Realized revenue represents the cumulative revenue of all Bitcoins moved on the chain and is calculated because the distinction between the acquisition value and the switch value. This can be a direct measure of the profitability of Bitcoin holders, indicating when buyers are more likely to promote and e-book income.

Realized caps, however, signify market valuations extra precisely than conventional market capitalizations. We calculate Bitcoin's market capitalization by valuing every unit on the value it was final moved at, slightly than its present value. This indicator reveals the whole value base of the market and divulges the common acquisition value of all Bitcoins.

These indicators are essential for understanding the depth of market exercise, investor sentiment, and the true financial weight behind value actions.

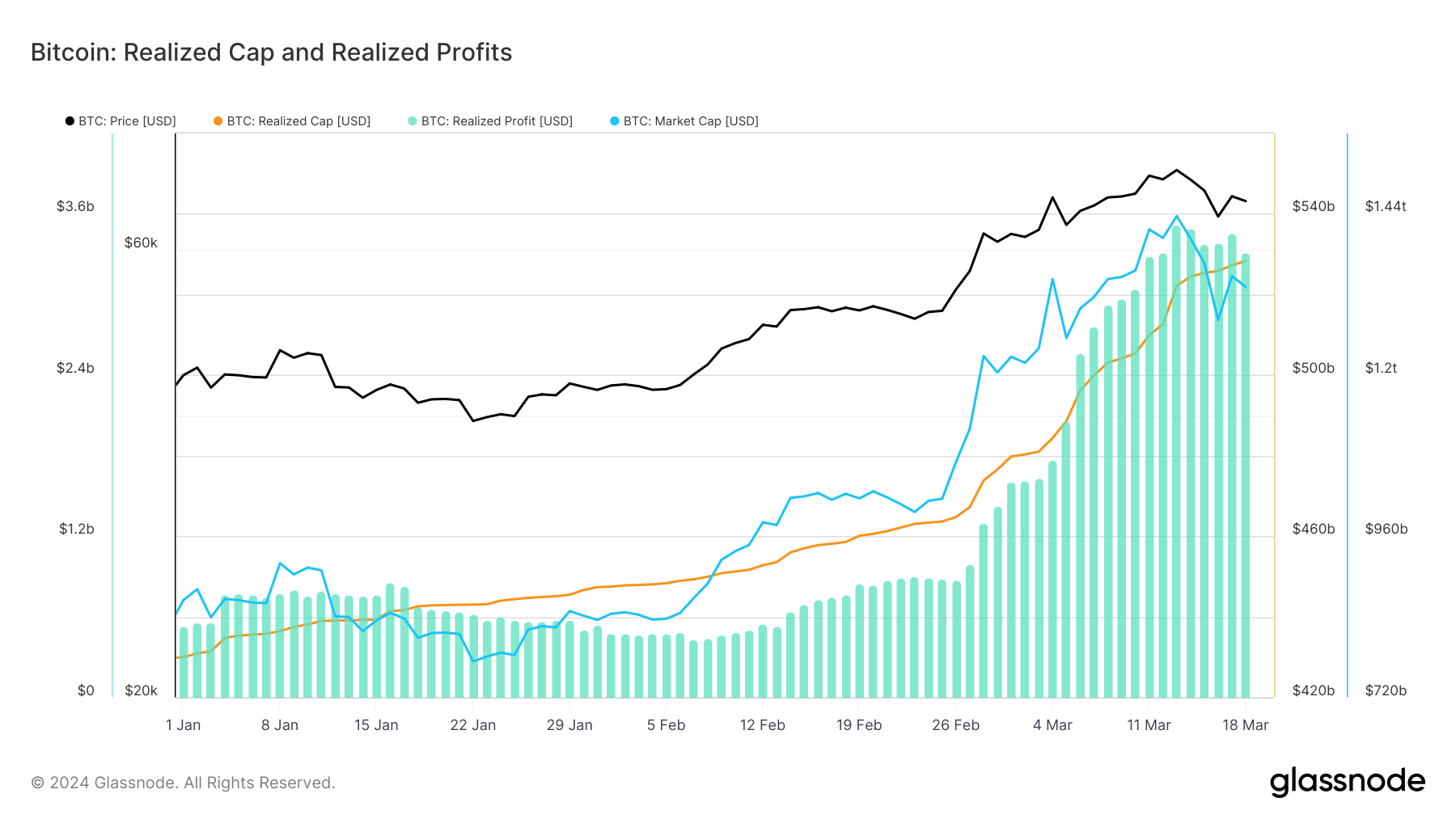

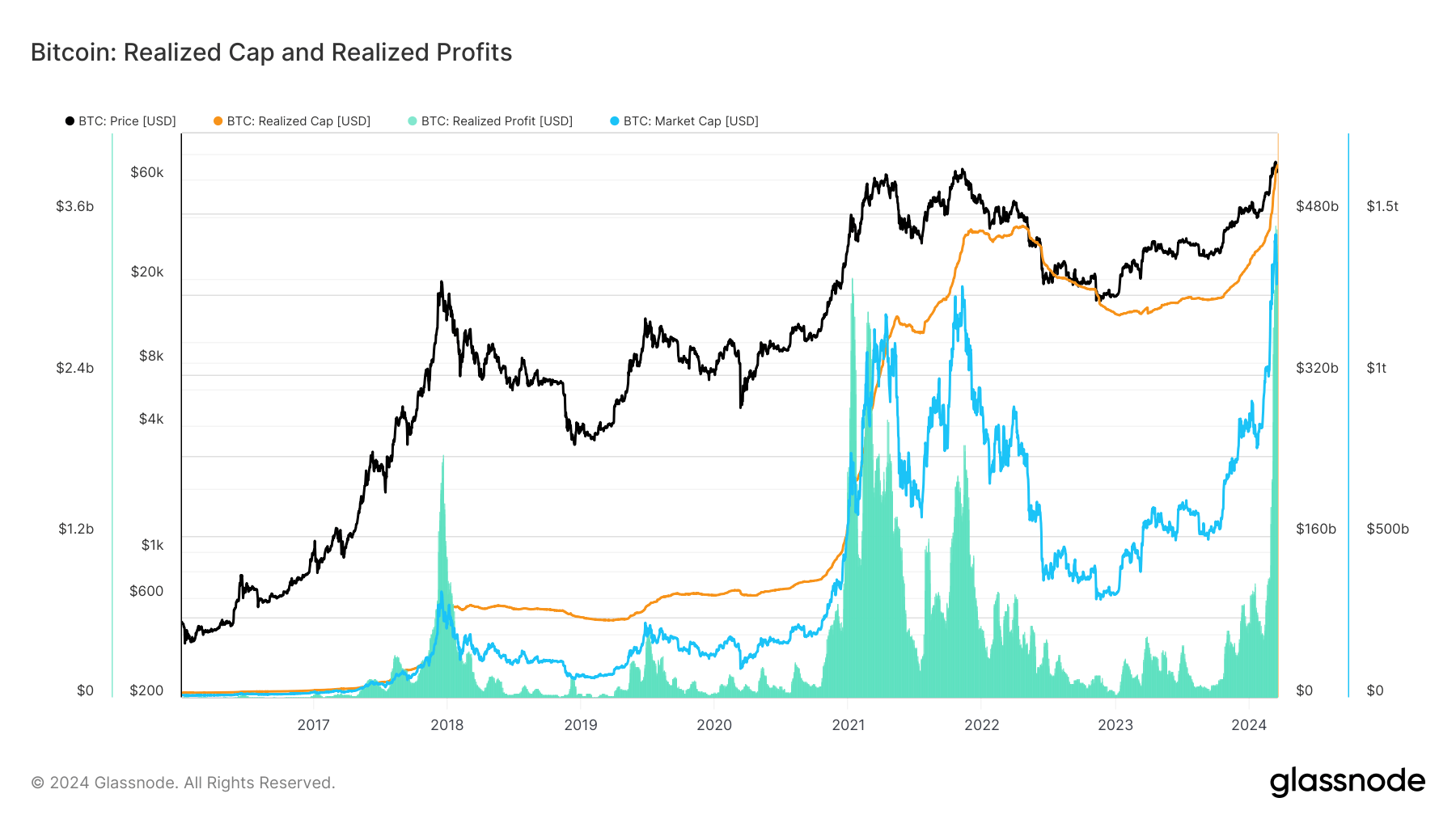

Because the starting of the 12 months, Bitcoin’s realized positive factors have been steadily rising, with a large rally starting in March. Realized income reached a report excessive of $3.51 billion on March 13. This RP spike got here as Bitcoin broke by the ATH and traded for the day at simply over $73,100.

It was solely a matter of time earlier than the extent of profit-taking out there turned excessive. The second highest realized achieve was $3.13 billion recorded on January 10, 2021. Bitcoin value fluctuations over the following few days have been doubtless the results of buyers benefiting from the value spike, with realized income reducing to $3.31 billion by March 18th. This implies a return to normalcy after the decline.

It’s tough to pinpoint what prevented Bitcoin from falling additional under $65,000 on March sixteenth. Whereas a number of indicators point out that stable help has shaped at that stage, it’s also doubtless that continued accumulation performed a key function in absorbing a lot of that promoting strain.

This may be seen within the constant progress in Bitcoin's realized cap, which elevated from $429.97 billion at first of the 12 months to $528.32 billion as of March 18th. This regular progress contrasts with extra unstable market capitalization adjustments, indicating continued accumulation regardless of value fluctuations. The regular improve within the realized cap even throughout a value correction reveals sturdy confidence in Bitcoin, which seems to have established a stable basis for additional progress.

This knowledge highlights the resilience of the market and reveals that regardless of short-term speculative pressures, the underlying development is considered one of sustained accumulation and confidence. The divergence between the regular rise in realization limits and market capitalization volatility highlights a mature market the place long-term accumulation methods nonetheless outweigh short-term hypothesis.

The publish Bitcoin’s realized income have reached ATH, however the market continues to build up appeared first on currencyjournals.