- Bitcoin costs soared by double digits, hitting a excessive of $64,100 on Coinbase.

- Nonetheless, BTC plummeted as Coinbase customers reported issues with their account balances.

- Coinbase CEO Brian Armstrong famous that the alternate has recorded a spike in visitors.

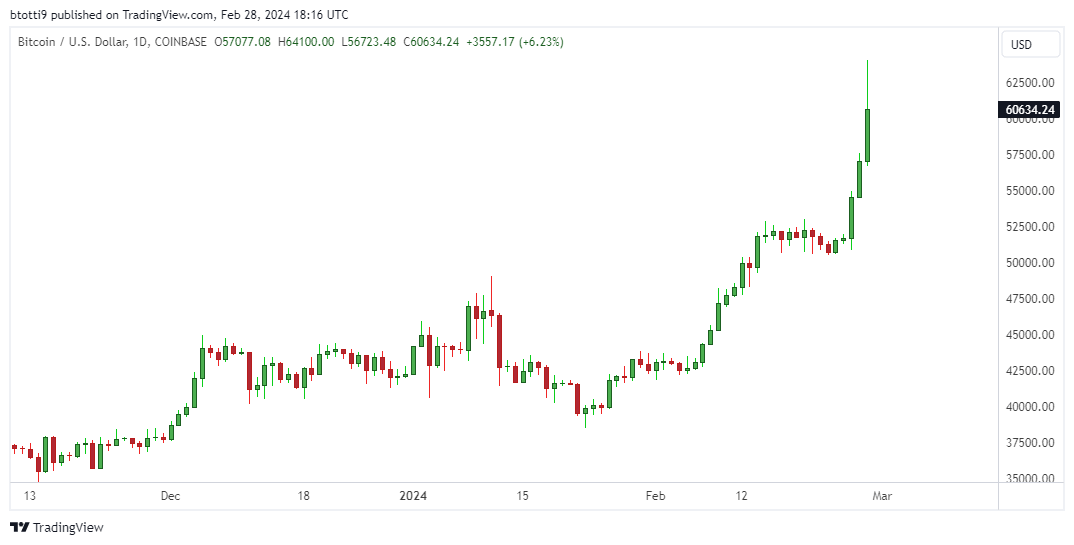

Bitcoin value crossed the $64,000 milestone on Wednesday, February twenty eighth, marking its highest degree since October 2021. The worth of the highest cryptocurrency rose greater than 12% in 24 hours, hitting a excessive of $64,100 on Coinbase.

Nonetheless, as $100 million in BTC liquidations reached the market in an hour, the value plummeted to a low of $58,000. Up to now 24 hours, the full liquidation quantity throughout the cryptocurrency market has reached greater than $630 million. In line with Coinglass knowledge, brief sellers have purchased greater than $355 million and patrons have purchased greater than $280 million.

The $6,000 plunge occurred after a consumer reported an issue with their Coinbase account – the steadiness was $0. Coinbase assist turned conscious of the difficulty and the BTC value shortly rose above $60,000. On the time of writing, the value is hovering round $61,300.

We’re conscious that some customers could expertise zero balances or errors when shopping for or promoting throughout their Coinbase accounts. Our crew is investigating this challenge and can present an replace quickly. Your property are protected.

You’ll be able to observe this incident at https://t.co/a3pl4WiDhZ.— Coinbase Help (@CoinbaseSupport) February 28, 2024

Brian Armstrong, Founder and CEO of Coinbase Admitted The sudden improve in visitors that was occurring on the alternate.

We deal with large-scale visitors spikes. We apologize for any points you could encounter. The crew is engaged on repairs.

— Brian Armstrong 🛡️ (@brian_armstrong) February 28, 2024

What's subsequent for Bitcoin?

Rising practically 50% up to now 30 days, BTC has soared to multi-year highs and is inside 5% of its all-time excessive of $69,000. At at this time's all-time excessive, Bitcoin would have doubled from its October 2023 degree, when it breached the $30,000 degree.

The momentum driving the bull market larger this week coincided with massive inflows into spot Bitcoin ETFs. The SEC's approval of spot ETFs in January pushed Bitcoin's value above $50,000, and the document quantity gained additional momentum this week.

This week alone, BlackRock's IBIT recorded a staggering $1.3 billion in buying and selling quantity. At present, spot ETFs reached ~$2.6 billion in simply half a day of buying and selling knowledge. Bloomberg ETF analyst Eric Balchunas shared this on his X.

JEEZ: We're solely midway via the buying and selling day, however the New 9 Bitcoin ETF has already damaged its all-time document for day by day quantity of $2.6 billion. A 4-bit ETF entered the highest 20. $IBIT is No. 4 total and can commerce extra at this time than within the first two weeks mixed. That is formally a growth. pic.twitter.com/Wqez1rKrCg

— Eric Balchunas (@EricBalchunas) February 28, 2024

The market is predicting that Bitcoin costs could fall forward of the halving. Nonetheless, when you placed on shorts,

(Tag Translation) Market