CoinShares' newest weekly report highlighted notable adjustments in crypto funding merchandise, with the sector experiencing its greatest outflows in three months.

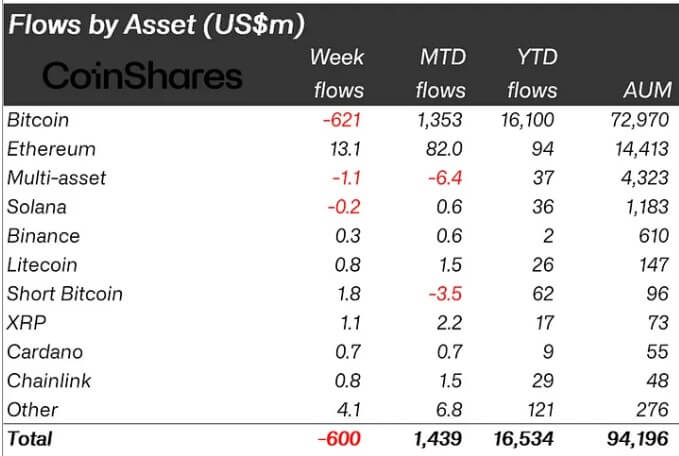

Final week, traders pulled $600 million out of the market, with Bitcoin merchandise bearing the brunt, seeing outflows of $621 million.

In the meantime, quick Bitcoin merchandise noticed inflows of round $2 million, reflecting bearish sentiment.

James Butterfill, head of analysis at CoinShares, attributes this alteration in sentiment to a “extra hawkish than anticipated FOMC assembly.” Final week, the Federal Reserve’s (Fed) Federal Open Market Committee determined to maintain rates of interest on maintain, with many consultants suggesting this implies there shall be just one fee minimize this 12 months.

Butterfill defined that the transfer has pressured traders to scale back their publicity to belongings with mounted provides like Bitcoin. He added:

“These outflows, together with the current value declines, have prompted whole belongings below administration (AuM) to fall from over $100 billion to $94 billion in a single week.”

In the meantime, the weak spot within the US appears to have had an influence on different international locations, with outflows from Canada, Switzerland and Sweden totalling $15 million, $24 million and $15 million respectively, whereas Australia, Brazil and Germany noticed smaller inflows of $1.7 million, $700,000 and $17.4 million respectively.

Moreover, crypto ETP buying and selling quantity final week was $11 billion, effectively under the weekly common of $22 billion. Nonetheless, these merchandise accounted for 31% of whole buying and selling quantity on main exchanges.

Altcoin inflows proceed.

Regardless of Bitcoin's bearish development, most altcoins had a powerful week and attracted vital quantities of cash.

Ethereum continued its upward development, growing inflows by $13.1 million to $82 million YTD. The upturn was pushed by the much-anticipated launch of an Ethereum spot exchange-traded fund (ETF) product within the U.S., which consultants imagine will enhance market entry for the nascent business.

In the meantime, different altcoins corresponding to Cardano and Lido attracted over $1 million, whereas different belongings corresponding to Litecoin, Chainlink, and so forth. noticed reasonable inflows.