- Bitcoin has been experiencing extended value volatility regardless of hitting file highs.

- Bitcoin’s RSI is at 46.86, indicating impartial momentum, suggesting neither overbought nor oversold situations.

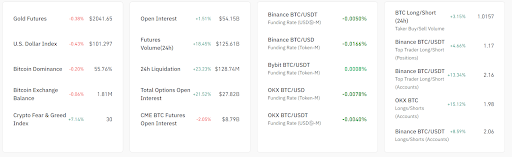

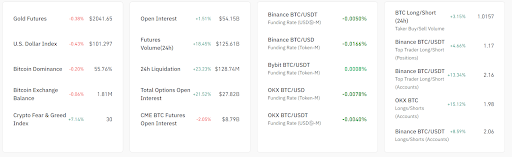

- The Crypto Concern and Greed Index rose 7.14%, signaling a extra optimistic shift in market sentiment.

Bitcoin analyst Bitcoin Journal Professional just lately famous that regardless of hitting new all-time highs earlier this 12 months, Bitcoin has since skilled a unstable sell-off over the previous few months, elevating investor considerations in regards to the sustainability of the present bull run.

Bitcoin value is at present at $59,337.38 with a 24-hour buying and selling quantity of $31.54 billion, up 0.84% over the past 24 hours. It has a market cap of $1.17 trillion and a circulating provide of 19,742,653 BTC out of a most provide of 21 million BTC.

A number of technical indicators supply perception into present market sentiment for Bitcoin: The Relative Power Index (RSI) is suggesting impartial momentum at 46.86, whereas the Transferring Common Convergence Divergence (MACD) line is barely above the sign line, suggesting potential bullish momentum.

Bitcoin's market share decreased by 0.20%, indicating a slight decline in Bitcoin's share relative to different cryptocurrencies. Moreover, change balances decreased by 0.06%, suggesting that extra Bitcoin is being withdrawn from exchanges, which can point out elevated holdings and switch exercise.

Moreover, the Crypto Concern and Greed Index elevated by 7.14%, indicating a shift in the direction of extra optimistic sentiment amongst buyers. Notably, Bitcoin futures and choices open curiosity elevated by 1.51% and 21.52%, respectively, highlighting elevated buying and selling exercise and potential volatility available in the market.

Moreover, 24-hour futures buying and selling quantity surged 18.45%, highlighting the surge in market exercise. Additionally, funding charges for the BTC/USDT pair on main exchanges reminiscent of Binance, Bybit, and OKX stay optimistic, indicating continued bullish sentiment. Notably, nearly all of prime merchants on these platforms are at present holding lengthy positions, additional reinforcing the optimistic outlook.

Based mostly on their evaluation of Bitcoin value traits, Changellyblog predicts that Bitcoin could attain a peak of $73,150.86 in September 2024. Nonetheless, there’s a likelihood that the worth could fall to $61,782.28, with the common value in September 2024 anticipated to be round $67,466.57.

Trying additional forward, after learning Bitcoin value fluctuations over the previous few years, it’s predicted that the bottom Bitcoin value will probably be round $99,191 in 2025. The anticipated highest BTC value will attain round $120,014, with the common buying and selling value in 2025 more likely to be round $102,727.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. This text doesn’t represent any type of monetary recommendation or counsel. Coin Version isn’t liable for any losses incurred because of using the content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to our firm.