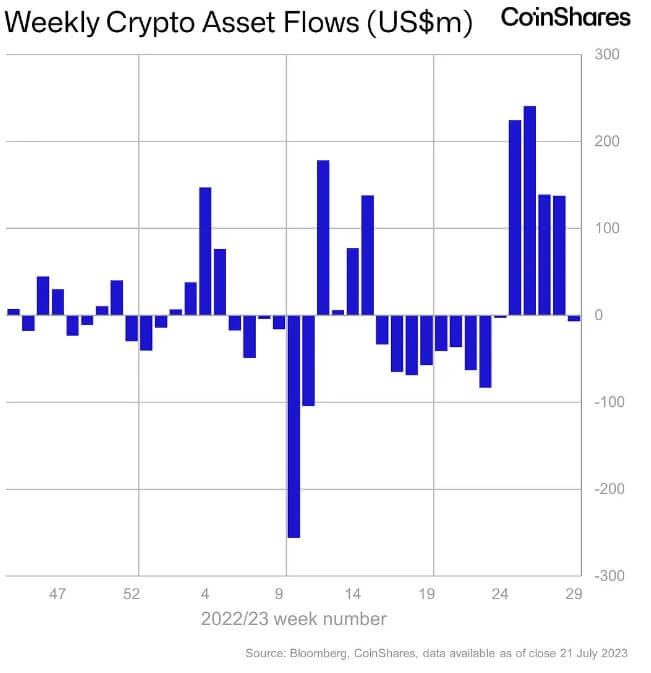

Digital asset funding merchandise posted a $6.5 million outflow this week after 4 consecutive weeks of whole inflows of $742 million. coin share Reported on July twenty fourth.

This week’s outflow marks the longest streak of inflows since late 2021, coinciding with a current market downturn that noticed the value of Bitcoin (BTC) plummet to its lowest stage since June 21.

Coinshares additionally reported that buying and selling quantity for the week ending July twenty first was $1.2 billion, beneath its annual weekly common of $1.4 billion and effectively beneath the $2.4 billion recorded for the week ending July 14.

Ethereum and XRP are seeing inflows.

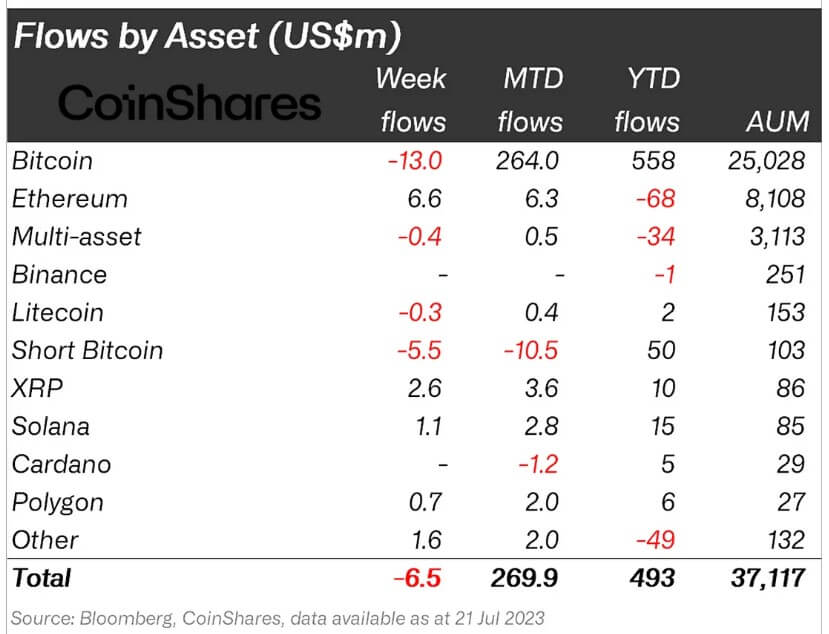

Final week, the Ethereum (ETH) funding product topped the influx leaderboard with $6.5 million inflows.

James Butterfill, head of analysis at Coinshares, wrote that the influx suggests a attainable shift in sentiment across the asset. For the reason that starting of the 12 months, ETH has recorded a $68 million outflow in year-to-date indicators.

XRP, then again, noticed inflows of $2.6 million throughout the identical interval, bringing its year-to-date inflows to $10 million.

Coinshares famous that investor confidence in XRP has elevated following Ripple’s partial victory over the U.S. Securities and Alternate Fee (SEC). The corporate mentioned its digital asset funding merchandise noticed inflows of $6.8 million in 11 weeks.

Different altcoins resembling Solana (SOL), Polygon (MATIC), and Uniswap (UNI) registered smaller inflows of $1.1 million, $700,000, and $700,000 respectively.

Bitcoin accounts for almost all of outflows

After weeks of overwhelming inflows, traders withdrew $13 million from Bitcoin funding merchandise. In distinction, the BTC brief funding product recorded his $5.5 million outflow, persevering with its thirteenth consecutive week of outflows.

Bitcoin short-term investments at present have $103 million in property beneath administration. At its peak, it accounted for 1.4% of all Bitcoin funding merchandise. It’s now all the way down to 0.4%.

CoinShares mentioned the principle explanation for the outflow was as a consequence of damaging sentiment within the North American market, with 99% of the $21 million outflow coming from the North American market. Nevertheless, inflows of $12 million in Switzerland and $1.9 million in Germany have been capable of offset the affect.

An article first appeared on currencyjournals about Bitcoin’s first outflow in a month, whereas Ethereum and XRP get pleasure from investor confidence.

(Tag Translation) Bitcoin

Comments are closed.