Adjustments in futures and choices open curiosity present perception into market sentiment, liquidity, and potential worth actions. Futures and choices reveal how merchants are positioning themselves and present their expectations for future worth actions. Open curiosity measures capital move, exhibiting whether or not new capital is flowing into or out of the market.

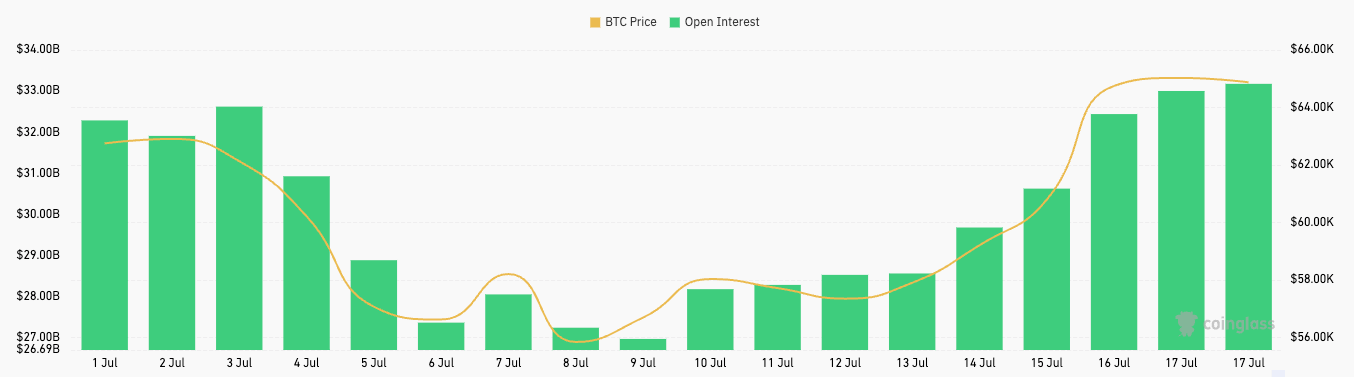

A have a look at open curiosity reveals that Bitcoin's latest rise has given new power to the derivatives market after a comparatively calm and uneventful July. This stability displays weeks of sideways worth fluctuations the market has skilled. The sideways pattern turned optimistic final week, with Bitcoin beginning at $56,680 on July 9. The value rise began slowly however started to choose up tempo after July 14, surging from $59,205 to $65,025 on July 17.

Futures open curiosity carefully mirrored this worth motion: on July 9, open curiosity was $26.97 billion and steadily elevated, reaching $33.25 billion on July 17. This sharp enhance in open curiosity signifies that merchants opened extra contracts as Bitcoin breached the $60,000 mark, doubtless anticipating additional worth good points.

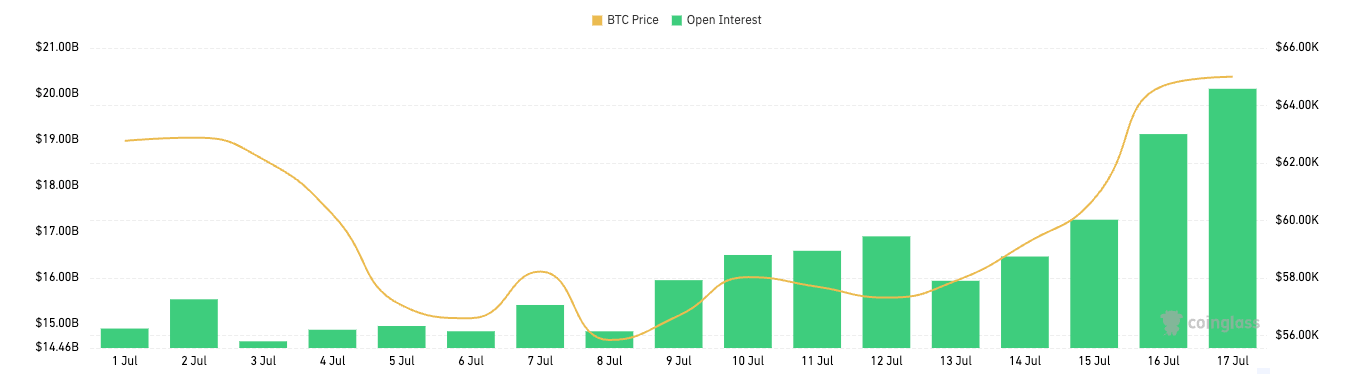

The choices market adopted the identical pattern: on July 9, the open stability was $15.94 billion. It steadily elevated the next week, reaching $20.11 billion on July 17. Just like the futures market, there was a notable enhance within the open choices stability since July 15, reflecting Bitcoin's worth enhance. The spike additionally signaled a big enhance in exercise from merchants who rushed to capitalize on worth fluctuations and revenue from them.

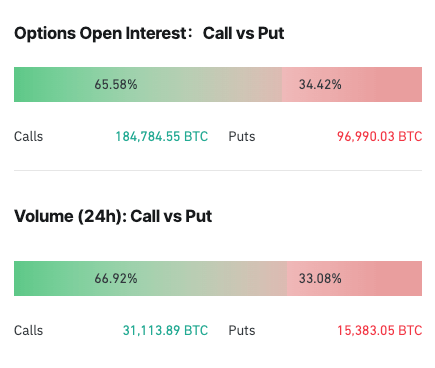

Wanting on the distribution of calls and places, we see that over 65% of the open curiosity and buying and selling quantity are calls. Which means that a small share of merchants are hedging draw back danger and trying to revenue from additional worth will increase. Choices present a mechanism for merchants to leverage their positions whereas controlling danger, which is particularly enticing in periods of risky costs.

The simultaneous rise in futures and choices open curiosity alongside the value enhance reveals how consolidated the Bitcoin market is. Greater spot costs appeal to extra futures contracts, which in flip encourages elevated choices buying and selling. This reveals a complete response from the market utilizing complicated buying and selling devices.

Moreover, the correlation between open curiosity and worth signifies that the derivatives market favors optimistic worth actions: flat worth actions considerably scale back futures and choices open curiosity, whereas rising costs appeal to new capital into the derivatives market.

The publish Bitcoin Rise Reignites Derivatives Market appeared first on currencyjournals.