- Bitcoin value has fallen by round 7% over the previous week, with bulls failing to maintain above the $70,000 mark. Renewed promoting strain has pushed BTC right down to round $66,350 in the present day.

- Whereas costs are falling because the market reacts to macroeconomic occasions, analysts at CryptoQuant say a part of the decline is because of promoting strain confronted by miners.

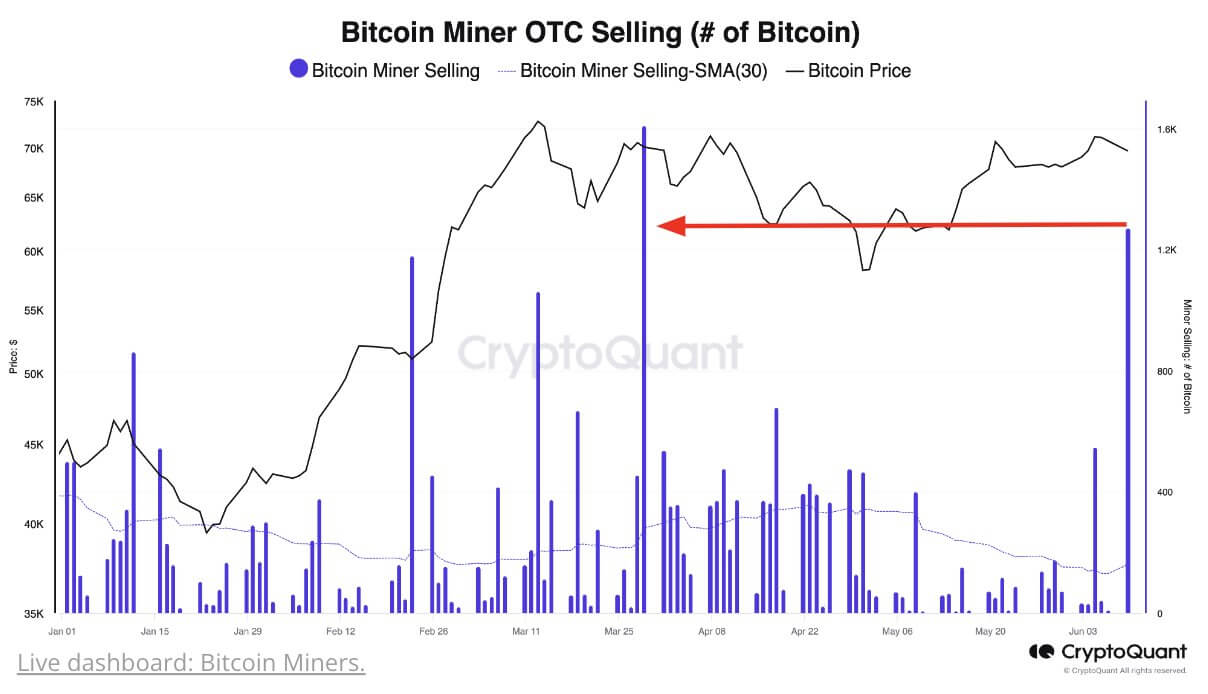

In response to an replace from CryptoQuant on Thursday, there was a rise in BTC mining pool transfers and OTC desk gross sales, with among the bigger publicly-listed bitcoin mining corporations additionally lowering their holdings lately.

“BTC miners are rising their promoting as the value fluctuates between $69,000 and $71,000. On June 9, transfers from mining swimming pools to Binance surged, pushing the cryptocurrency to a two-month excessive of over 3,000 BTC. This modification coincides with the value correction that despatched Bitcoin right down to $66,000,” the CryptoQuant group famous in a put up by X.

Information exhibits that OTC gross sales have additionally been rising, with the newest being an OTC desk sale of 1,200 BTC on June tenth.

In the meantime, main U.S. bitcoin miners have been promoting off cash. For instance, Marathon Digital (MARA) offered 1,400 BTC in June, in comparison with simply 390 BTC offered in Could.

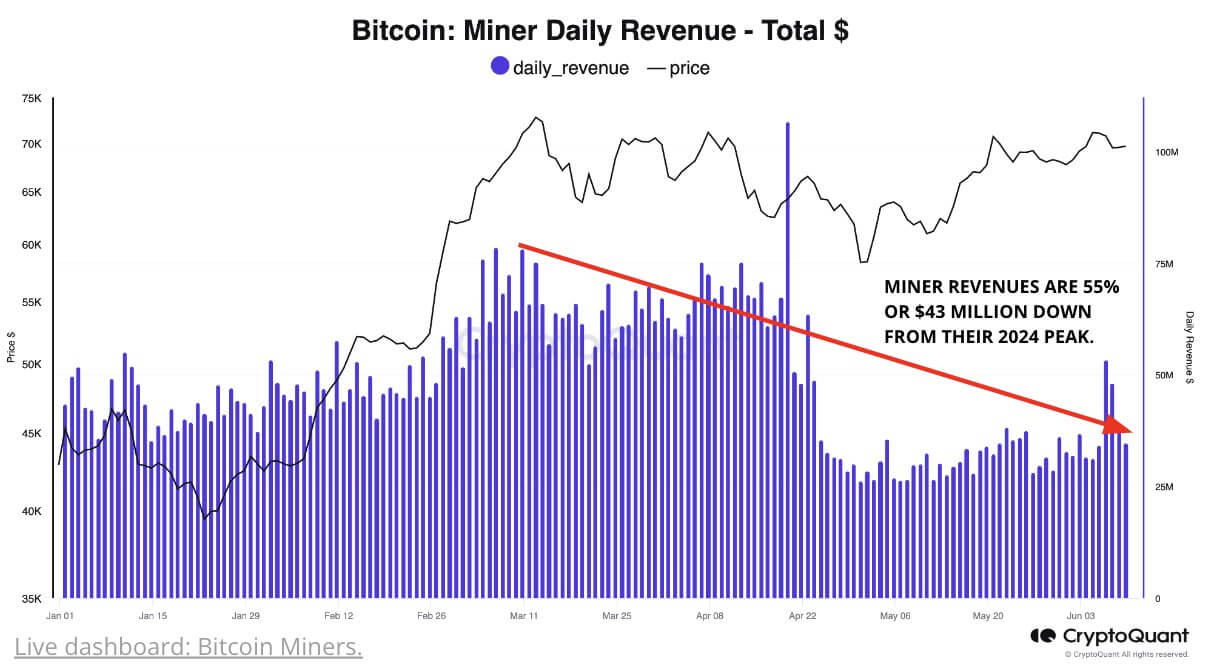

Mining firm revenues plummet 55%

As mining revenues fall, strain on mining corporations to promote is rising.

For instance, after the halving, miners' every day income reached $35 million, peaking at over $78 million in March, a pointy decline of 55%.

“Amid low miner revenues following the halving, Bitcoin's every day transaction charges have fallen to round 65 BTC from 117 BTC earlier than April 18. Regardless of document buying and selling, common transaction charges in USD phrases stay low, highlighting the strain on miner revenues,” the CryptoQuant group famous.

Analysts be aware that the Bitcoin community additionally noticed a drop in hash charge after the halving, however the drop was solely 4%.

This implies miners face stiff competitors amid declining block rewards, and low miner revenues and excessive hash charges “typically point out a possible market downturn.”

“Mining corporations have confronted important wage shortfalls since Could, suggesting costs could also be nearing a backside.”