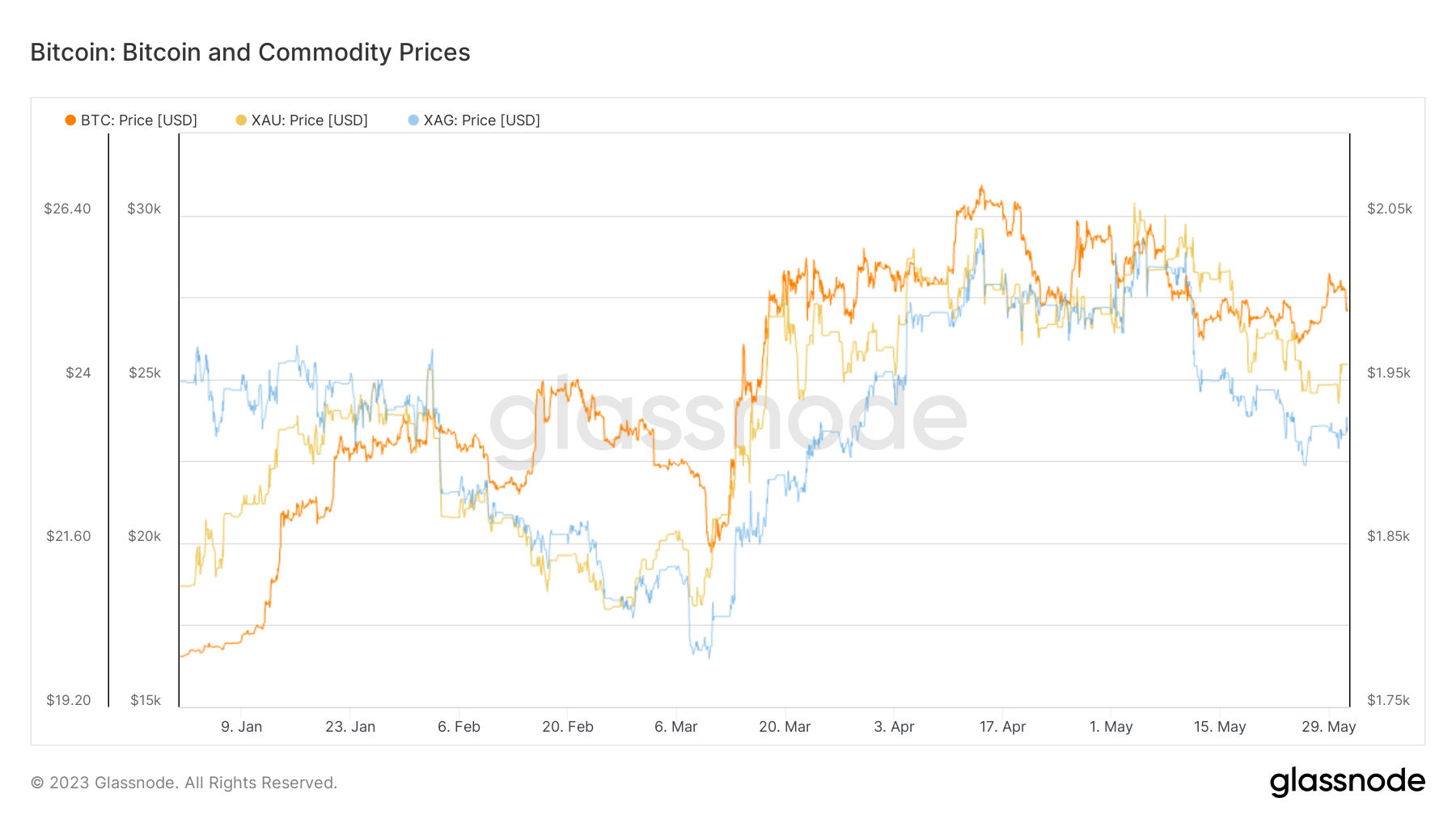

Regardless of the widespread market disaster brought on by the US debt ceiling, Bitcoin and commodities, particularly gold and silver, have proven exceptional efficiency to date in 2023.

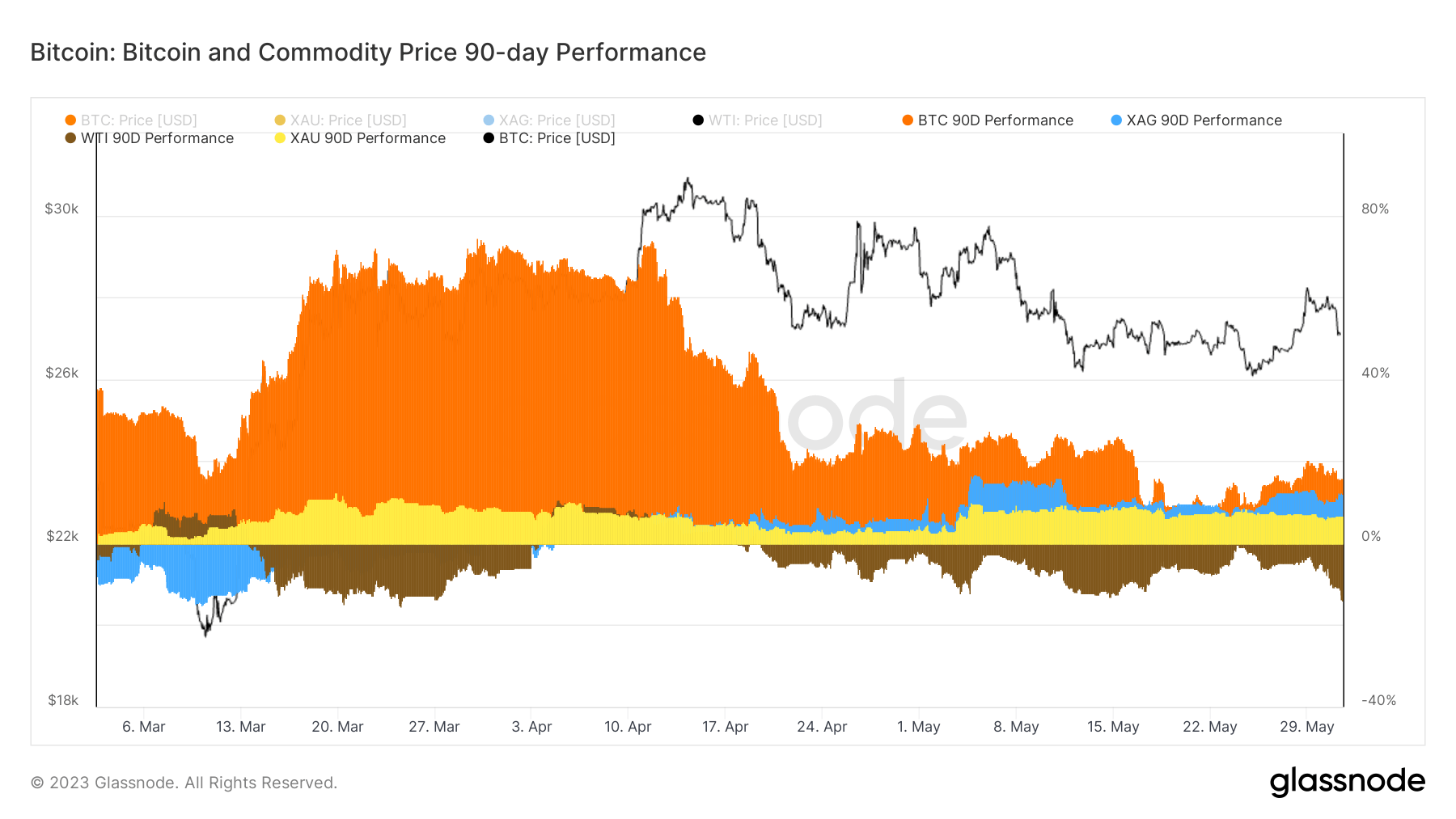

Over the previous 90 days, Bitcoin recorded a 15.85% acquire, beating silver’s 12.41% acquire and gold’s 6.82% acquire.

Nevertheless, Bitcoin’s gradual and regular return noticed shouldn’t be misinterpreted as an indicator of an imminent steady market.

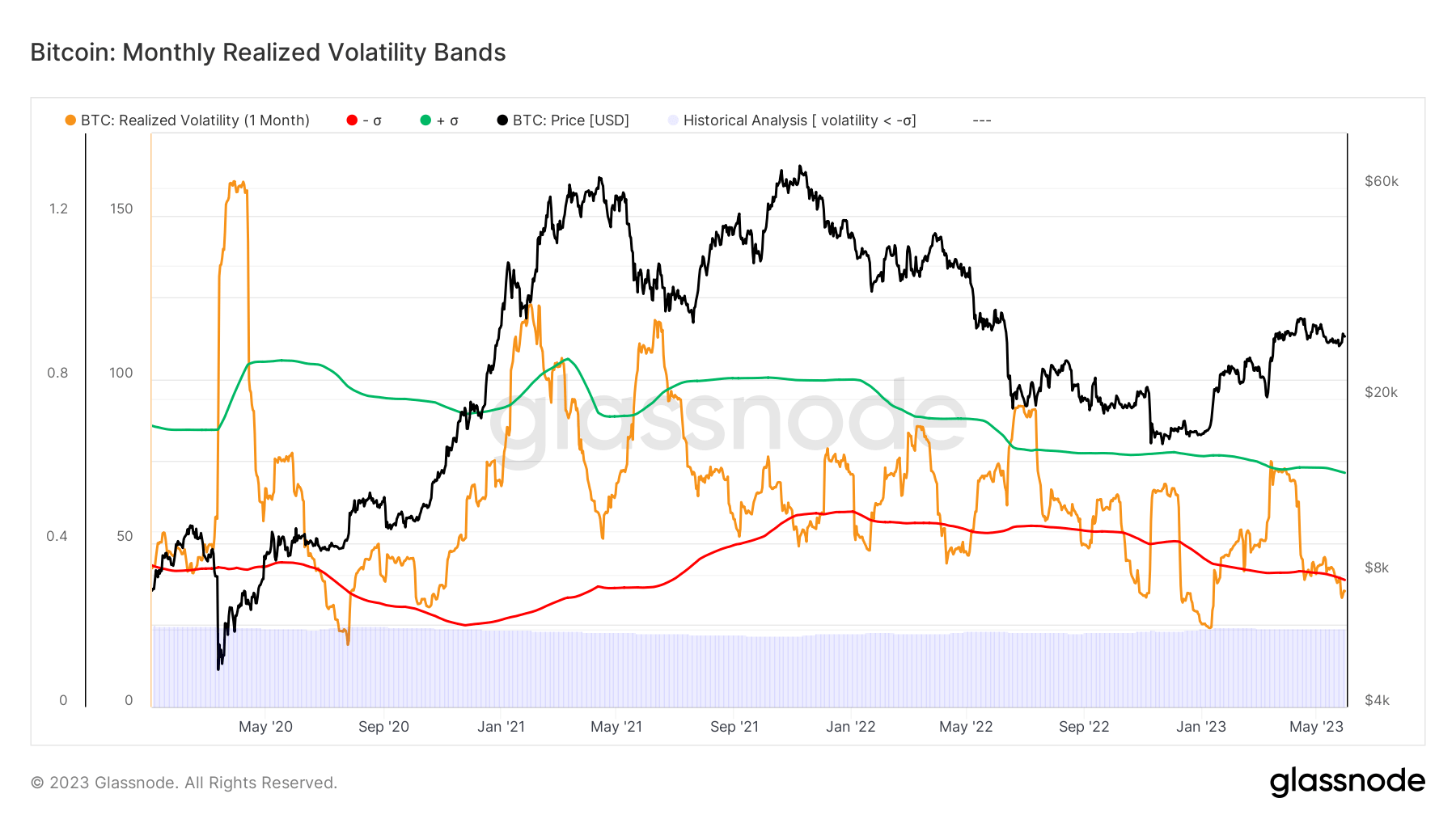

Bitcoin’s month-to-month realized volatility – a measure of how unstable or diversified an asset’s returns are over a month – has fallen to 34.1%, beneath the decrease finish of the Bollinger Bands of 1 commonplace deviation.

Bollinger Bands are a technical evaluation software that plots a variety set round asset costs, with wider bands representing increased volatility and vice versa. A drop beneath the decrease band may sign an upcoming correction or reversal.

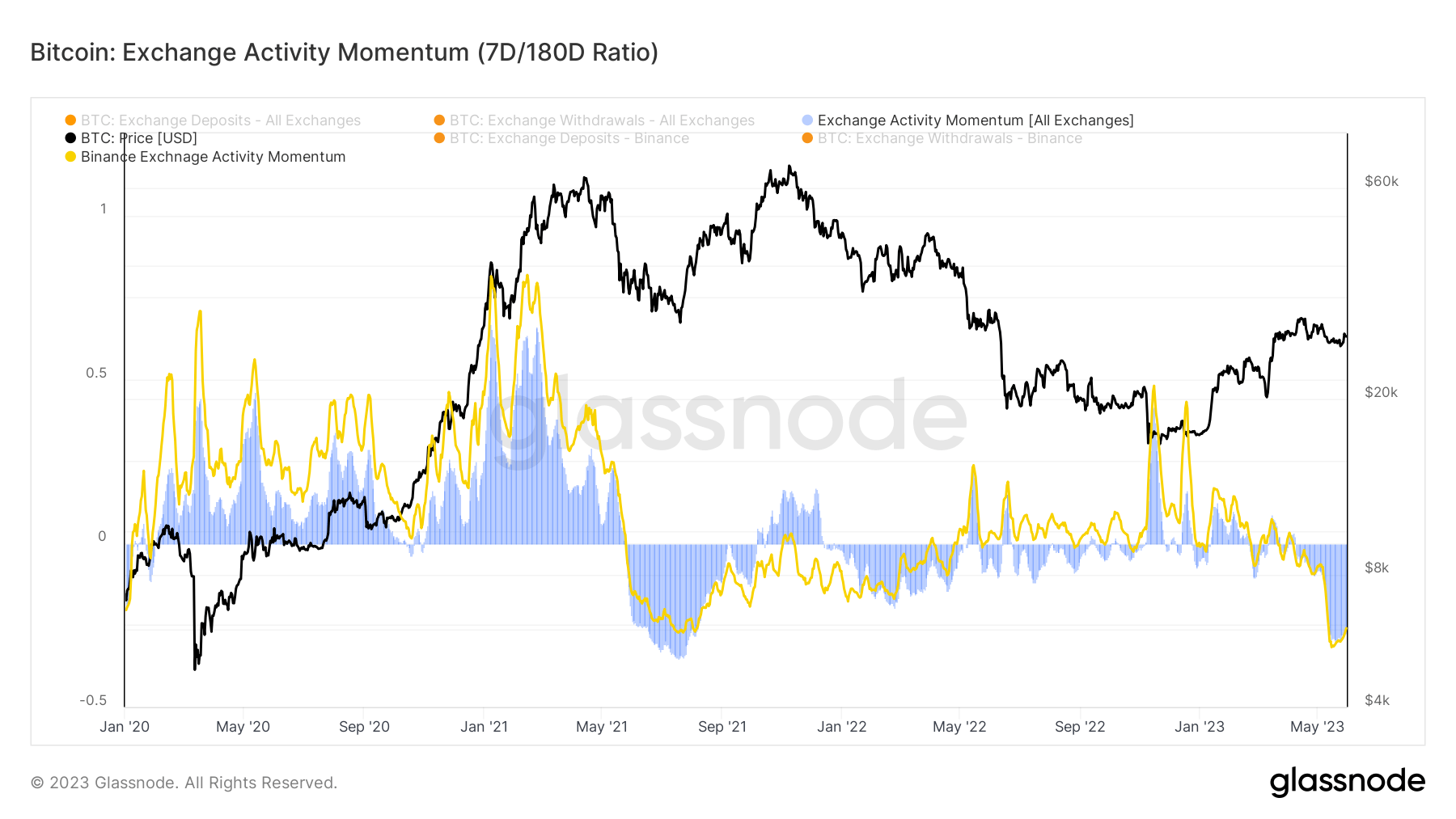

The slowdown in Bitcoin market exercise is additional supported by the momentum seen in foreign money exercise. Glassnode calculates this metric by evaluating the typical variety of overseas change deposit and withdrawal transactions for the present week to the median variety of such transactions over the previous six months to create an exercise charge.

The current 27.3% drop on this ratio in comparison with the final six months confirms the downward pattern in market contributors.

These two components – decrease investor exercise and decrease realized month-to-month volatility – paint a dormant, flat market. Nevertheless, in keeping with Glassnode, such durations of low volatility accounted for simply 19.3% of Bitcoin market historical past, suggesting that volatility is prone to spike going ahead.

Bitcoin outperforming commodities first appeared on currencyjournals as markets equipped for top volatility.

Comments are closed.