In our earlier article, we thought of Ethereum (ETH) methods based mostly on ADX calculations. ADX, whose acronym stands for “Common Directional Motion Index”, is an indicator used to measure development energy.

If the indicator tends in direction of decrease values, the development is nearly gone, but when the ADX takes greater values, the underlying development turns into extra essential.

Backtesting the ADX buying and selling system on Bitcoin, MATIC and BNB

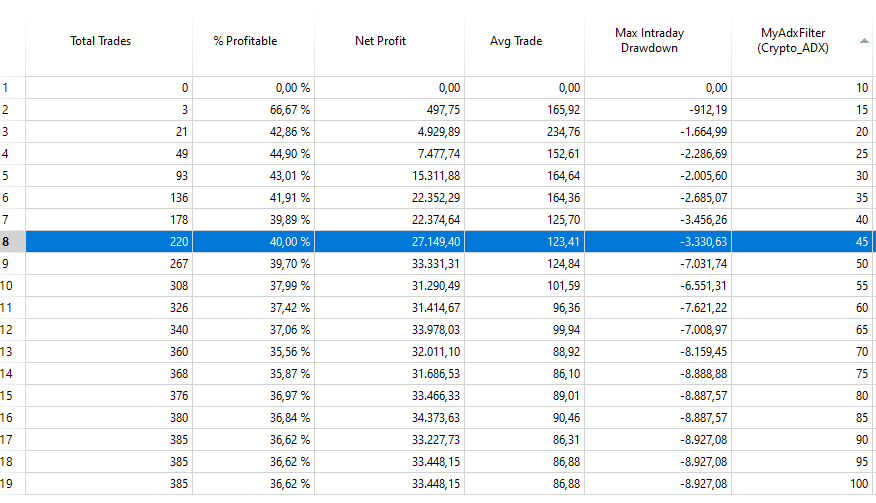

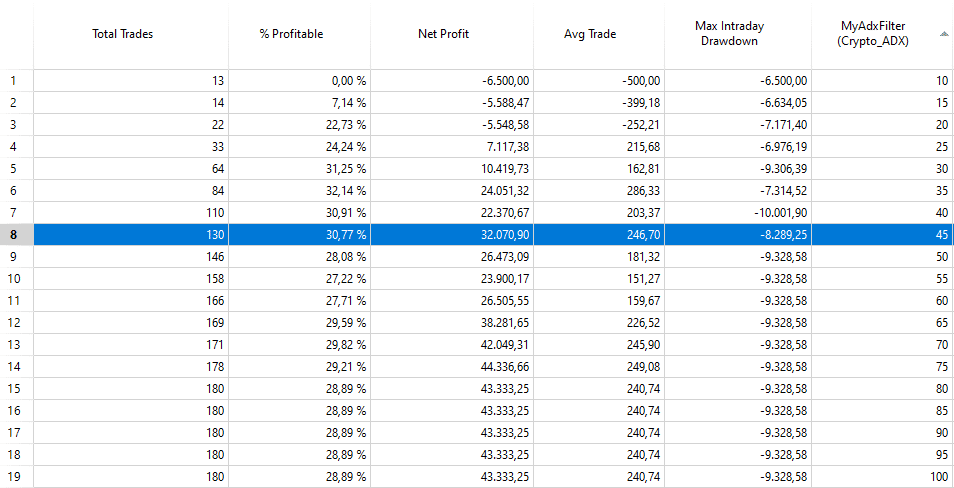

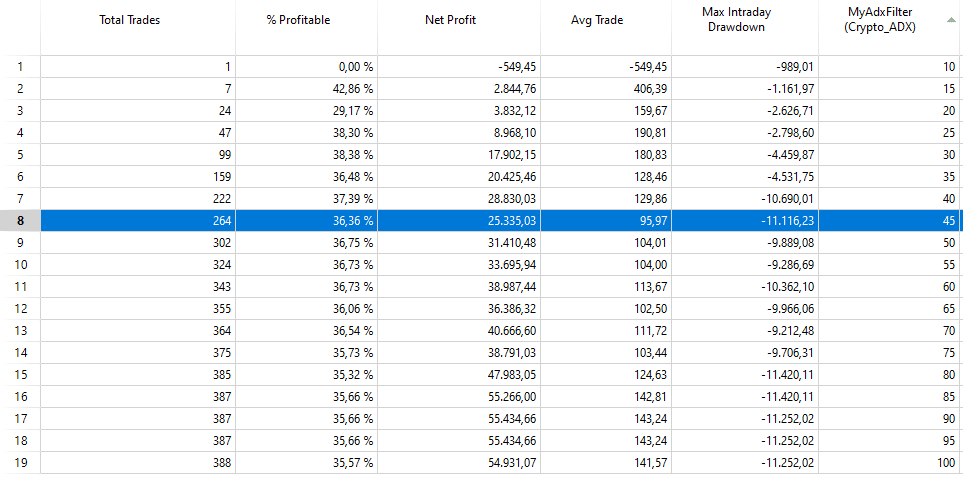

Since this buying and selling technique yielded fascinating outcomes on ETH, it was determined to check the identical logic on different cryptocurrencies. Particularly, the technique included a long-only entry and he had an ADX of lower than 50 on the final 200 bar excessive (at quarter-hour).

Exits have been made on the lowest of the final 200 bars, in addition to with a cease loss (5% of the worth of the place) or after as much as 5 days out there.

How does this logic work with different cryptocurrencies?

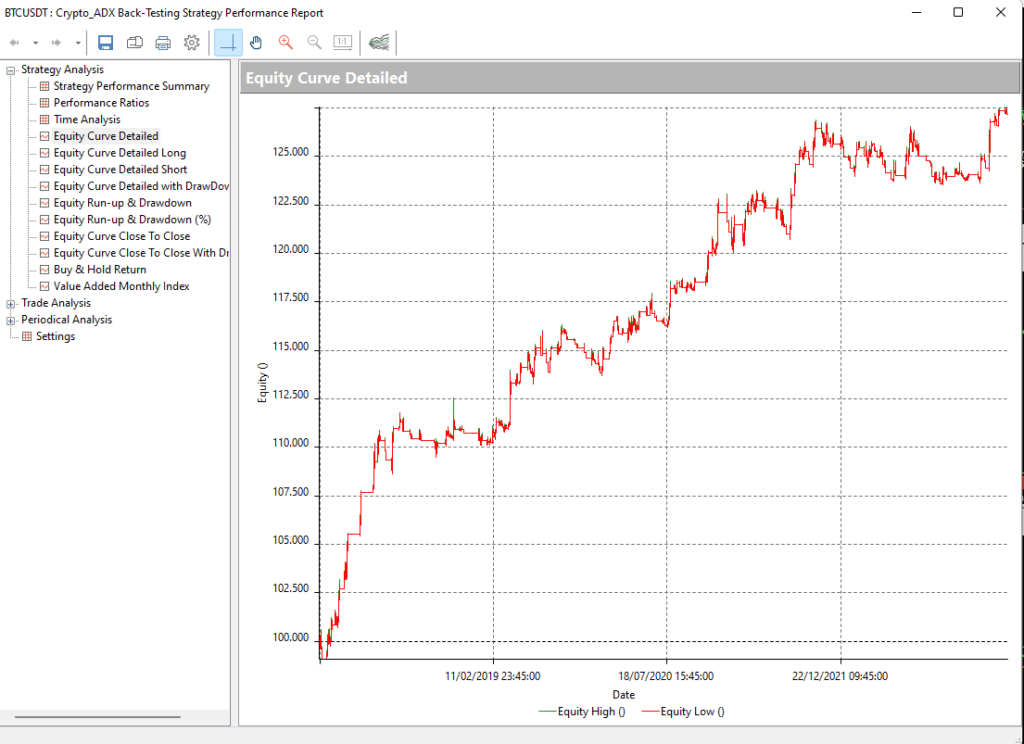

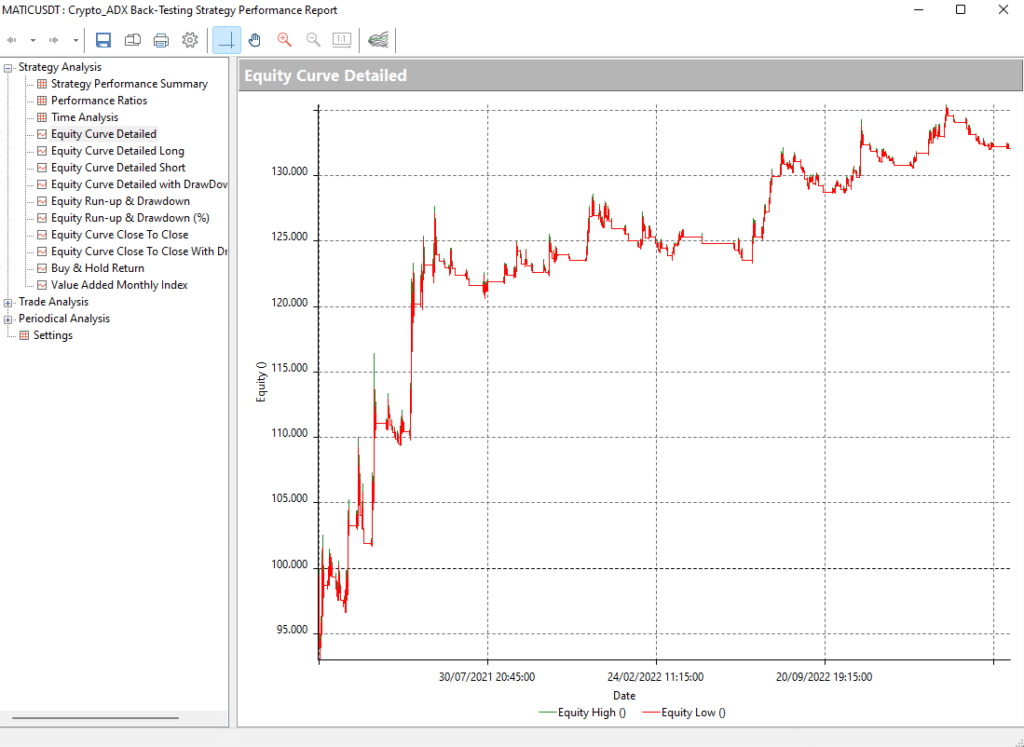

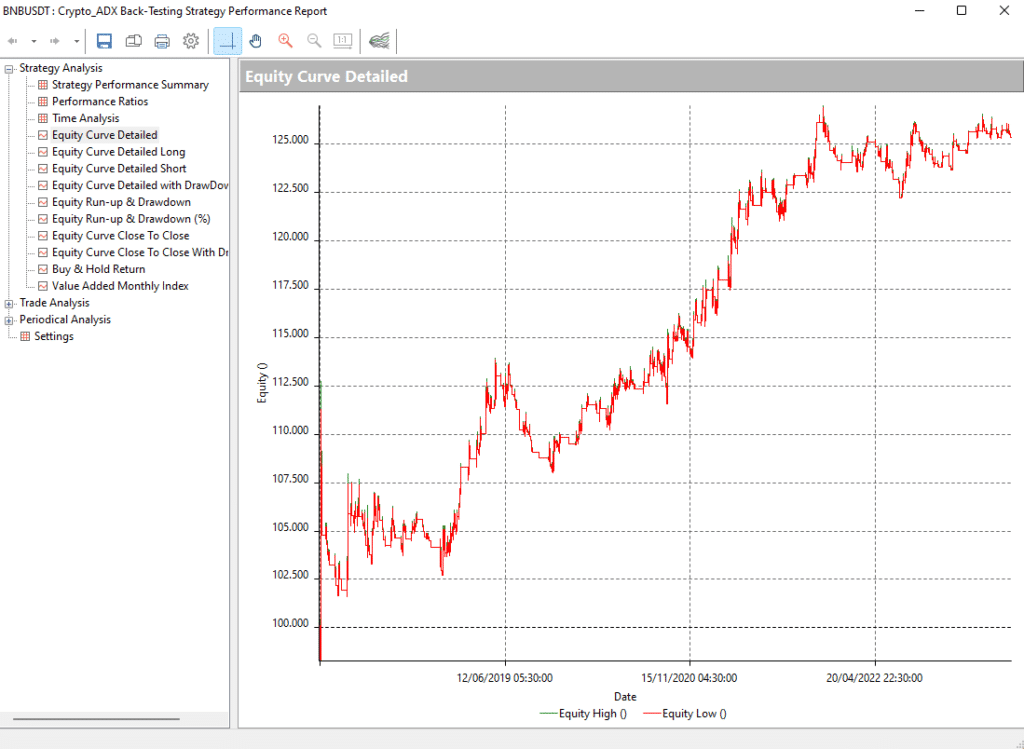

Testing the buying and selling system with Bitcoin (BTC), MATIC and BNB exhibits continuity with the outcomes obtained with ETH from the start.

We selected to make use of an ADX worth of lower than 45 (barely tighter than the ETH technique) for these crypto property. It is because it provides the perfect total outcome (Determine 2-3-4). Income lower when the ADX worth drops, however common trades enhance (apart from BNB the place different ADX values appear to work). Because of this, the drawdown decreases because the ADX filter turns into extra stringent.

This definitely signifies that the indicator has finished filtering job as the standard of the common trades has improved.

The place is all the time mounted and has a financial worth of $10,000. The common buying and selling quantity you get is unquestionably massive sufficient to commerce on the true market.

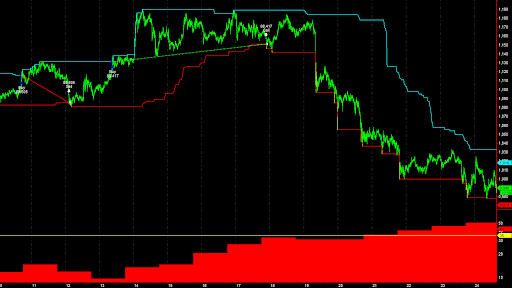

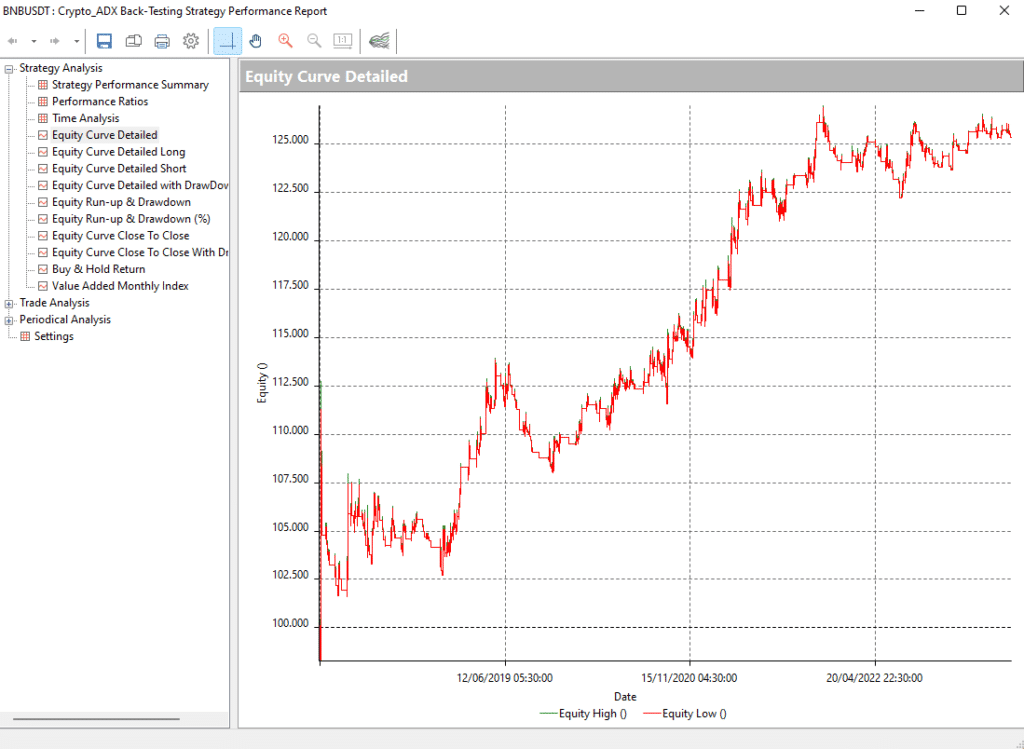

Within the following determine (5-6-7) we are able to see that the person curves are additionally exceptional. It seems like ADX also can present fascinating ends in new and new markets resembling cryptocurrencies.

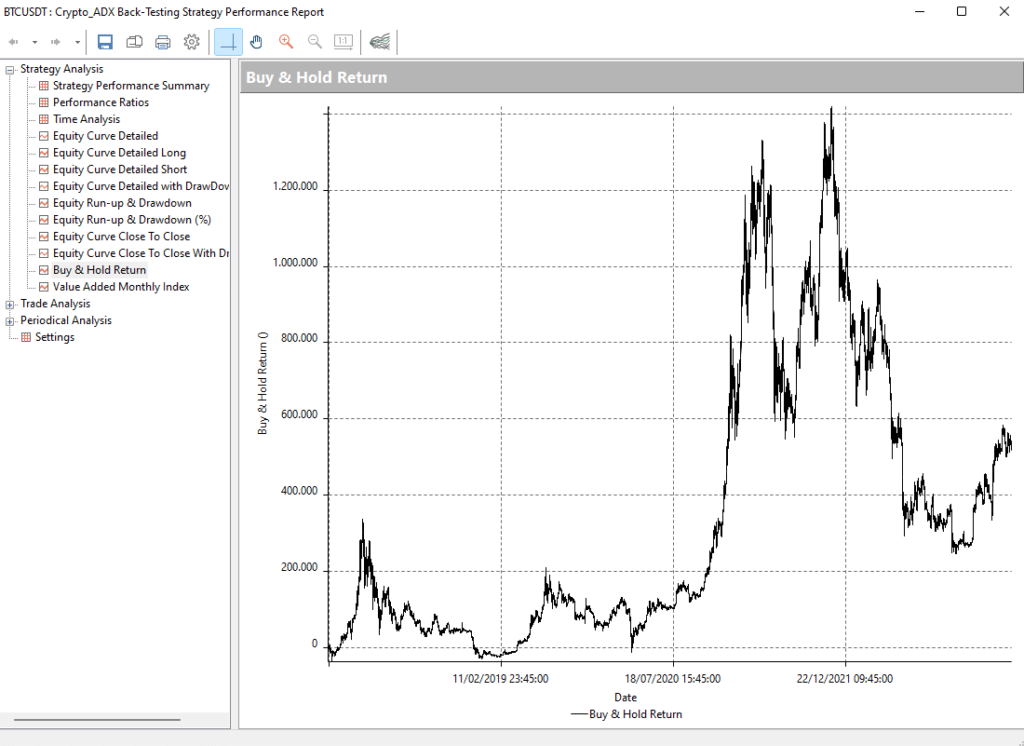

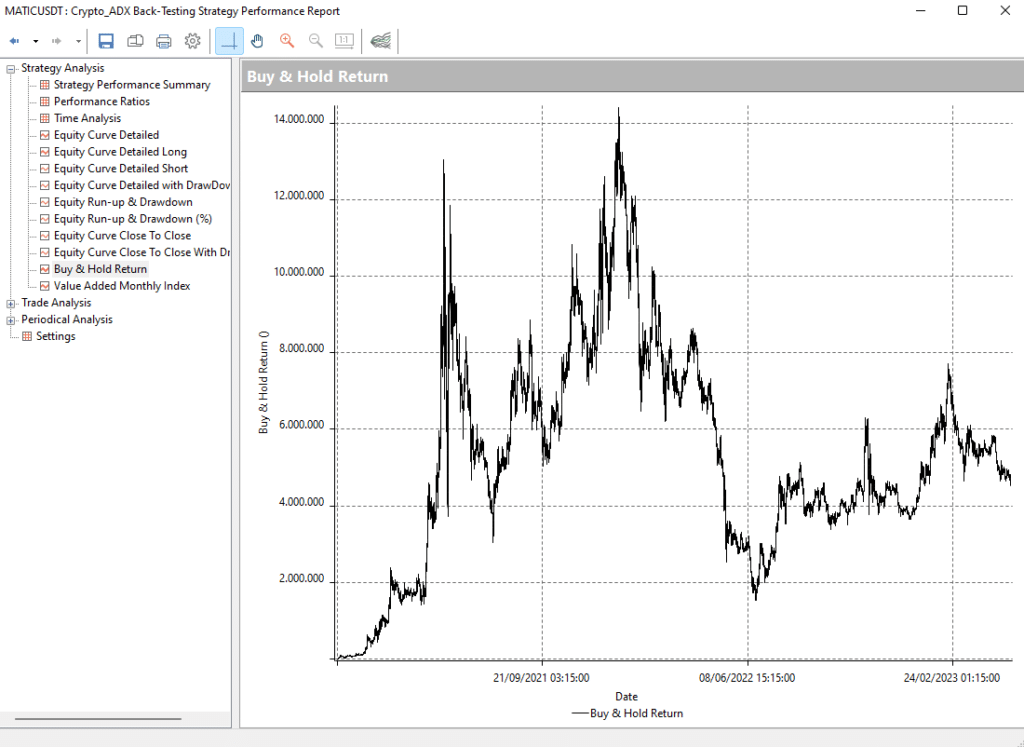

It is also fascinating to check the straightforward purchase and maintain of those commodities to the technique we used earlier.

CONCLUSION ON ADX TRADING SYSTEM FOR BITCOIN, MATIC AND BNB

What instantly catches my consideration is that within the current a part of our backtesting, and extra usually within the final yr and a half, this technique has carried out higher than a easy purchase and maintain of commodities.

In reality, whereas the general revenue of this technique is decrease than that of purchase and maintain, it is not going to have the sharp drawdowns recorded by the market from the start of 2022 to the tip of the identical yr.

Automated methods with the assistance of ADX have been capable of keep away from market phases by which it’s inconvenient to enter and take lengthy positions.

Bitcoin, which is the oldest market amongst crypto property and subsequently a market conducive to the event of automated methods, has additionally lately reached a peak within the worth of the technique within the face of the exceptional restoration that very same market confirmed final yr. backside. The primary few months of 2023.

Once more, the automated technique was capable of scale back threat on the one hand, and hit previous highs extra continuously than the traditional buy-and-hold strategy on the opposite.

Till subsequent time!

Andrea Unger

Comments are closed.