- Bitcoin possibility expiration date drops OI from 515K BTC to 355K BTC.

- Skew reveals the demand for PUT by merchants as a unfavorable facet threat of hedging.

- Consumers misuse liquidation to seize low-cost upside bets.

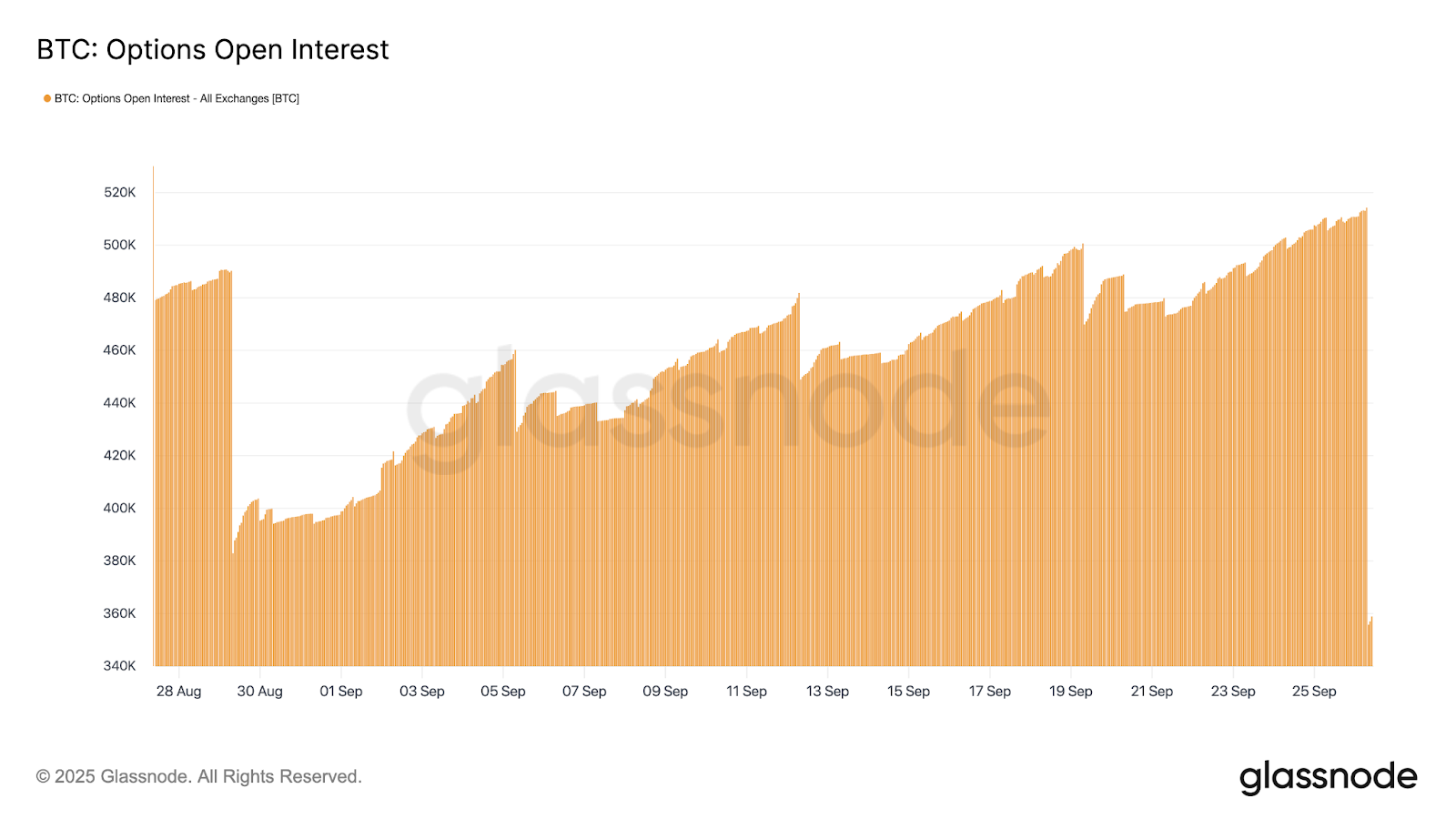

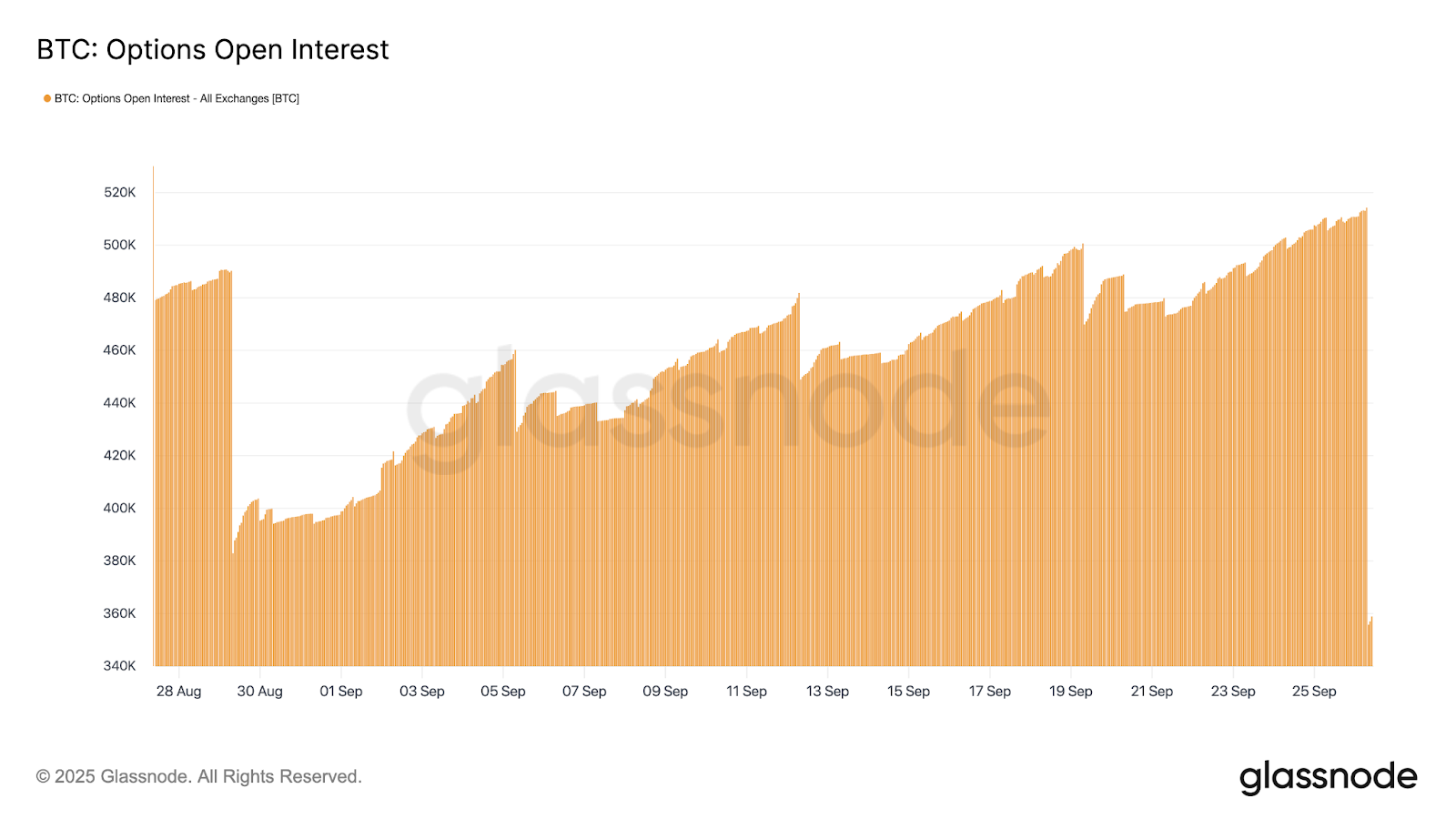

Bitcoin confronted a notable possibility reset this week, following its largest weekly expiration date on Deribit. In keeping with GlassNode information, BTC has settled at almost $109,000.

What stays is a extra lean market the place merchants weigh whether or not the subsequent wave shall be larger or the drug shall be decrease.

Associated: Bitcoin value near $109,000 as PCE inflation information and ETF outflow checks $107K assist

Open Curiosity drops 160,000 BTC

Open curiosity on BTC choices fell sharply from 515,000 BTC to 355,000 BTC in a single sweep. That is a 160,000 BTC equal contract is gone. It reveals how busy the derivatives market has been.

Now, the query is the place the brand new positions shall be constructed. That restructuring tells us whether or not the merchants are bracing for one more slide or quietly organising for a gathering.

Associated: Merchants goal $120,000 as Bitcoin awaits a key US PCE inflation report

What skew and volatility say about sentiment

The pricing of choices signifies what merchants are afraid of. The advantage of 25-delta’s skew is that draw back safety is pricey.

Belative volatility transactions, particularly on the brief edge, are richer than the volatility achieved. It is a signal that the market expects extra issues, even when value fluctuations haven’t but been maintaining. In different phrases, merchants are paying to forestall losses.

The place the dealer moved throughout liquidation

GlassNode information highlights one counterpoint. When pressured to drive a gross sales hit, some merchants intervened and acquired the cellphone. They used dips to seize an inexpensive rising publicity.

It would not erase consideration available in the market, nevertheless it reveals a pocket of confidence that Bitcoin may very well be larger briefly bursts, even towards heavier backgrounds.

Bitcoin value context and market indicators

On the time of the reset, Bitcoin was buying and selling at almost $109,000, down virtually 6% for every week. The every day quantity exceeded $70 billion. This proves that the exercise stays intense. The sale was neither skinny nor illiquid. It’s pushed by an actual cash move adjusting expiration dates.

With the outdated bets being resolved, the market is ready to see the place the brand new contracts settle. When open curiosity is restructured on the put facet, the bearish tilt is strengthened. When the decision begins typing, the trail to the squeeze opens. For now, Bitcoin is being caught between hedgers paying for safety and opportunists betting on rebounds. That stress determines the subsequent main motion.

Disclaimer: The data contained on this article is for info and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version will not be responsible for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.