Bitcoin spot buying and selling volumes over the previous week present various ranges of market exercise and sentiment: Bitcoin worth has seen some fluctuations over the week, peaking at $69,270 on Could twenty fifth earlier than declining barely and stabilizing within the $68,000 to $69,000 vary.

This peak equates to the bottom spot buying and selling quantity previously week at $2.121 billion, suggesting the value surge could have led to a drop in buying and selling exercise because the market waited for additional worth motion or reached a hesitation level.

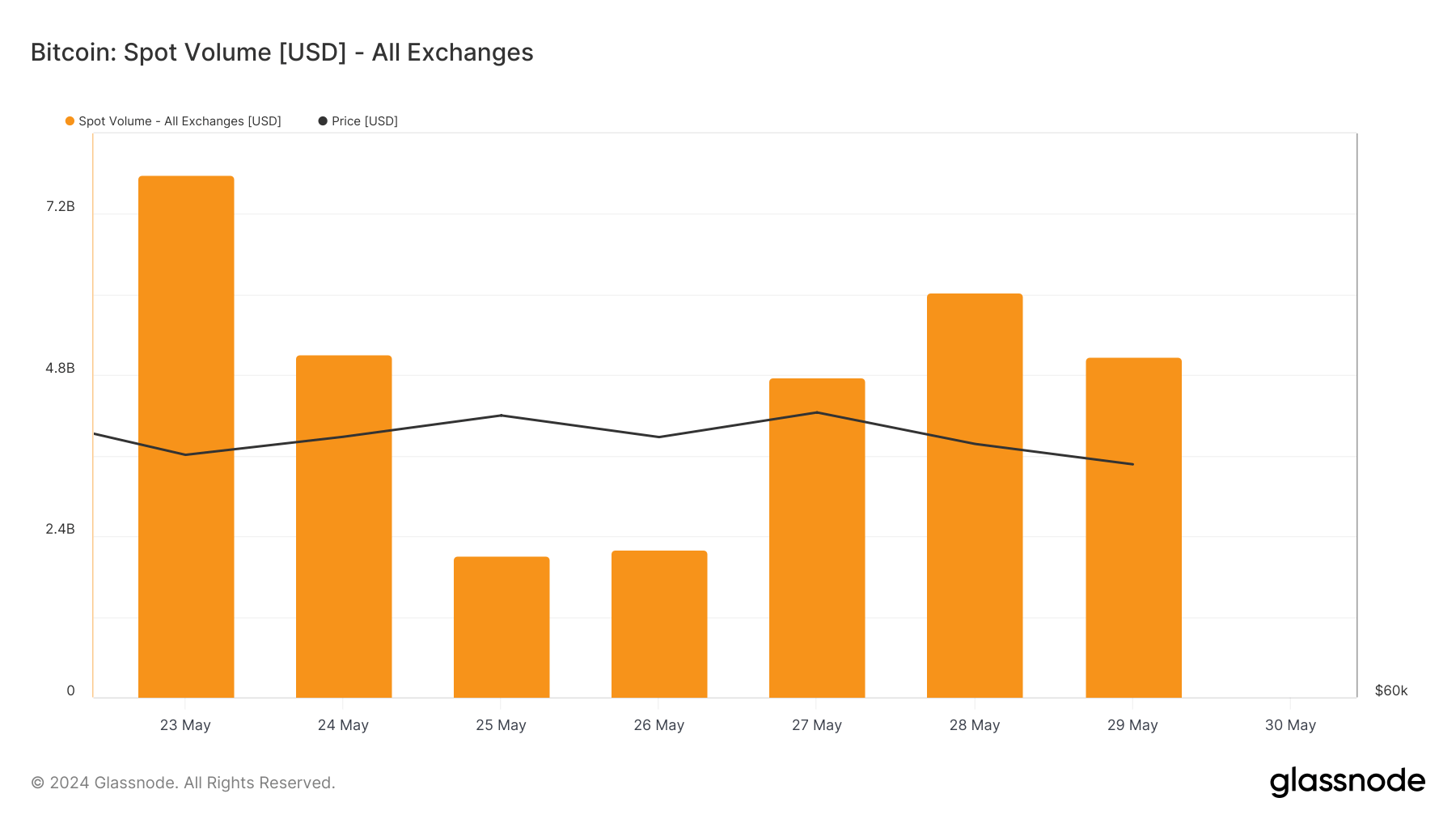

Intraday spot buying and selling quantity information from Glassnode reveals a pointy decline from $7.78 billion on Could 23 to $2.121 billion on Could 25. This vital quantity decline signifies a interval of low volatility and an absence of sturdy market catalysts, leading to a major decline in buying and selling exercise.

The next days noticed a restoration in buying and selling volumes: on Could 27, spot buying and selling quantity elevated to $4.761 billion as Bitcoin recovered to $69,385. On Could 28, spot buying and selling quantity exceeded $6 billion regardless of the value dropping barely to $68,280.

This sample means that worth peaks should not essentially adopted instantly by a rise in buying and selling exercise, as merchants have a tendency to attend for the consolidation that inevitably happens after a worth rally.

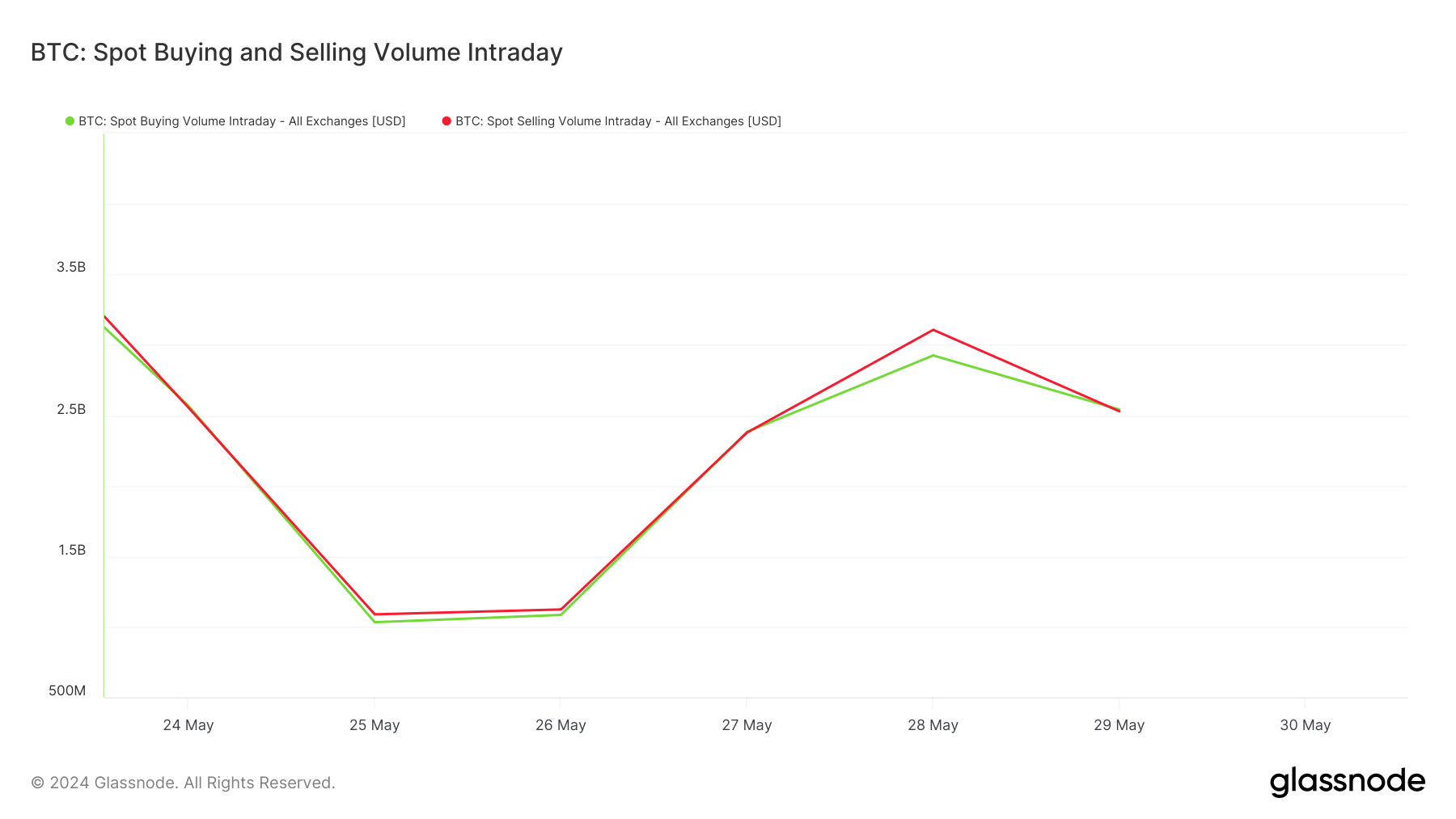

Analyzing intraday spot shopping for and promoting volumes may help gauge the general market sentiment. If the vast majority of buying and selling quantity is pushed by promoting, it signifies a bear market the place buyers are benefiting from the sudden worth actions to make a fast exit or reduce their losses.

Conversely, if the vast majority of buying and selling quantity is pushed by shopping for, it creates an amazing bullish sentiment because the market is racing to get in at present costs in hopes of additional upside.

Taking a look at Glassnode information for the previous week, we will see that the market is roughly balanced: purchase quantity was $3.796 billion and promote quantity was $3.984 billion on Could 23. Whereas this is able to usually point out bearish sentiment, the truth that these volumes have been so shut signifies a fragmented market with no clear directional bias.

This pattern continued final week: on Could 24, purchase and promote volumes have been roughly equal at about $2.566 billion and $2.553 billion, respectively, however the lowest volumes in Could have been $1.032 billion for purchase and $1.088 billion for promote.

As buying and selling volumes started to get well on Could 27, purchase and promote volumes continued to match at round $2.383 billion and $2.378 billion, respectively, indicating a really lively buying and selling surroundings with individuals shopping for and promoting equally.

Spot promoting peaked at $3.106 billion on Could 28, whereas shopping for was $2.924 billion, probably signaling some bearish sentiment as merchants took benefit of the value motion to unload their holdings, sending the value all the way down to $68,280.

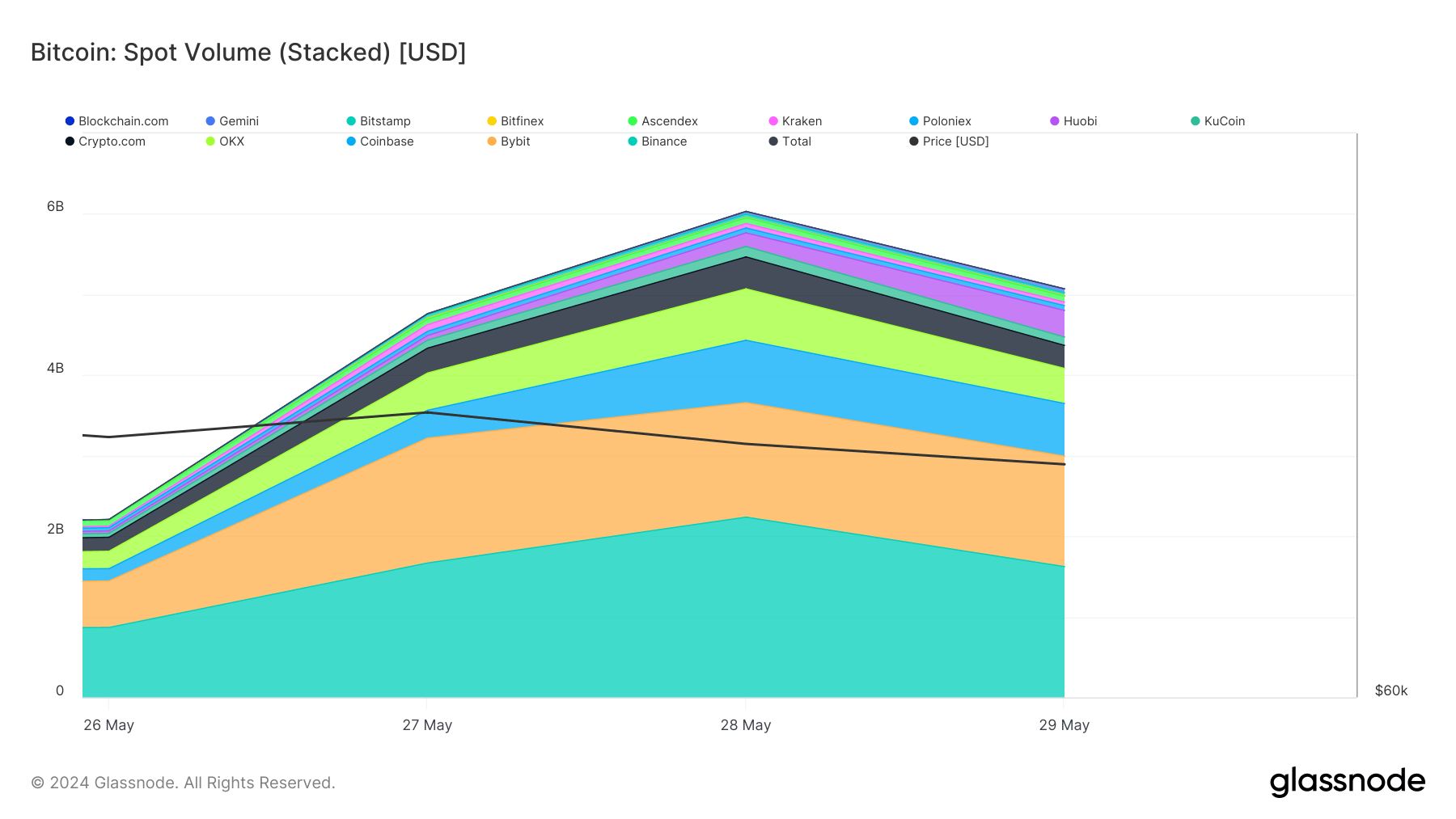

Taking a look at spot volumes throughout exchanges, Binance has persistently topped the record, adopted by Bybit and Coinbase. On Could 26, Binance's quantity was $866.776 million, which elevated considerably to $2.236 billion on Could 28. Bybit and Coinbase additionally noticed quantity will increase, with Bybit peaking at $1.55 billion on Could 27 and Coinbase at $774.203 million on Could 28.

Binance’s considerably larger buying and selling quantity, typically surpassing that of Bybit and Coinbase mixed, is because of its giant person base and low buying and selling charges, making it the trade of selection for high-volume merchants.

The steadiness between shopping for and promoting volumes over the previous week signifies that the market is indecisive and unstable.

The put up Bitcoin Market Splits Whereas Shopping for and Promoting Quantity Stays the Similar appeared first on currencyjournals