- Bitcoin fell greater than 23% in November, on monitor to be its worst month since 2022.

- Based on CoinGlass, $2 billion disappeared previously 24 hours alone.

- The $70,000 to $73,000 zone is the decisive assist for the bullish cycle.

Bitcoin is on monitor for its largest month-to-month decline for the reason that brutal market crash of 2022, when the collapse of main crypto corporations resembling FTX and Celsius sparked panic within the trade. In the meantime, previously 24 hours, the Concern and Greed Index has dropped to 11.

As November attracts to an in depth, Bitcoin is down about 23%, the bottom month-to-month decline since June 2022. Regardless of supportive rules for digital belongings and a big improve in institutional investor involvement earlier this yr, cryptocurrencies are at present cooling down.

As Bitcoin crashes to $83,000, Ether (ETH) has additionally fallen 30% over the previous 30 days to a day by day low of $2,664. The bears proceed to have the higher hand after the October 10 liquidation crash worn out $19 billion in leveraged crypto bets.

Based on knowledge from CoinGlass, a further $2 billion of leveraged positions have been liquidated previously day. A whopping $1.47 billion was liquidated within the final 12 hours alone.

Capital outflows from establishments and declining momentum

As an alternative of stepping in to soak up the decline, giant buyers are pulling out. The 12 U.S.-listed Bitcoin exchange-traded funds recorded mixed outflows of $903 million on Thursday, the second-largest redemption date since their inception.

In the meantime, Bloomberg reported that U.S. shares, which had not too long ago rallied on enthusiasm for AI and robust earnings from huge tech corporations, misplaced all their positive aspects amid expectations of a Federal Reserve price lower.

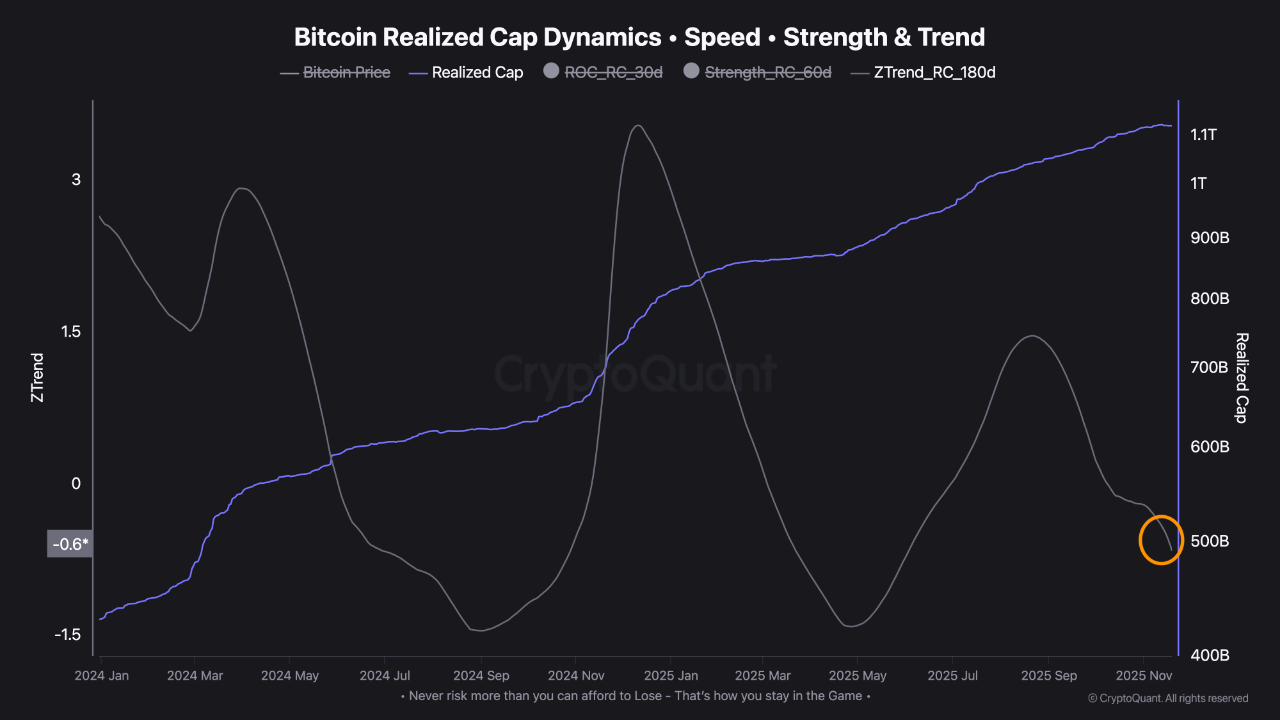

Based on analyst TeddyVision, though Bitcoin’s realization ceiling is rising, the 180-day Z-trend continues to maneuver into damaging territory. This principally implies that the expansion price of Bitcoin’s basic valuation is slowing.

Technical breakdown for essential assist

After falling under $90,000, analysts level out that Binance’s spot quantity knowledge exhibits a brand new buying and selling vary forming between $70,000 and $90,000. Probably the most traded value inside this vary, at present round $83,000, might additionally act as assist.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t answerable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.