- Shopping for momentum in BCH has weakened because the amount of cash flowing into the market has decreased.

- Regardless of a slight bullish bias, the coin could solely have the ability to meet a consolidation close to $262.

- Merchants averted lengthy positions as there have been indicators that the BCH value may fall.

Bitcoin Money (BCH) has been pressured to take care of a retracement after the current lengthy interval of inexperienced printing. Regardless of the value drop, the coin’s 30-day efficiency held up round 149%.

One of many causes BCH, or Bitcoin (BTC)’s onerous fork in 2017 rose, was the inclusion of BCH within the launch of the EDX Markets trade. Because of this, BCH crossed the $300 threshold on June thirtieth.

rally is probably not quick

As well as, the BCH/KRW buying and selling pair had the very best buying and selling quantity on South Korean trade Upbit, Coinmarketcap revealed. This induced the cryptocurrency to rebound on July sixth after an preliminary drawdown.

Nevertheless, regardless of remaining within the high two buying and selling volumes on Upbit, the value of BCH had fallen to $282 on the time of writing.

From the BCH/USD 4-hour chart, the Chaikin Cash Move (CMF) has dropped to -0.04. CMF falling beneath the zero line signifies that BCH’s energy available in the market could have weakened.

Furthermore, this was an indication of extra capital outflows than inflows. In different phrases, distribution flourished fairly than accumulation. Due to this fact, BCH could discover it very tough to remain on the uptrend because of waning demand.

The chart above additionally takes under consideration BCH volatility. Primarily based on the Bollinger Bands (BB), the coin’s volatility has began to say no since promoting stress started round $297.21 on July 3.

Nevertheless, the stress pushed BCH to oversold ranges after the value hit the decrease finish of $262.42. At this level, the contractions had calmed down a bit. Additionally, the BCH value failed to the touch the decrease or higher bands. Due to this fact, the coin could proceed to consolidate within the quick time period.

Do you count on additional declines?

Furthermore, the shifting common convergence divergence (MACD) collapsed across the midpoint of 0.67. Equally, patrons and sellers alike struggled to regulate because the orange and blue dynamic traces moved nearer collectively.

Nevertheless, MACD remaining above zero signifies that there was a extra bullish pattern than a bearish sign. However on the identical time, the BCH value could improve by a small quantity, if in any respect.

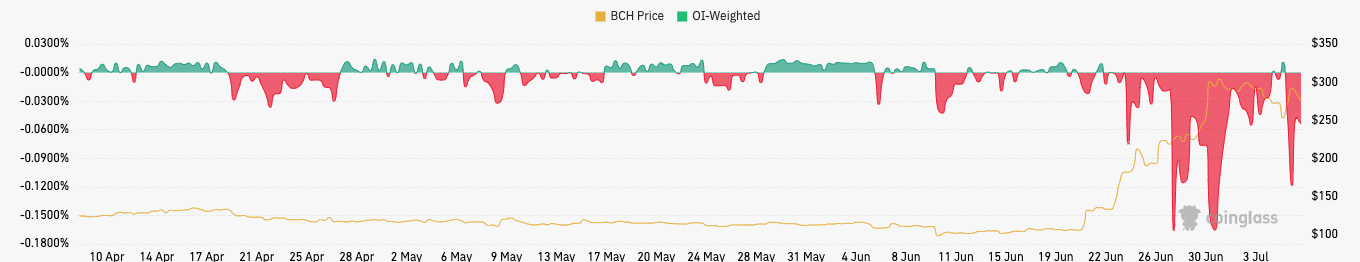

In the meantime, BCH’s eight-hour funding fee had fallen to $274 on the time of writing. Funding fee is normally the distinction between an asset’s perpetual value and its spot value.

A constructive funding fee signifies that the dealer is bullish. Nevertheless, BCH’s declining funding fee means that quick merchants had the higher hand. Due to this fact, the market as a complete expects cryptocurrencies to fall additional.

In conclusion, traders anticipating BCH to recuperate above $300 ranges could have to attend longer. Consolidation or a drop beneath present costs might be an choice, because the technical outlook has revealed.

Disclaimer: The views, opinions and knowledge shared on this value forecast are printed in good religion. Readers ought to do their analysis and due diligence. Readers are strictly chargeable for their very own actions. Coin Version and its associates are usually not chargeable for any direct or oblique damages or losses.

Comments are closed.