Bitcoin over-the-counter (OTC) holdings, usually missed in cryptocurrency buying and selling, have surged to their highest stage prior to now yr, with inflows constantly outstripping outflows since Might 2023, in keeping with Glassnode knowledge.

Over-the-counter (OTC) buying and selling refers back to the direct alternate of property corresponding to Bitcoin between two events, bypassing conventional exchanges. This off-exchange transaction takes place via a decentralized community of sellers and infrequently includes giant quantities of bitcoin.

That is achieved via a decentralized seller community. Within the context of Bitcoin, OTC buying and selling is commonly utilized by whales who need to purchase and promote Bitcoin with out having an excessive amount of affect in the marketplace worth. That is essential as large-scale buying and selling on public exchanges could cause vital worth fluctuations.

OTC Holdings refers back to the quantity of Bitcoin held by these OTC desks. These holdings might present perception into the habits of huge buyers. For instance, a rise in OTC holdings means that extra whales are shopping for bitcoin via his OTC trades, probably signaling bullish market sentiment. Conversely, a lower in OTC holdings may imply the alternative.

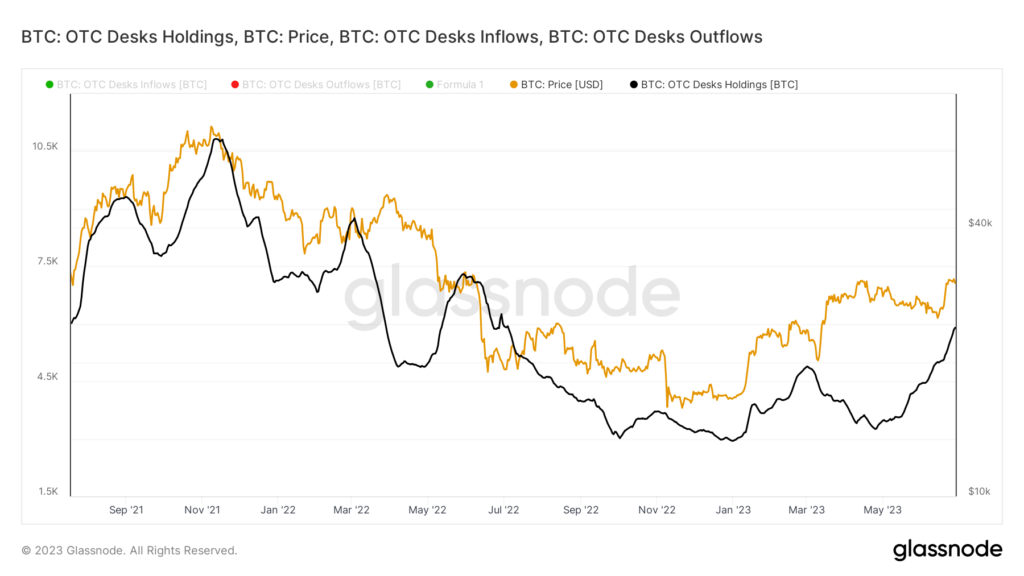

Bitcoin OTC holdings

After beginning the yr with a neighborhood low of round 2,969 BTC, OTC holdings recovered and reached 6,285 BTC on June 28, 2023, the best stage since Might 2022.

Regardless of this current surge, Bitcoin OTC holdings have but to surpass the all-time excessive of 11,928 BTC set on August 17, 2020. The report was set amid Bitcoin’s all-time excessive of $68,692 on November 10, 2021.

Curiously, there appears to be a unfastened correlation between Bitcoin worth and OTC holdings, with OTC holdings barely lagging BTC worth. For instance, as Bitcoin has been buying and selling comparatively flat since June 21, OTC holdings have elevated by 12.45%, rising from 5,244 BTC to five,899 BTC utilizing the 30-day EMA. This rise occurred whereas the value of Bitcoin remained close to $30,000.

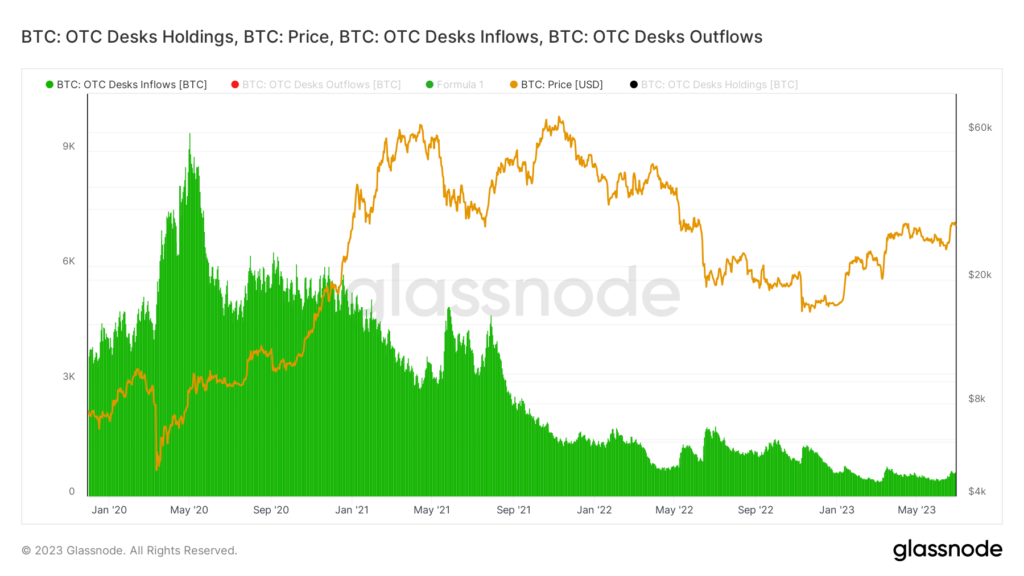

Bitcoin OTC influx

On the identical time, Bitcoin OTC inflows have continued to say no since their peak across the Bitcoin halving in Might 2020. At the moment, the OTC desk noticed him often see inflows of effectively over 6,000 BTC. Nonetheless, as evidenced by the drop in holdings, 2023 just isn’t so favorable, with inflows slumping to the 30-day EMA low of 394 BTC.

Nonetheless, the pattern appeared to reverse in June, with inflows rising to round 645 BTC, effectively down from pre-pandemic ranges.

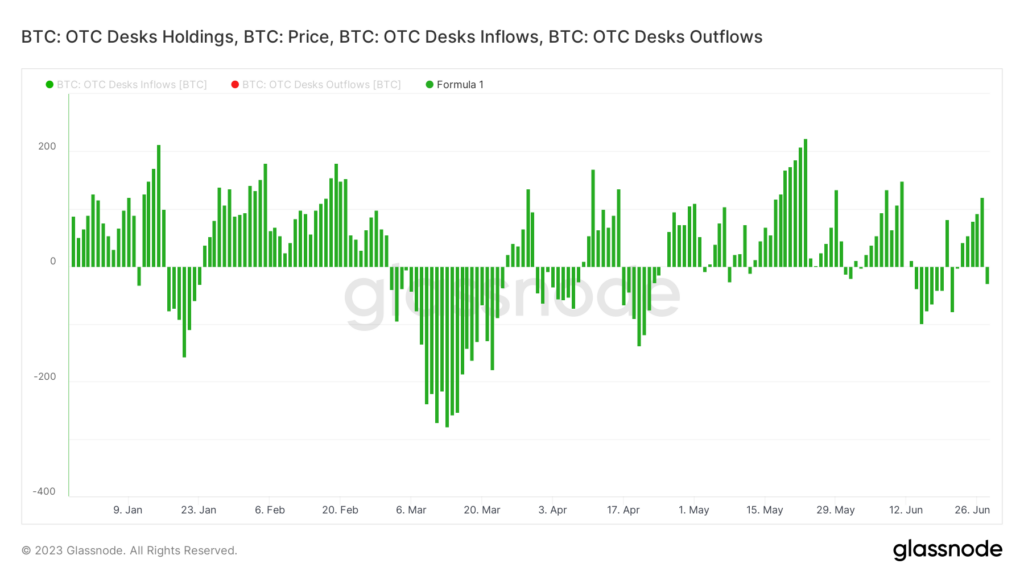

Evaluating OTC inflows and outflows, Glassnode knowledge reveals a constant extra of inflows since Might 2023. That is notably noteworthy because the final runoff interval was noticed in his March 2023.

Current tendencies in OTC holdings and inflows counsel that market confidence in Bitcoin is rising once more, however total decline in inflows since 2020 and OTC holdings stay The truth that it’s effectively beneath its all-time excessive signifies that the market has quite a lot of room for progress.

These tendencies and indicators are worthy of consideration by buyers and fanatics as key indicators of whale sentiment and potential funding alternatives. Moreover, given the myriad of bankruptcies, lawsuits and different regulatory points which have plagued the crypto business over the previous 12 months, we anticipate OTC desk buying and selling exercise to proceed as reserves are restructured and collectors repay. will probably be

(Tag Translation) Bitcoin

Comments are closed.