- Bitcoin (BTC) leads cryptocurrency rally to ~$115,700 on hope US-China commerce deal eases issues

- Vital week forward as Fed QT finish and FOMC rate of interest determination might enhance volatility

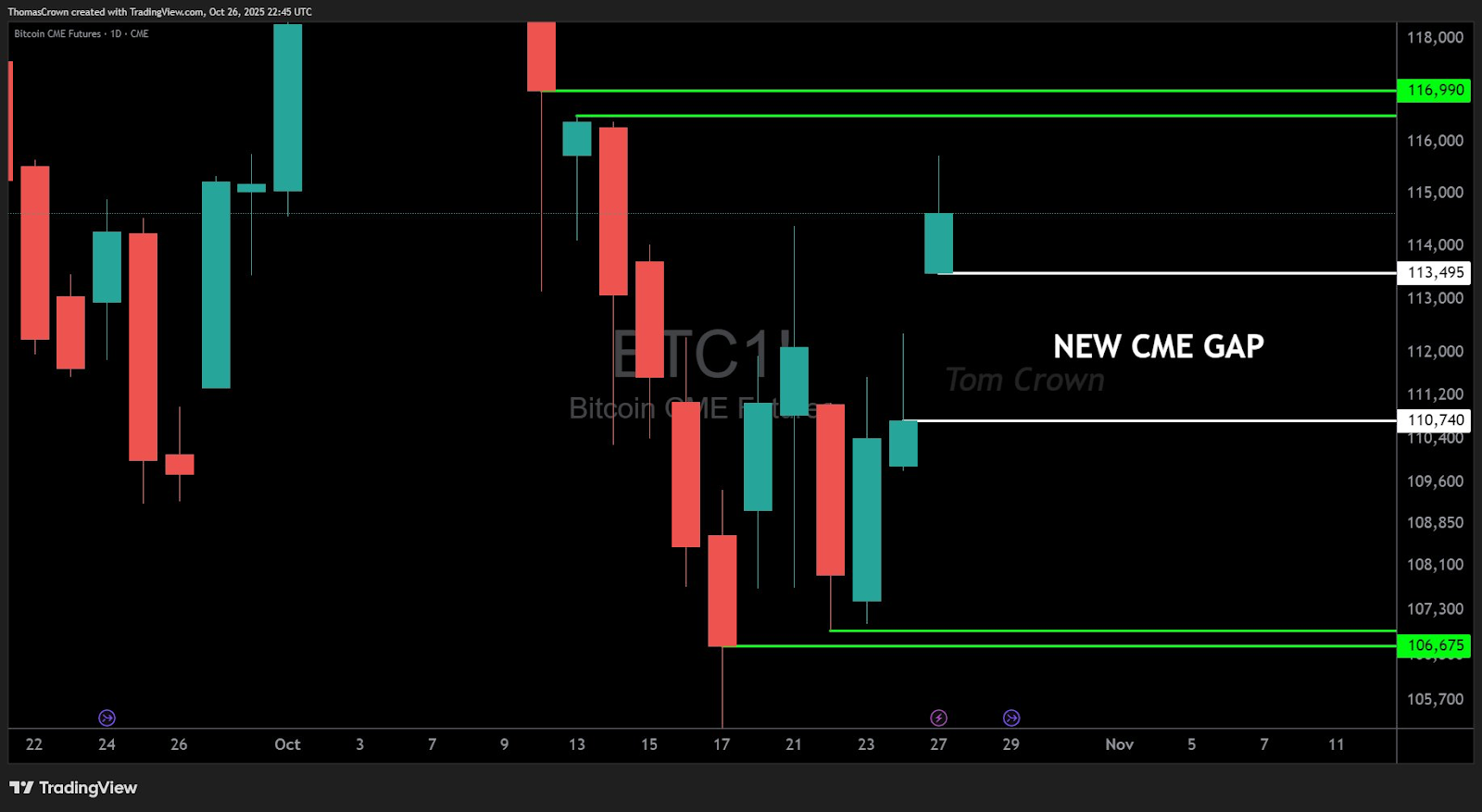

- Analyst Gambardello warns that unfilled BTC CME hole of almost $110,000 poses medium-term pullback danger

Bitcoin (BTC) ushered in a broader crypto market rally, decisively transferring above $115,000 as optimism surrounding a possible U.S.-China commerce deal eased latest market jitters.

BTC posted its fifth consecutive day by day acquire in early London buying and selling on Monday, buying and selling round $115,679, pushing the whole crypto market cap up 3.7% to $3.9 trillion. This restoration has considerably receded fears of an extra correction, mirrored within the rise within the CoinMarketCap Worry & Greed Index.

Associated: If BTC.D weakens, Fed steadiness sheet pivot will increase odds of alt season

Why digital forex is attracting consideration at present

US-China commerce deal will trigger quick squeeze

In the present day’s cryptocurrency market rose primarily as a result of US-China commerce deal. In the present day, greater than $469 million in inflows got here from leveraged crypto merchants, with the bulk coming from quick sellers.

The US-China commerce struggle, which has escalated attributable to latest macro fears, has considerably lowered. As traders turned bullish, the broader crypto market additionally noticed modest features, following the Nasdaq 100 futures and S&P 500.

Constructive macro information for crypto this week

Over the following seven days, volatility within the cryptocurrency market is bound to extend. Due to this fact, leveraged merchants are cautioned to all the time be cautious. Whereas US financial indicators could also be affected by the continuing authorities shutdown, there are some high-impact macroeconomic information that may impression the crypto trade this week.

- Quantitative tightening (QT) is anticipated to finish this week.

- Federal funds charge and FOMC assertion.

- Financial institution of Japan (BOJ) coverage charges, Financial institution of Canada (BoC) financial coverage report.

- Tariff deadlines inside commerce agreements.

- The Fed expects to concern $1.5 trillion to start the quantitative easing (QE) section.

Gambardello’s mid-term warning: the unbridgeable BTC CME hole ($110,000) is looming

Regardless of optimistic value developments and a probably bullish macro setting, analyst Dan Gambardello expressed medium-term warning across the Bitcoin CME futures chart.

He famous that there’s a vital unfilled CME hole on the decrease finish, round $110,000. The CME Hole represents the value distinction between Friday’s closing value and Sunday/Monday’s opening value of the CME Bitcoin futures market. Traditionally, these gaps typically are likely to “shut”, which suggests the value returns to that stage.

Gambardello urged that this $110,000 distinction might act as a magnet, pushing costs again within the quick time period forward of a extra sustained rally, or capping present features. Though not assured, this represents a technical danger issue that might delay a possible “uptober” rally even when the month-to-month closing value stays bullish.

Discover the Prime: Gambardello on Month-to-month RSI and Gold Correlation Alerts

Wanting past the speedy week, Gambardello believes the market remains to be within the early phases of a euphoric bullish section and shared his insights on figuring out the final word cycle peak. He highlighted two vital macro indicators.

- 1. Month-to-month RSI Bearish Divergence: Gambardello identified that the tops of main Bitcoin bull markets up to now have typically been preceded by bearish month-to-month Relative Power Index (RSI) divergences. This happens when the value makes a brand new excessive, however the RSI fails to succeed in the corresponding new excessive, indicating that momentum is weakening regardless of the height value.

- 2. Altering correlation between gold and Bitcoin: He additionally highlighted the connection between gold and Bitcoin. Traditionally, Bitcoin tends to prime out earlier than gold makes its closing rally in a macro cycle. Due to this fact, monitoring the value habits of gold relative to all-time highs after Bitcoin probably hits new highs might be an vital sign in the direction of the tip of the crypto bull market. If gold begins a robust rally after Bitcoin’s peak, it might sign a shift within the broader danger cycle.

Associated: Bitcoin hovering at $110,000 doesn’t point out a peak, Van de Poppe says.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version isn’t accountable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.