- BCH holds an essential midband zone that locks in momentum and guides near-term course.

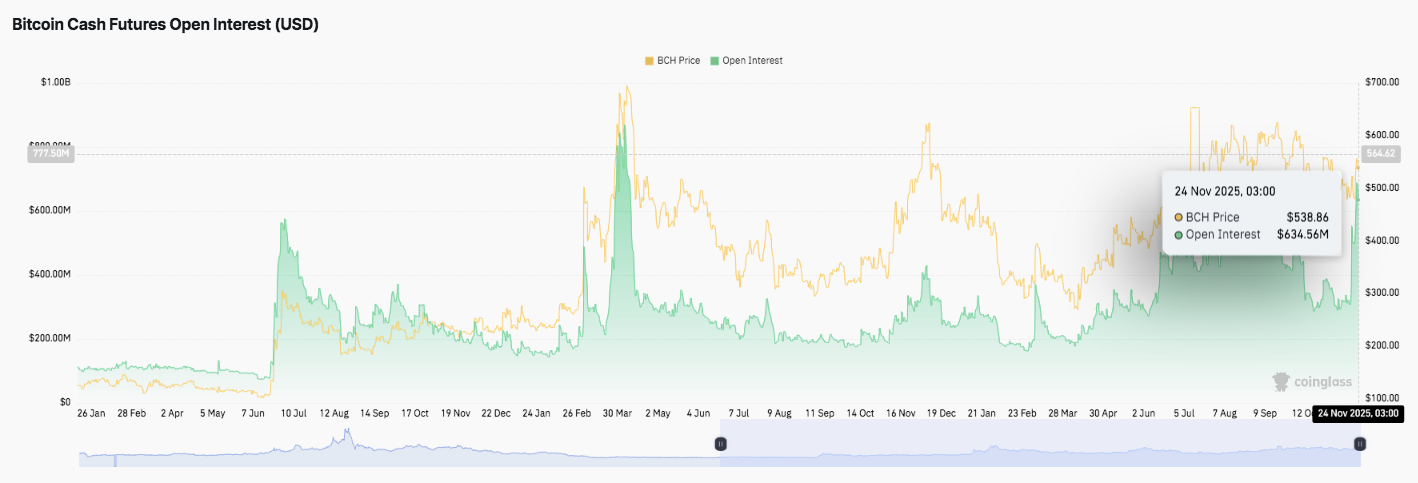

- The rise in futures rates of interest means that speculative demand is rising amid structural tightening.

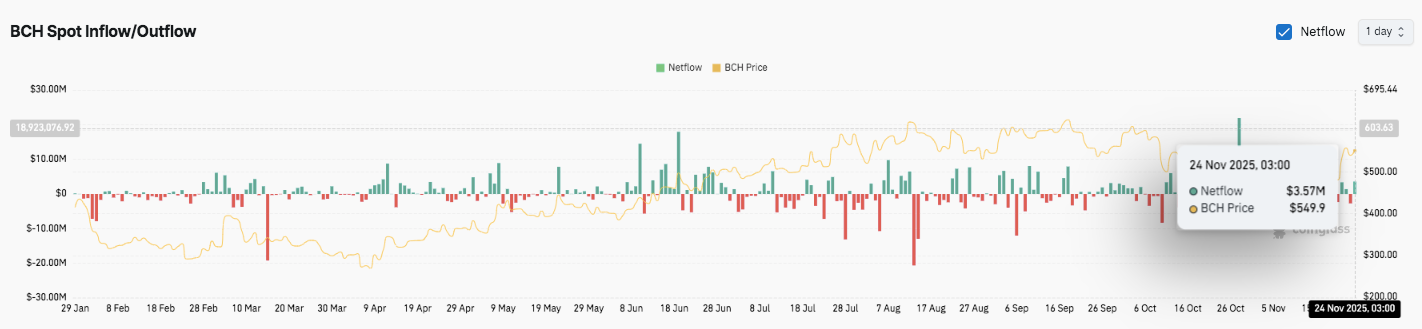

- The resumption of spot inflows means that situations are stabilizing after a chronic interval of outflow.

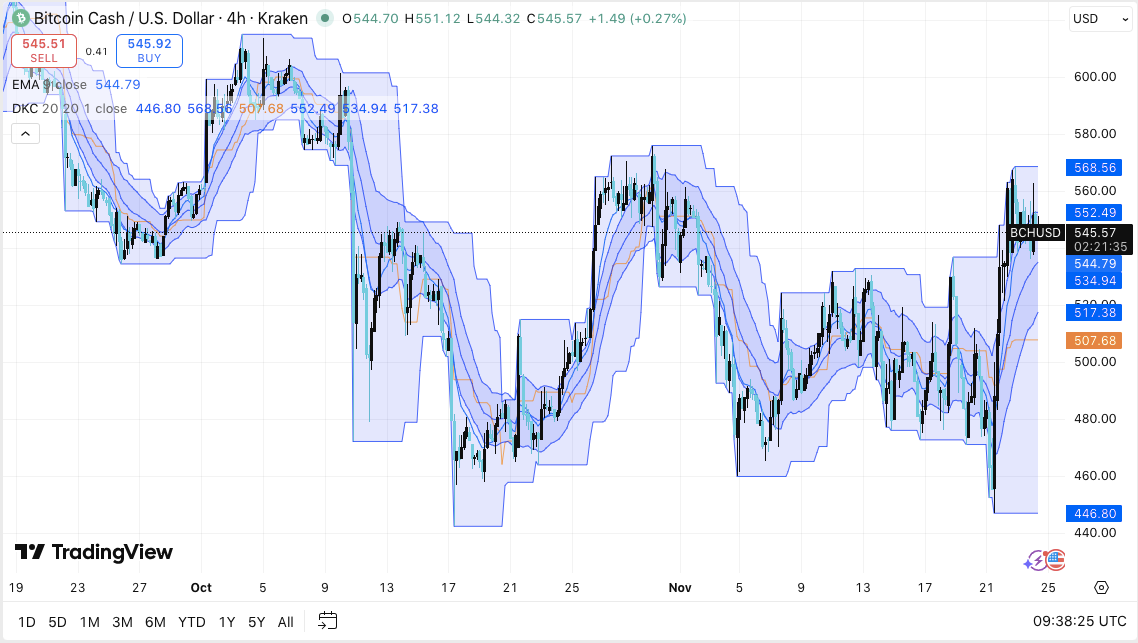

Bitcoin Money is at a important technical juncture because the market reacts to new volatility throughout main altcoins. The asset is buying and selling close to the mid-$540 area after recovering from sub-$470 ranges. The rebound got here after weeks of heavy capital outflows and risky volatility. Moreover, merchants are at present targeted on whether or not BCH can safe a steady place past the pattern pivot on the 4H chart.

This stage has formed each main transfer since early November. Due to this fact, market consideration stays targeted on the mid-band zone and rising derivatives exercise, reflecting rising speculative confidence.

Mid-band zone the place worth is vital

BCH is buying and selling simply above the midpoint between the short-term EMA and the Donchian Keltner channel. The area has served as an essential entrance via latest consolidation.

Moreover, the worth is at present attempting to achieve traction after breaking the earlier resistance stage round $517 to $534. Analysts mentioned the latest financial enlargement candle has created room for makes an attempt to proceed within the brief time period.

Associated: Bitcoin Value Prediction: BTC faces multi-week downtrend as futures leverage cools

The $534-$545 pocket stays crucial assist. This space protects the present construction and maintains the restoration pattern. A decline under $517 would weaken the momentum and expose the draw back channel across the $507 zone.

In consequence, merchants are targeted on whether or not BCH can regain the higher volatility band between $552 and $568. Importantly, if the worth closes above $568, the subsequent goal will probably be round $580.

Excessive curiosity in futures

Futures open curiosity continues to extend and at present stands at practically $634 million. This pattern signifies that speculative exercise is rising as BCH makes an attempt to stabilize.

Moreover, leveraged positioning has elevated since mid-year, regardless of a interval of excessive worth volatility. The sustained curiosity reveals that merchants stay dedicated to BCH publicity regardless of market uncertainty.

Spot move suggests emotional adjustments

Spot move information present that the outflow continued for an prolonged time period from September to October. Nevertheless, the latest influx of $3.57 million signifies a renewed curiosity in accumulation.

Moreover, the alternating traits all year long present that the market continues to maneuver between profit-taking and re-entry conduct. Latest capital inflows counsel that sentiment could also be stabilizing after extended promoting strain.

Coinbase Derivatives Extends 24/7 Buying and selling

The market construction may change into much more tense as Coinbase Derivatives introduces 24/7 buying and selling for altcoin futures on December fifth. This enlargement consists of BCH, SHIB, and Dogecoin. Due to this fact, merchants count on deeper liquidity and sharper worth discovery as soon as 24-hour buying and selling begins.

Technical outlook for Bitcoin Money worth

Bitcoin Money is buying and selling in a tightening construction following the latest rally, so key ranges stay nicely outlined. The upside ranges are $552, $568, and $580, that are the fast hurdles for continuation. A powerful push above $568 may prolong to the $600-$612 area the place the subsequent liquidity cluster exists.

Associated: Ethereum Value Prediction: Can Patrons Break Resistance and Lastly Reverse Downtrend?

Draw back ranges start at $545 and $534, indicating short-term mid-band assist. The breakdown under $534 exposes $517, adopted by $507. This represents the decrease certain of the principle construction of the 4-hour chart. The ceiling of resistance stays at $568, which is in line with the Keltner higher boundary and may flip into medium-term bullish momentum.

The technical image reveals that BCH is compressing inside a midrange channel, which traditionally has triggered an enlargement transfer at any time when volatility will get squeezed. This construction mirrors earlier setups the place sustained holds above EMA 9 served as ignition zones for broader continuations.

Will Bitcoin Money rise?

Bitcoin Money’s subsequent transfer will rely on whether or not patrons defend the $534-$545 band lengthy sufficient to pressure a problem to $552-$568. Compression, rising futures open curiosity, and stabilizing spot inflows all level to increased volatility forward. If the bullish strain will increase, BCH may retest $580 and transfer nearer to $600 in an prolonged breakout.

Failure to carry $534 dangers breaking the restoration construction and exposing the deeper assist at $517 and $507. For now, BCH stays in a pivotal zone the place liquidity flows, traits are confirmed, and reactions on a mid-band foundation decide the subsequent course.

Associated: Hedera Value Prediction: Bulls Maintain Assist However Face Technical Resistance

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version will not be liable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.