Bitcoin worth fell under $51,000 to retest a key assist degree on February seventeenth, regardless of remaining agency following better-than-expected CPI knowledge over the previous few days.

The flagship cryptocurrency was buying and selling at $50,856 on the time of writing after hitting a low of $50,625.

This decline marks a 2.81% drop previously 24 hours, and Bitcoin's market cap is now nearing $997.31 billion, simply shy of the $1 trillion milestone.

combined feelings

Latest worth actions have been pushed by each bullish and bearish investor sentiment.

In line with Changelly's evaluation, market sentiment is predominantly bullish, with 76% bullish sentiment in comparison with 24% bearish outlook, which is a robust indicator of the prevailing greed out there, based on the Concern & Greed Index rating. That is supported by 77.

Regardless of this optimism, Bitcoin has skilled important worth fluctuations over the previous month, ending within the inexperienced for 19 of the previous 30 days.

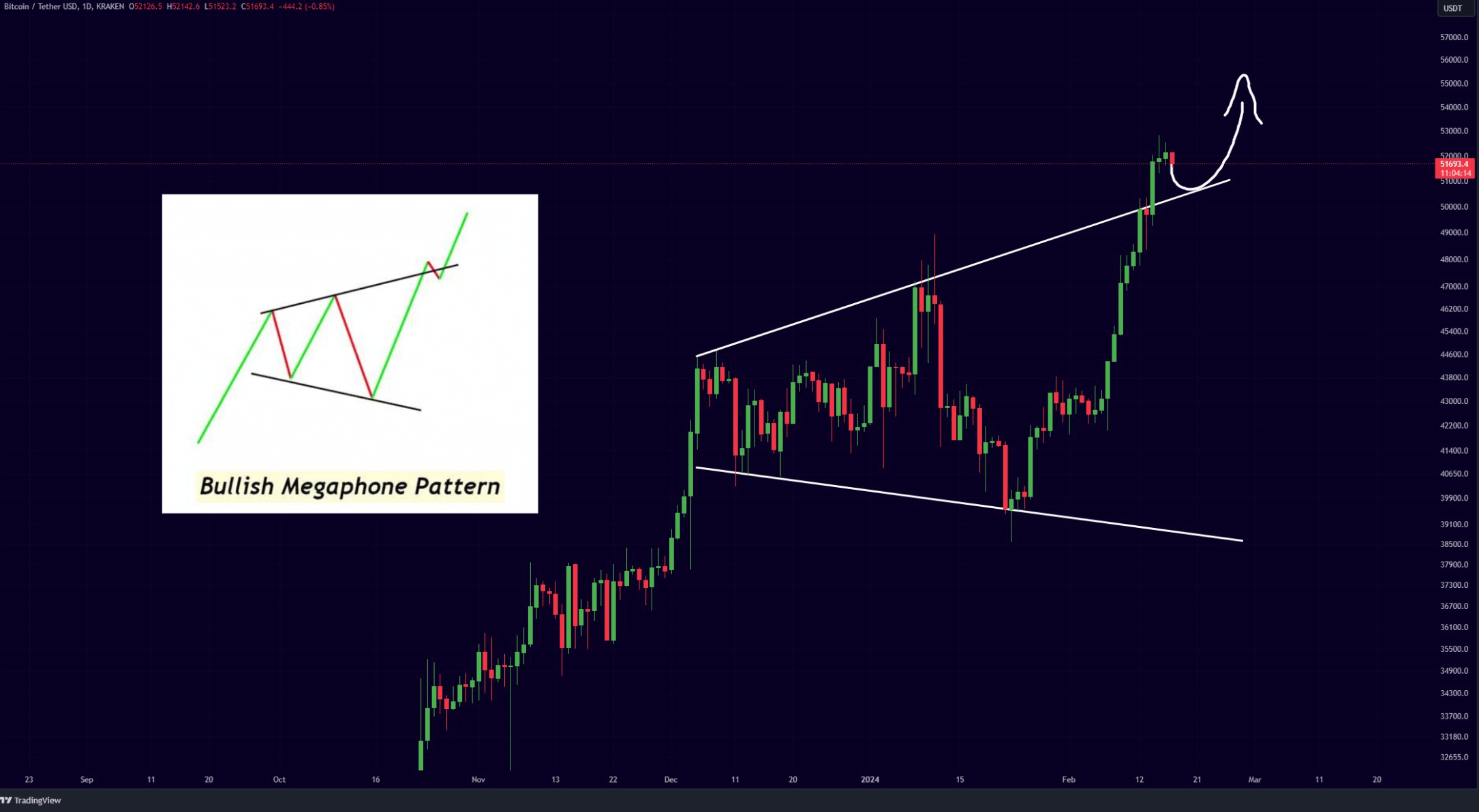

Bitcoin bulls recommend worth is testing assist Costs soar to year-to-date highsas a result of it has already damaged by means of an essential worth ceiling and shaped a bullish megaphone sample.

focus of dialogue

Bitcoin, the world's first decentralized cryptocurrency, continues to be a spotlight of debate amongst buyers, policymakers, and most people. Its vitality consumption, safety features, and potential adoption as authorized tender in varied nations stay scorching subjects.

The method by which cryptocurrencies went from being perceived as a dangerous funding to changing into a major reserve asset for main firms reminiscent of MicroStrategy and Bitcoin ETFs issued by main asset administration firms is because of the widening acceptance of cryptocurrencies and digitalization. It exhibits a change in perspective in direction of forex.

Moreover, the authorized and political panorama surrounding Bitcoin is evolving. Nations like El Salvador have adopted Bitcoin as their authorized tender, a transfer that has spurred debate concerning the adoption of cryptocurrencies by different nations.

In the meantime, environmental issues associated to Bitcoin mining proceed to stimulate debate concerning the sustainability of cryptocurrencies and their impression on international vitality consumption.

Comments are closed.