- Bitcoin perpetual futures open curiosity has returned to $16 billion, however funding charges stay reasonable.

- This quantity coincides with Bitcoin reaching $71,400 at present, led by merchants on Binance.

- The SOPR indicator for short-term holders signifies managed profit-taking at 1.017, under the overheating degree.

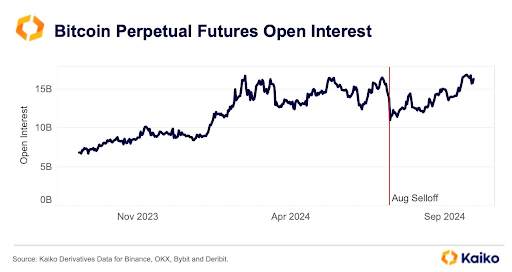

Open curiosity within the perpetual futures market has returned to $16 billion as Bitcoin nears all-time highs, in keeping with Kaiko Information.

This introduced open curiosity again to August ranges, simply earlier than the large drop. Capital inflows point out a rise in market individuals.

Notably, this newest determine coincides with Bitcoin returning to the much-awaited $70,000 degree, a degree it has struggled to realize for the previous 4 months. Bitcoin is presently properly on its method to an all-time excessive, reaching an intraday excessive of $71,400. This places it simply 3.48% off the all-time excessive of $73,750.

Regardless of elevated exercise within the perpetual futures market and a return to August highs, funding charges stay reasonable. This implies that demand is subdued whilst the worth of Bitcoin has risen to $71,000. Funding charges mirror the prices related to holding lengthy or brief positions and supply perception into market sentiment.

Binance Whales Drive Bitcoin Uptrend

In response to CryptoQuant, the current rise in Bitcoin costs could also be associated to huge buying and selling exercise by the Binance whale. CryptoQuant has noticed {that a} Binance whale has been lively throughout Asian buying and selling hours since October 14th, impacting the Coinbase Premium Hole (CPG), which tracks the worth distinction between Coinbase and Binance. . Regardless of the rise in Bitcoin costs, CPG is falling, indicating a “detrimental premium.”

This detrimental premium doesn’t mirror a decline in US demand. Over the previous two weeks, the US Bitcoin Spot ETF has seen vital inflows of roughly $3.34 billion. Subsequently, whereas sturdy US demand usually results in optimistic CPG, the present detrimental premium suggests that enormous Binance merchants are primarily driving the worth of Bitcoin.

Quick-term holders present modest revenue taking

In a separate evaluation, CryptoQuant highlights Bitcoin's short-term holder expenditure return (SOPR), which presently stands at 1.017. This indicator measures revenue realization on cash held for 1 hour to 155 days. Values above 1 point out that short-term holders are promoting at a revenue.

Traditionally, SOPR ranges above 1.03 point out a market approaching overheating. Quick-term holders have realized reasonable income with out extreme profit-taking at 1.017, leaving room for additional worth appreciation.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version shouldn’t be accountable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.