for lower than 24 hours, amounting to 132,180 BTC. The second largest quantity was from every day and weekly volumes, totaling 91,685 BTC.

The 1 week to 1 month previous cohort misplaced 40,235 BTC, the 1 month to three month previous cohort misplaced 34,088 BTC, and the three to six month previous cohort misplaced 18,869 BTC, whereas the 6 to 12 month previous cohort spent 1,077 BTC, and the over 1 yr previous cohort spent just below 1,300 BTC in complete.

There are a number of attainable components that would clarify this big buying and selling quantity. Traders who purchased Bitcoin with the intention of short-term income usually react shortly to market actions. As well as, many merchants use stop-loss orders that routinely promote property when the value falls to a sure stage. The sudden value drop might have triggered a cascade of stop-loss orders, leading to a considerable amount of Bitcoin being bought at a loss in a brief time frame.

Moreover, automated buying and selling bots performing high-frequency buying and selling might have led to the lack of massive quantities of Bitcoin. These bots are programmed to react to market actions inside seconds or minutes, leading to a flood of trades from newly acquired cash.

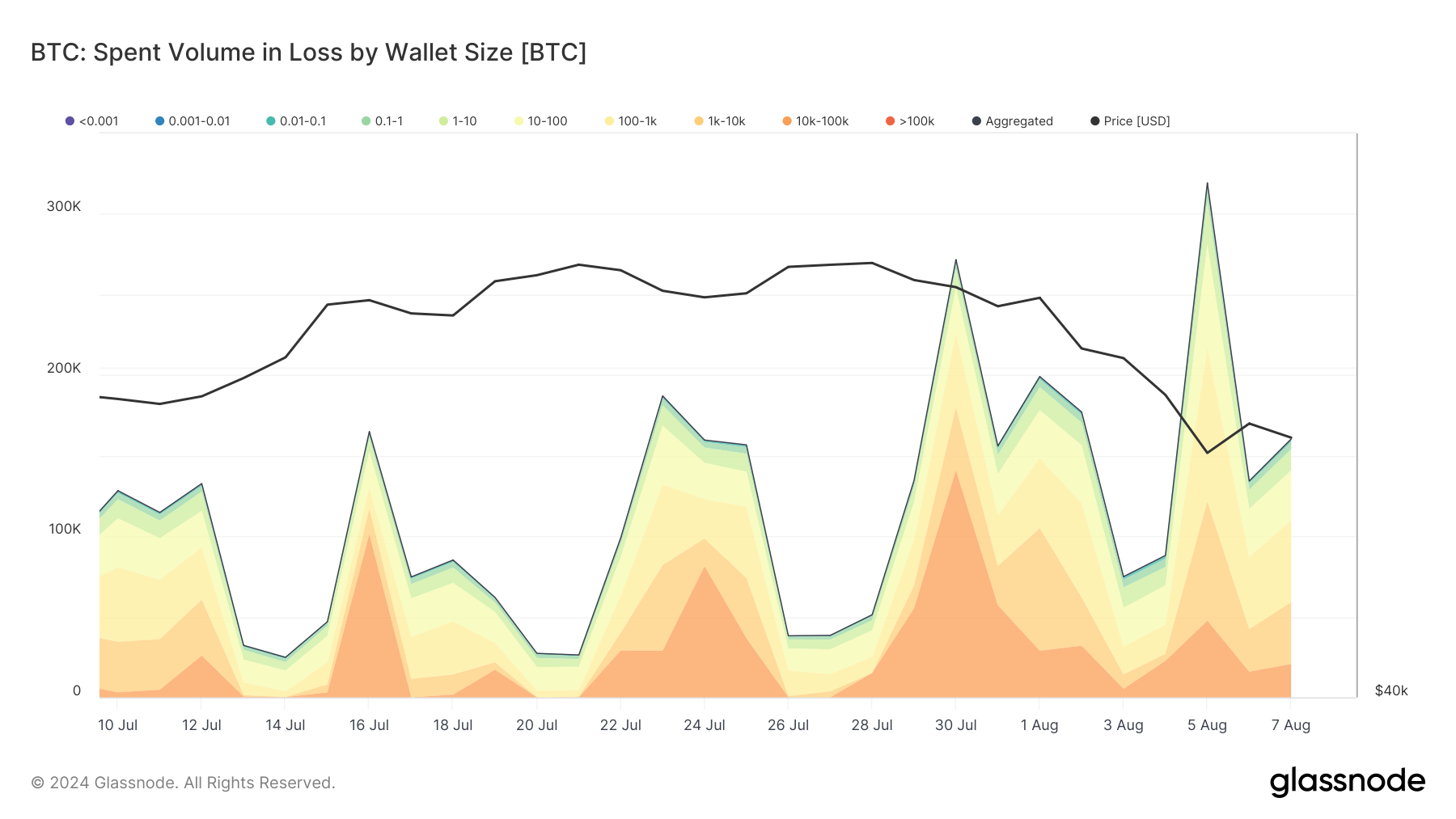

losses by pockets measurement, wallets holding 100-1,000 BTC misplaced essentially the most, totalling 95,590 BTC. Wallets holding 1,000-10,000 BTC spent 73,990 BTC, and wallets holding 10-100 BTC misplaced 63,869 BTC.

Wallets holding 100 to 1,000 BTC usually belong to institutional buyers and enormous holders. Information reveals that giant buyers had been aggressively promoting Bitcoin throughout value drops. As Bitcoin ETFs (exchange-traded funds) turn out to be extra widespread, vital promoting from these funds might have contributed to the large consumption of Bitcoin at a loss.

ETFs that observe the value of Bitcoin want to regulate their holdings based mostly on market actions and investor demand, resulting in massive volumes of buying and selling. Moreover, many exchanges retailer massive quantities of Bitcoin in sizzling wallets, starting from 100 BTC to 1,000 BTC.

During times of excessive buying and selling exercise, corresponding to a sudden value drop, exchanges might transfer massive quantities of Bitcoin to handle liquidity or to facilitate massive promote orders from customers.

The put up Bitcoin Buying and selling Quantity Losses Attain Highest Degree Since FTX Collapse appeared first on currencyjournals