Bitcoin's drop under $50,000 on August 5 was the largest drop within the present cycle, resulting in important revenue loss and liquidation, and whereas it has since stabilised round $60,000 and proven indicators of restoration, the market stays cautious after not too long ago dropping under this psychological help.

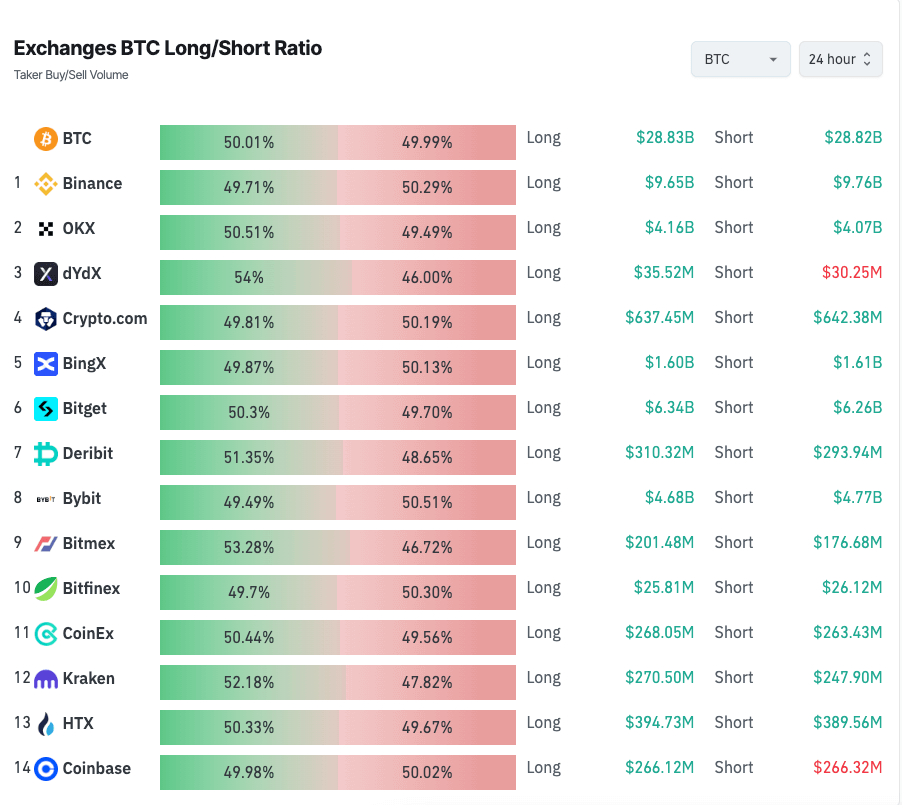

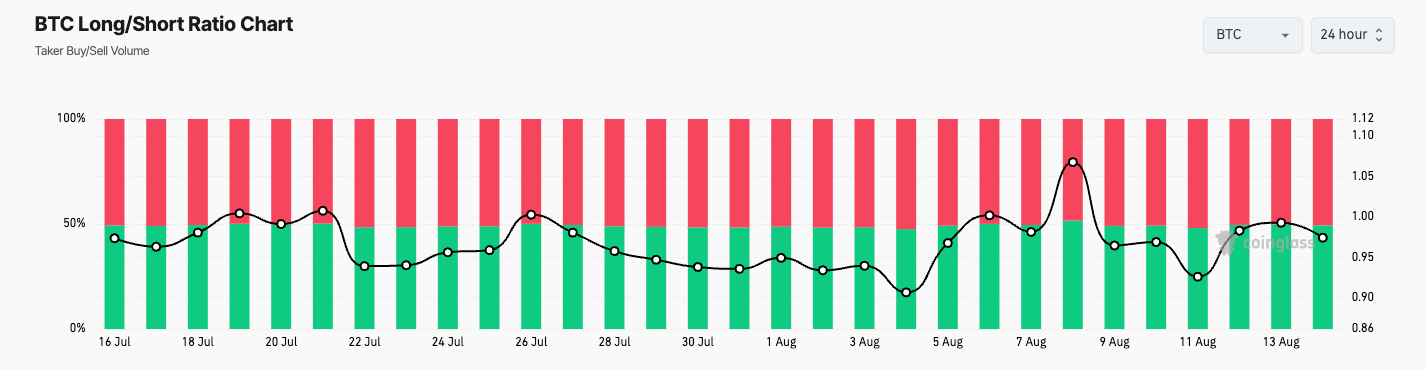

This warning is most evident within the derivatives markets, the place the futures lengthy/quick ratio has remained secure at round 1, with 50.16% lengthy and 49.85% quick.

This almost even distribution signifies that there isn’t any clear directional bias amongst merchants. The present ratio marks a big shift from the bullish outlook seen earlier this month, which peaked at a ratio of 1.068 on August 8.

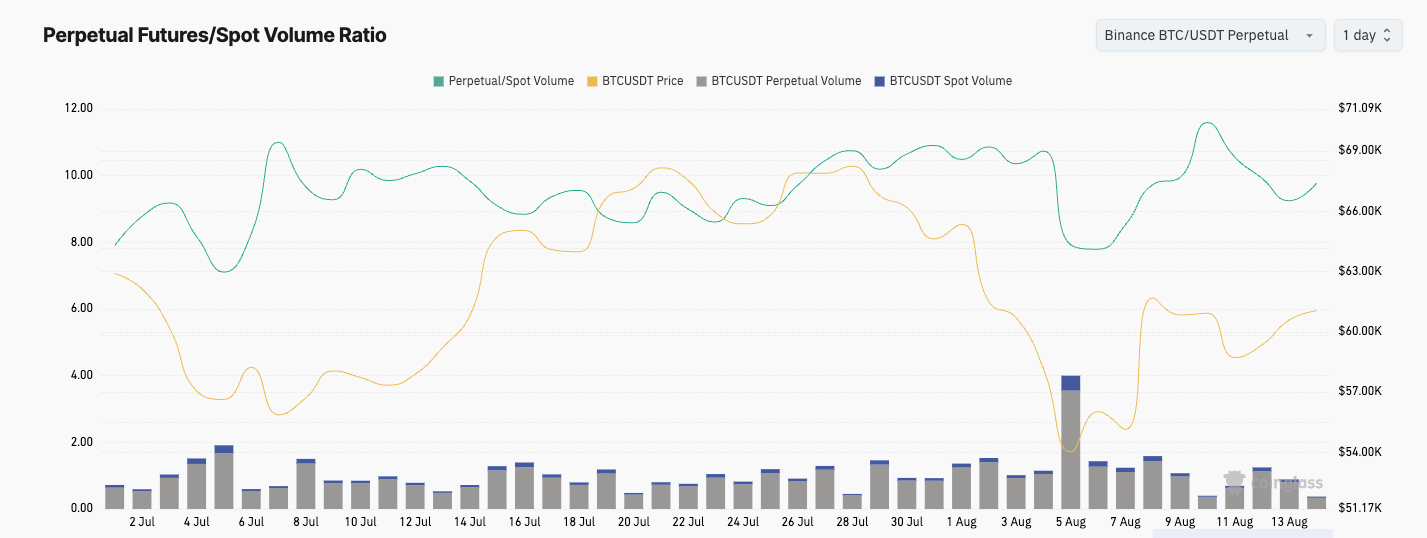

This directional stability is definitely maintained as perpetual futures turn out to be the mainstream of Bitcoin derivatives buying and selling. On August 5, perpetual futures buying and selling quantity reached $67.88 billion, almost eight instances the spot market quantity of $8.58 billion. The ratio of perpetual futures to identify buying and selling quantity reached 11.60 on August 10, the second highest degree this yr.

Having such a excessive futures to identify quantity ratio exhibits how vital derivatives are for worth discovery and liquidity. As we've seen over the previous yr, greater volumes have a tendency to extend volatility and velocity up worth actions. And with the vast majority of that quantity on Binance, the chance of volatility is even larger.

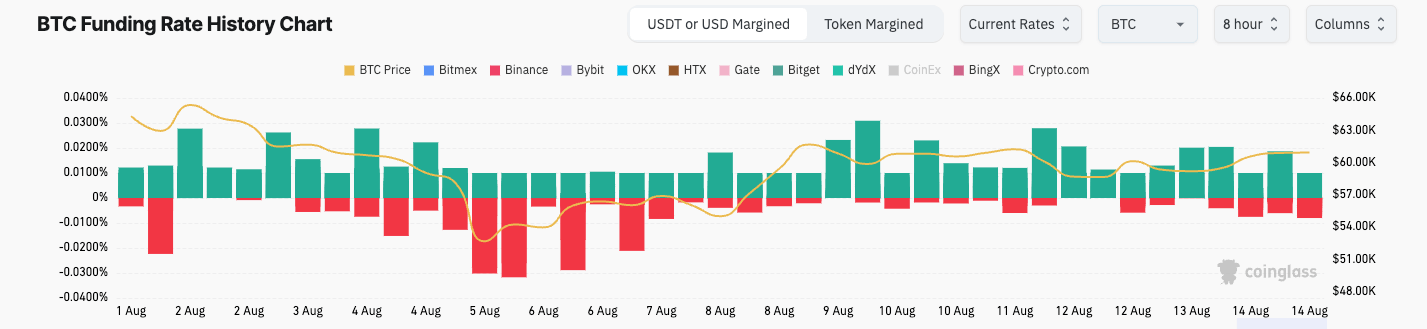

The perpetual futures funding charge has been constantly detrimental since August thirteenth after a principally constructive interval in early August. Excessive buying and selling quantity in Bitcoin perpetual futures suggests excessive market leverage. The detrimental funding charge within the perpetual futures market signifies short-term bearish strain. Nevertheless, this might additionally set off a possible quick squeeze if shopping for strain emerges from one other rally.

The gradual restoration in open curiosity additional confirms that the Bitcoin market is at the moment in a cautious restoration section. Although the value has recovered from latest lows, derivatives knowledge signifies that merchants are nonetheless unsure about its future path.

The dominance of perpetual futures and the stability of the lengthy/quick ratio point out that the market could expertise massive fluctuations within the quick time period, and most subtle merchants are making ready for the market to maneuver in each instructions.

The submit Bitcoin Market Turns Cautious as Longs and Shorts Steadiness Appeared First on currencyjournals