Launched on the day of Bitcoin's halving, Rune is a type of knowledge embedded immediately into Bitcoin transactions. Not like easy monetary transfers, runes encapsulate extra info inside these transactions.

Bitcoin Rune works by using a way generally known as “transaction augmentation,” which permits customers to embed arbitrary knowledge into the transaction output. Runes can retailer quite a lot of knowledge varieties, from easy messages to extra advanced contract-like scripts.

This mechanism is clearly completely different from different Bitcoin-based improvements akin to Ordinals and BRC-20 tokens. Ordinal numbers carve knowledge into particular person satoshis, remodeling every right into a discrete, uniquely identifiable unit of knowledge. Ordinals are perfect for representing digital artifacts akin to pictures and textual content on the Bitcoin blockchain.

BRC-20 tokens, alternatively, are a token commonplace much like Ethereum's ERC-20, designed for issuing and managing tokens on Bitcoin's sidechains, particularly the RSK sensible contract community.

The Runes protocol works utilizing a system generally known as Unspent Transaction Outputs (UTXO). UTXO represents a specific amount of unspent Bitcoin that can be utilized to fund new transactions. Runes are assigned to UTXOs by way of the OP_RETURN operate, permitting knowledge to be embedded in transactions with out disrupting the community.

In transactions, runes are linked to UTXO by means of the OP_RETURN output, which specifies the output location, the rune's distinctive numerical ID, and the quantity of runes being transacted. This setting additionally handles Rune traits akin to severability and different metadata, all encoded throughout the similar transaction. The switch of runes between events makes use of Bitcoin's safe framework to element which runes transfer from one his-her UTXO to a different his-her UTXO.

The strategic announcement of Rune on the day of the halving capitalized on the eye the occasion attracted from the broader market. This timing was chosen to maximise visibility and impression, making the most of the elevated consideration surrounding the halving, when miners' rewards will lower and Bitcoin's future worth might be hotly debated.

Runes' direct impression on the Bitcoin community was large. The market had anticipated excessive charges and congestion across the halving, however the impression of Runes seems to have been sudden.

Runes is designed to reduce community congestion through the use of OP_RETURN outputs, which clearly can’t be consumed and subsequently don’t immediately contribute to UTXO set progress, however they’re gaining reputation and era. The quantity of transactions concerned can nonetheless trigger community congestion.

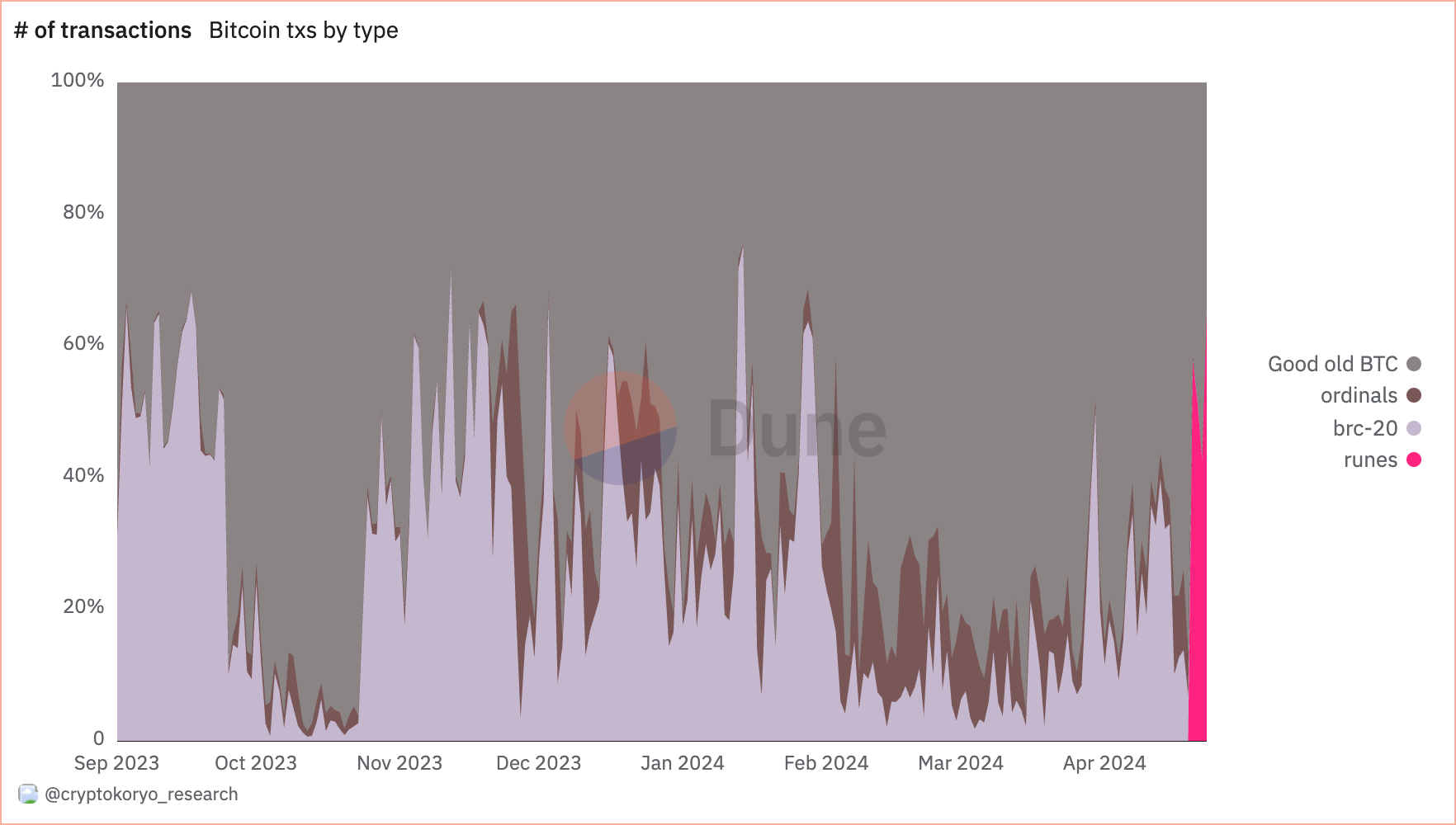

On April 19, the day earlier than the halving, many of the transactions on the Bitcoin community have been common monetary transactions, accounting for 86.7% of the entire transaction share. Ordinals and BRC-20 trades accounted for his 6.5% and 6.9% of the entire share, respectively.

On April 20, the day of the halving, rune transactions accounted for 57.7% of all transactions on the Bitcoin community. The share of monetary transactions accounted for 41.5%, and Ordinals and BRC-20 accounted for his 0.5% and 0.2% of transactions, respectively.

Loon continued to dominate the community over the weekend, accounting for 51.6% of whole transactions on April twenty first. By April twenty second, his dominance had decreased barely to 42.5%, and 56.5% of the entire transactions processed that day have been Bitcoin monetary transactions. .

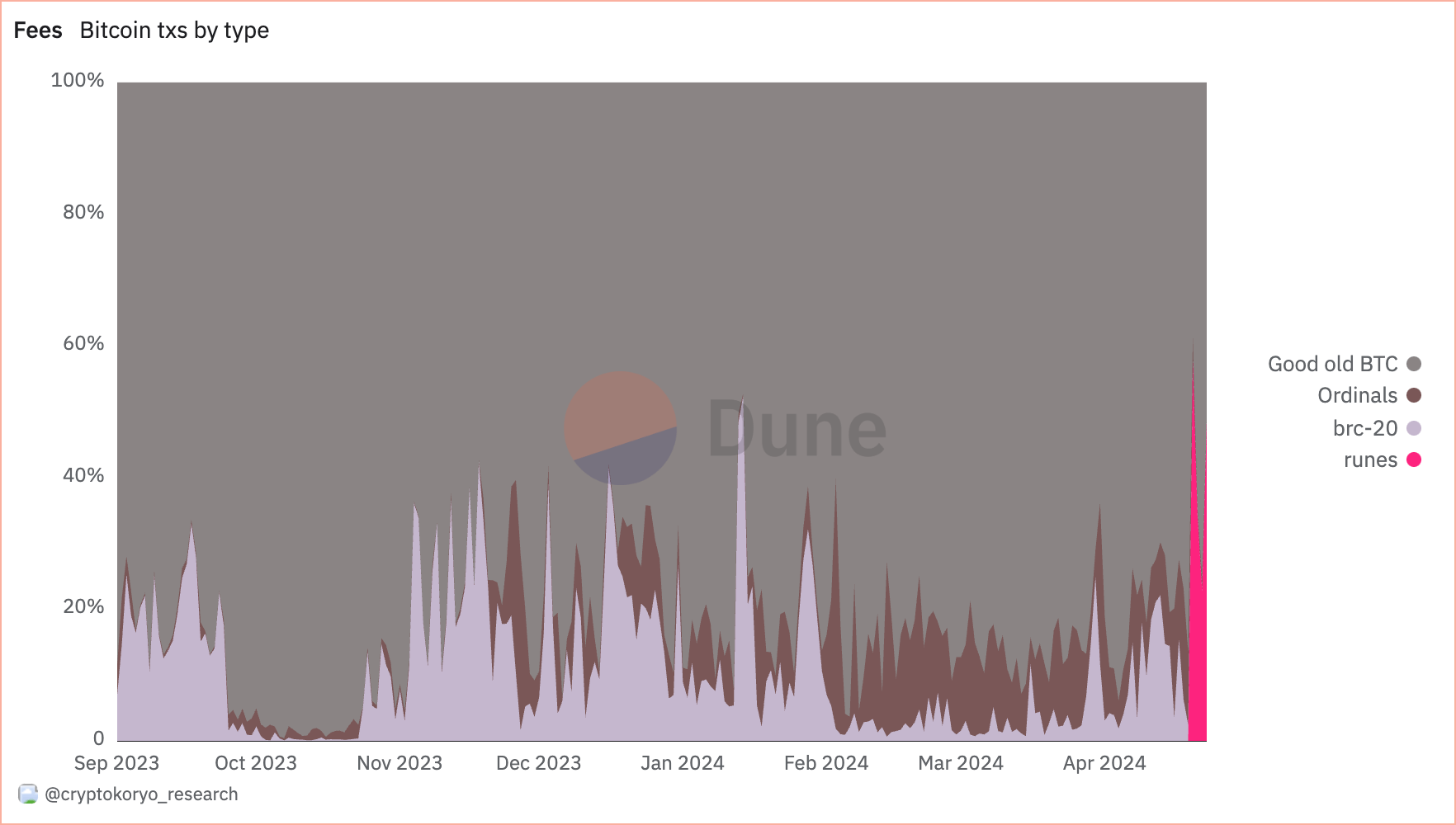

The financial impression of runes was equally vital, as evidenced by the distribution of transaction charges. On April twentieth, runes accounted for 57.7% of all transactions paid on the Bitcoin community.

The proportion of charges from monetary transactions decreased from 86.6% on April nineteenth to 38.7% on April twentieth. Nonetheless, the proportion of charges from Loon decreased within the days following the halving, because it accounted for 34.5% of charges on April twenty first and April twenty first. On April twenty second, it was 22.8%.

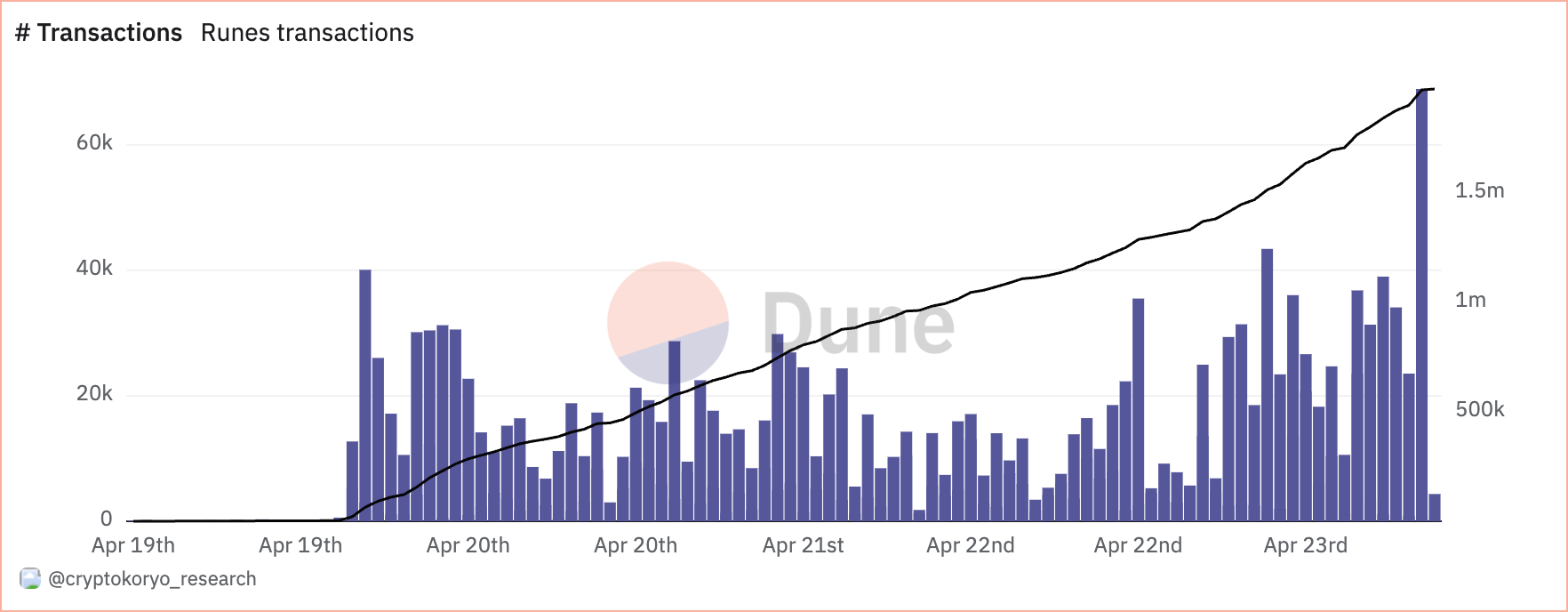

As of April 23, the variety of rune transactions is 1.973 million.

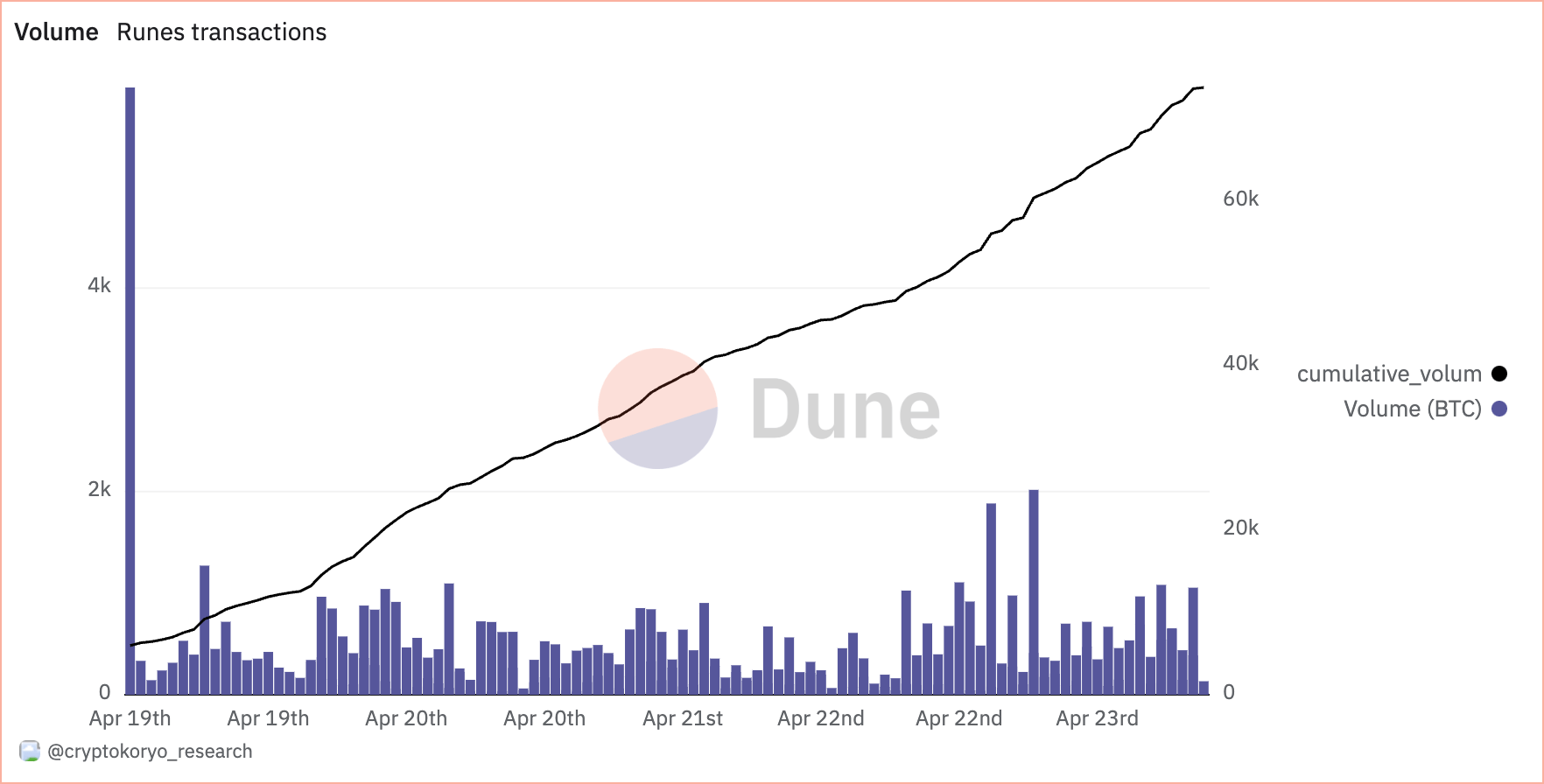

1,484 BTC was incurred as charges, and the cumulative quantity reached 73,765 BTC.

Regardless of the hyped launch, Rune's direct impression on the community eased considerably within the days following the halving. Loon's declining share in buying and selling and charges means that though preliminary pleasure was excessive, we may even see extra modest progress as a result of Loon's continued integration into common buying and selling patterns. Masu.

The complete extent of Rune's impression on the Bitcoin community will not be but understood. A good portion of the market has been celebrating the introduction of recent types of interplay with Bitcoin's blockchain. Whereas some are targeted on the speculative alternatives that requirements like Runes and Ordinals allow, others are excited concerning the innovation and customers this might convey to the Bitcoin ecosystem. .

Nonetheless, a fair bigger section of the market has warned of the elevated load on the community brought on by Loon, which might result in increased charges and slower buying and selling occasions. The primary drawback critics have appears to be the dilution of Bitcoin's purity. An costly and congested community impacts Bitcoin's usefulness as a method of fee in addition to a retailer of worth.

Nonetheless, it appears doable that the community will adapt to the presence of the runes and take in the stress they create. A comparatively related debate surrounded Ordinals when it launched, however almost a yr and a half later, knowledge reveals its impression has been minimal.

We may even see extra fluctuations in charges within the coming weeks and months, as we wait to see if Loon turns into a elementary a part of Bitcoin buying and selling or only a area of interest market throughout the bigger ecosystem. will take much more time.

The submit Bitcoin Loon Accounted for 57.7% of Halving Trades appeared first on currencyjournals.