- Bitcoin’s 30-day Nasdaq correlation has risen to round 0.80, close to its 2022 peak.

- The 5-year common is low round 0.54, indicating latest irregular conduct.

- BTC displays near-zero correlation with gold, bonds, or money property.

Whereas a pointy risk-off sentiment has weighed on the crypto market, the dominant pattern that has caught the eye of analysts is Bitcoin’s behavioral change. In keeping with the newest knowledge, the 30-day correlation between Bitcoin and the Nasdaq 100 has soared to almost 0.80, one of many highest because the 2022 bear market, which means BTC and large US tech shares are actually transferring in roughly the identical route.

For years, Bitcoin has been marketed as “digital gold,” however latest knowledge suggests one thing completely different. Moderately than behaving like a protected haven or inflation hedge, Bitcoin seems to be buying and selling like a high-risk, growth-based, high-tech asset.

Associated: Demise cross hits Bitcoin, however bulls level out the potential for a backside zone

Clarification of correlation quantity

This is what latest traits inform us:

- 30-day BTC-NASDAQ correlation: ~0.80 (near 10-year excessive)

- 5-year common correlation: ~0.54 (constantly optimistic)

- Correlation with money and gold: virtually zero

Which means that Bitcoin reacts extra like Apple, Microsoft, Nvidia, and Meta than gold or bonds, particularly when markets change into emotional, dangerous, or policy-driven.

How we obtained right here: A fast historical past look again

The connection between Bitcoin and shares will not be at all times steady.

2019 — Unbiased Gogyu Administration:

BTC rose from $3,000 to $12,000, however the inventory moved slowly. Bitcoin confirmed sturdy independence and acted like a separate asset class.

2020–2022 — Macro shock period:

When the pandemic hit and liquidity flooded the market, the correlation between Bitcoin and expertise skyrocketed as all danger property began transferring collectively attributable to central financial institution coverage.

2023 — Quick decoupling try:

BTC briefly moved independently, however rapidly re-aligned with expertise as market concern returned.

What’s subsequent for Bitcoin?

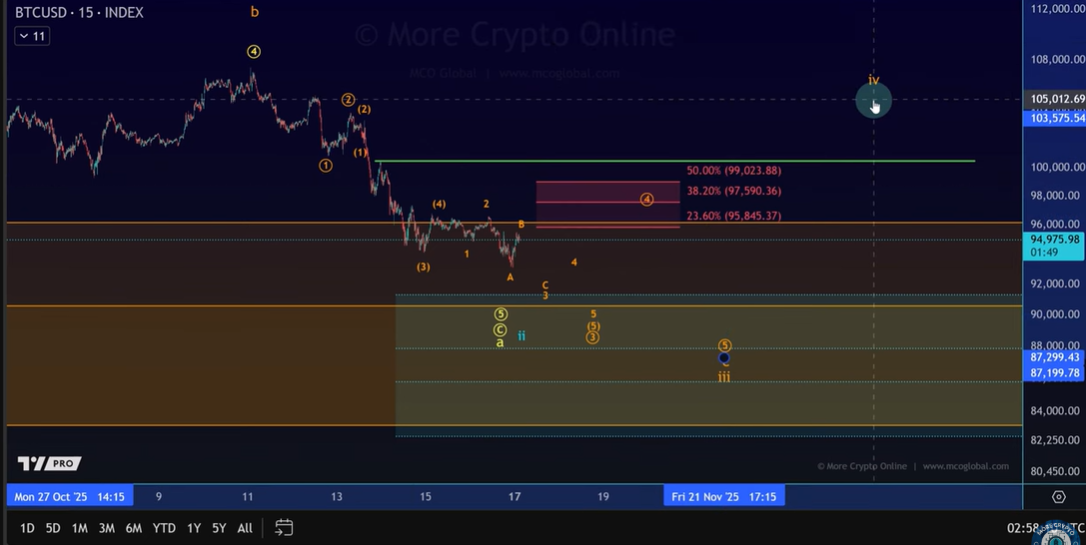

Bitcoin is presently forming a loss of life cross, which means the 50-day transferring common is beneath the 200-day transferring common. In earlier instances, Bitcoin has rallied between 30% and 45% after related crosses. This doesn’t assure an increase, but it surely does point out that the market could also be in an oversold zone relatively than initiating a extra extreme long-term crash.

Within the quick time period, Bitcoin has not confirmed its remaining backside. Costs might nonetheless fall in the direction of $91,400 till a robust restoration is tried. The upside will solely be confirmed if the value breaks out of the resistance zone between $95,800 and $99,200, and a stronger bullish shift might start above $99,000.

Associated: Bitcoin falls to 6-month low amid blended alerts

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version will not be chargeable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.