- Amid a sell-off within the $270 billion cryptocurrency market, Bitcoin briefly examined $49,000 earlier than rebounding to $51,000.

- Issues over a US financial slowdown and rate of interest hikes in Japan are inflicting market turmoil.

- The FBI warns that cryptocurrency scams will improve amid elevated market volatility.

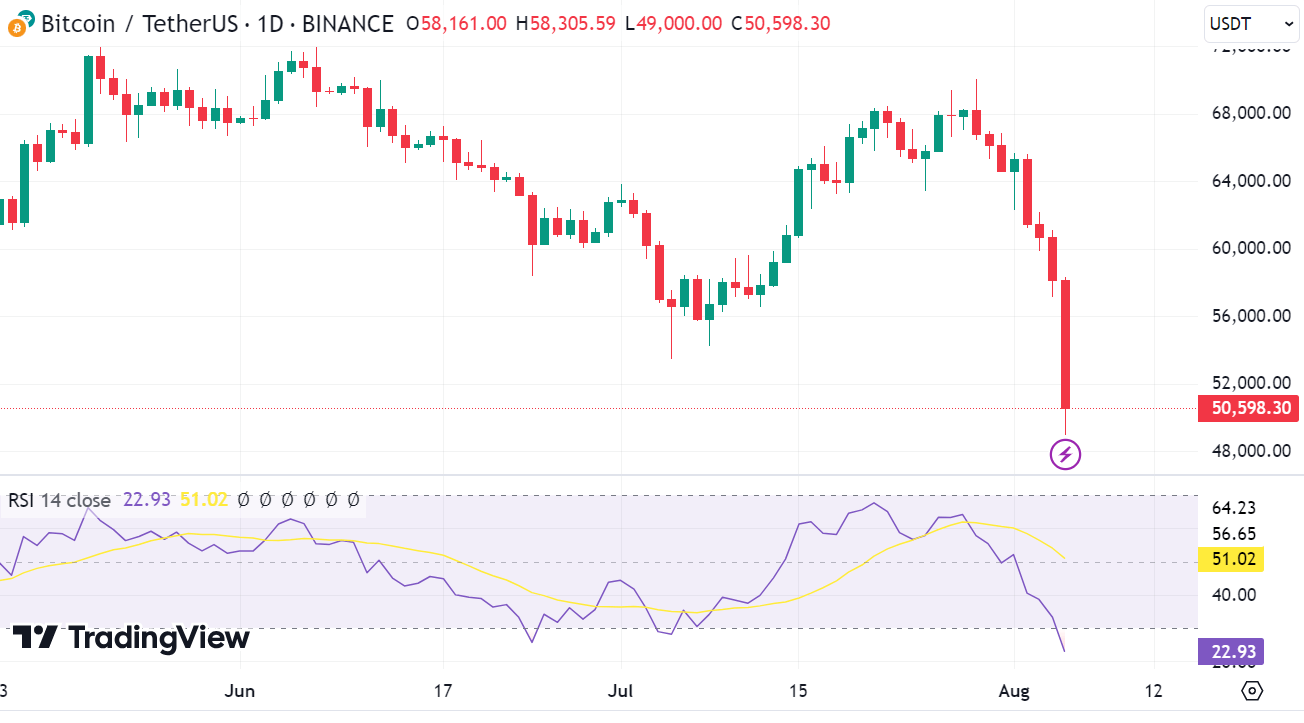

The cryptocurrency market skilled a serious drop at present, dropping round $270 billion in worth in 24 hours, in accordance with knowledge from CoinGecko. This drop was led by Bitcoin, which plummeted almost 20% to hit $49,121, its lowest stage since February's $53,091.

Ether additionally suffered an enormous 21% drop, dropping to $2,300, wiping out its beneficial properties this yr. Different cryptocurrencies corresponding to Binance’s BNB and Solana additionally suffered important losses.

The Financial institution of Japan raises its base rate of interest

The cryptocurrency market's dramatic decline coincided with a broader sell-off in inventory markets, notably in Asia-Pacific, exacerbated by a drop of as much as 7% in Japan's Nikkei common.

The sell-off was triggered by the Financial institution of Japan's choice to boost its coverage rate of interest to its highest stage in 16 years, sending shock waves by means of monetary markets.

The sudden rise in JPY/USD has triggered an enormous liquidation of yen carry commerce positions, contributing to the sharp decline in US shares. For many who don’t perceive how this works, right here’s a fast clarification.

1) Many merchants have been borrowing Japanese Yen (JPY) at low rates of interest… pic.twitter.com/sfi0Hva56M

— Adam Khoo (@adamkhootrader) August 5, 2024

The US Nasdaq additionally fell into correction territory, recording its worst three-week interval since September 2022, additional contributing to the sell-off in threat belongings together with cryptocurrencies.

Market response was influenced by financial tightening in Japan and up to date actions by the US Federal Reserve.

The Fed selected to maintain rates of interest on maintain however didn’t sign a fee reduce in September, as many market watchers had anticipated.

This uncertainty has elevated market anxiousness, main merchants to cost in a 100% probability of a reduce within the U.S. base rate of interest in September.

Issues over a possible US recession

The sell-off displays rising considerations a few potential U.S. recession brought on by softening financial knowledge and rising geopolitical tensions.

Tony Sycamore, market analyst at IG, confused that Bitcoin and different cryptocurrencies are threat belongings and extremely vulnerable to market fluctuations. He famous that Bitcoin is presently testing a key assist stage and desires to carry above the $53,000 mark to stop additional declines.

Nonetheless, on the time of writing, Bitcoin was buying and selling nicely beneath this assist stage at $51,657, regardless of recovering from across the $49,000 mark.

FBI points warning

Volatility within the cryptocurrency market has additionally raised safety considerations, with the FBI issuing a warning about scammers benefiting from market crashes to steal customers' funds.

The FBI has warned customers to be cautious of unsolicited messages or telephone calls suggesting issues with their accounts and urged them to test on the problems by means of official channels. The bureau's warning comes amid a big improve in cryptocurrency-related scams and hacking circumstances.

Within the first half of 2024, hackers stole $1.4 billion value of cryptocurrency, greater than double the quantity stolen in the identical interval in 2023.

The rise is as a result of rise in worth of varied tokens, together with Bitcoin, Ethereum, and Solana. Ari Redboud, world coverage head at TRM Labs, famous that whereas the safety of the cryptocurrency ecosystem hasn't essentially modified, the rise in token worth has made them extra enticing targets for criminals.

As Bitcoin and different cryptocurrencies navigate these unstable instances, traders and customers should stay vigilant about market circumstances and potential safety threats.