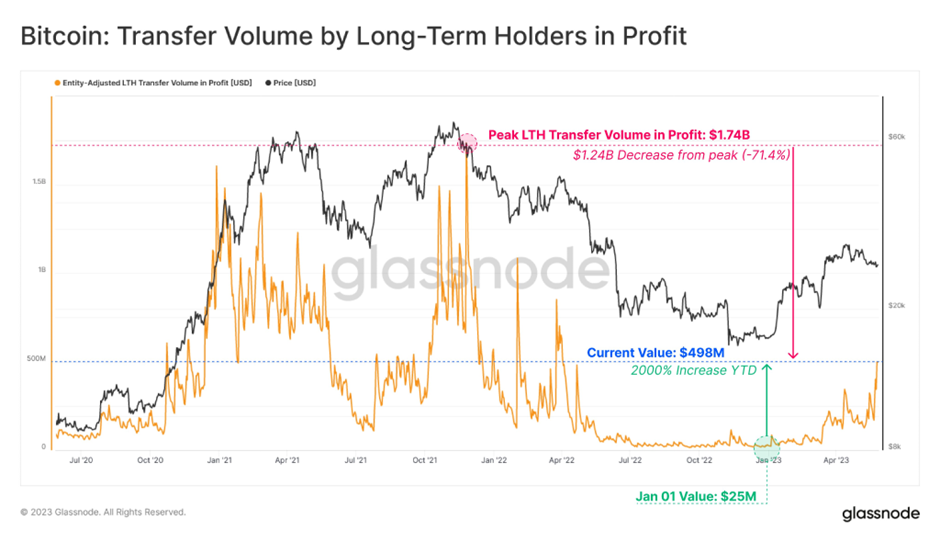

- Glassnode tweeted that bitcoin remittances despatched by long-term holders for revenue surged nearly 2000% year-to-date.

- BTC’s present worthwhile remittance quantity is $1.24 billion, down 71.4% from the 2021 bull market peak.

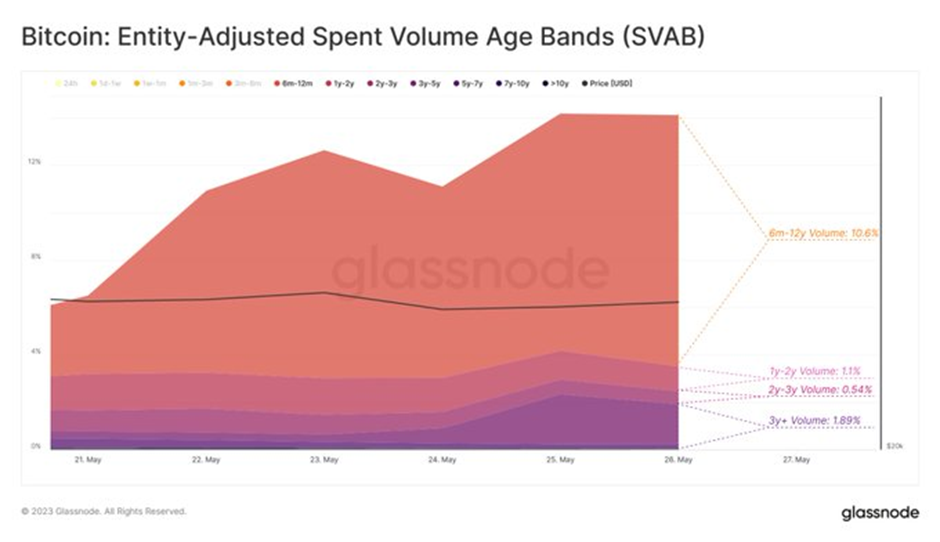

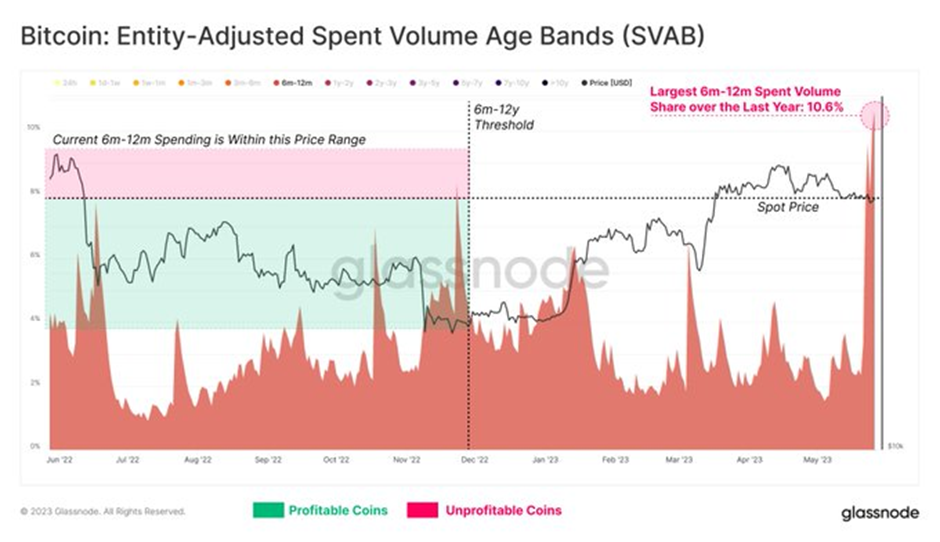

- The 6- to 12-month long-term holder cohort is the most important spender.

Information analytics platform Glassnode has seen a notable year-to-date enhance in bitcoin remittances by long-term revenue holders, leaping from $25 million to $489 million, a rise of almost 2000%. reported a rise.

However, BTC’s present worthwhile remittance quantity is $1.24 billion, 71.4% decrease than the height of $1.74 billion seen within the 2021 bull market.

In the meantime, Glassnode regarded on the spending breakdown of Bitcoin long-term holders (LTH) by age cohort, revealing that the 6- to 12-month cohort stood out as the largest spenders. stated. They recorded switch volumes thrice greater than his for all different LTH cohorts, or over a yr.

Moreover, when analyzing the coin’s spending vary from 6 to 12 months, Glassnode discovered that out of a complete of 183 potential acquisition dates, 167 (92%) are actually It says it is vital to understand that it is in a worthwhile place. Present spot worth. This data helps contextualize each the excessive spending throughout the 6- to 12-month-old cohort and the latest spike in worthwhile remittance volumes.

Moreover, the earlier TweetGlassnode factors out that the bitcoin market continues to function with unrealized positive factors, with worthwhile provide now nearly double the lossy provide, a ratio of 1.9 to 1. backside.

Nevertheless, the platform stresses it is vital to notice that this ratio remains to be considerably decrease than the height reached throughout the 2021 bull market growth. At the moment, the availability revenue/loss ratio skyrocketed to a staggering 554.5, indicating that the market was rather more worthwhile.

Disclaimer: As with all data shared on this pricing evaluation, views and opinions are shared in good religion. Readers ought to do their very own analysis and due diligence. Readers are strictly answerable for their very own actions. COIN EDITION AND ITS AFFILIATES SHALL NOT BE LIABLE FOR ANY DIRECT OR INDIRECT DAMAGES OR LOSSES.

(tag translation) bitcoin information

Comments are closed.