The short-term realized worth (SLRV) ratio is an usually neglected metric that gives nuanced perception into investor sentiment. This ratio compares the share of Bitcoin that final moved inside a short while body (24 hours) to the share of Bitcoin that final moved over an extended time-frame (6-12 months) and exhibits how a lot Bitcoin the market is holding. and which aspect of the commerce you might be leaning in direction of.

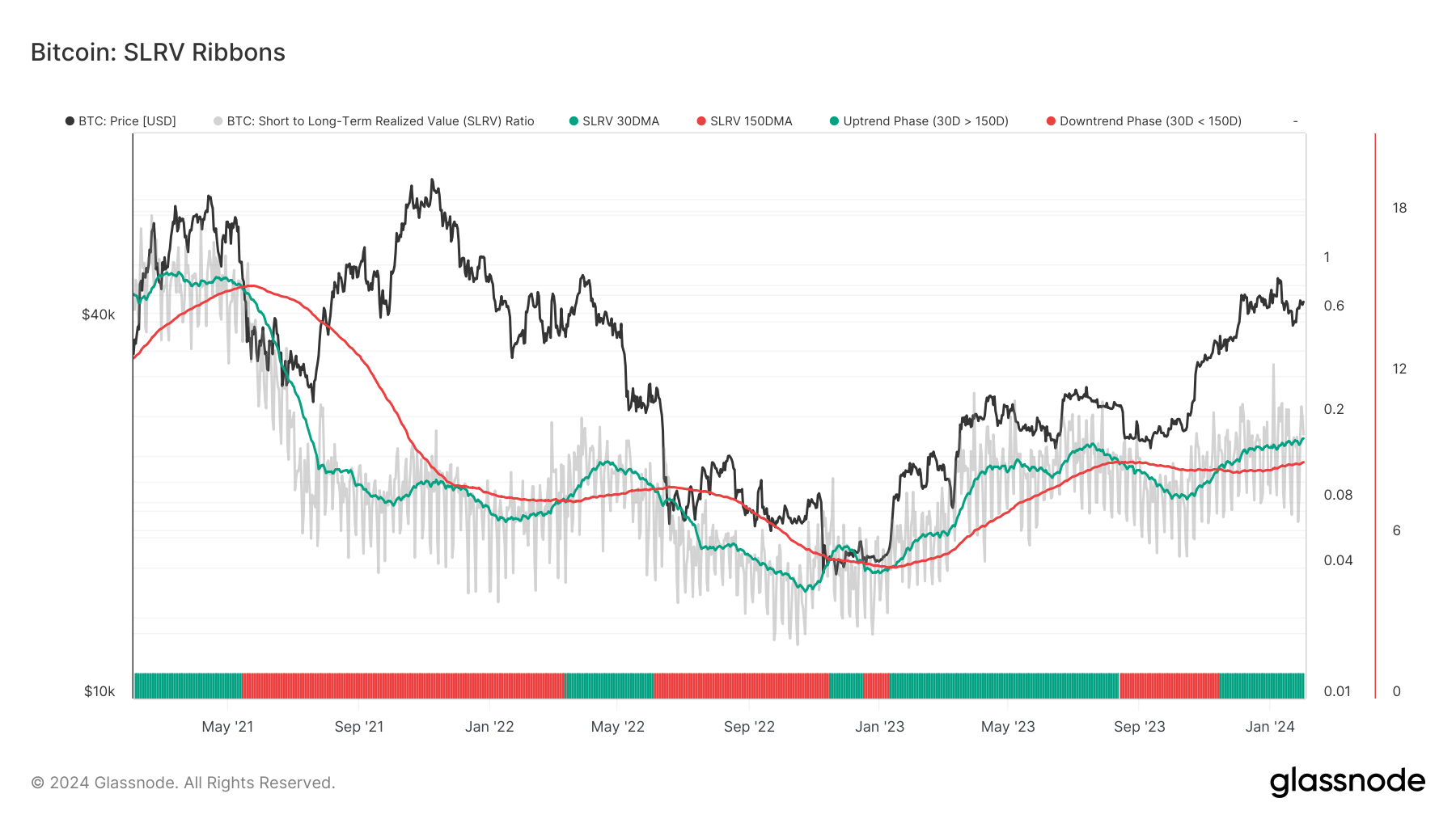

Nevertheless, the SLRV ratio alone is normally not enough to establish broader developments, as there’s vital day-to-day variation within the metric. Making use of and analyzing ratios by means of shifting averages, particularly the 30-day easy shifting common (SMA) and 150-day SMA, can present a transparent image of persistent market developments.

On February 1st, the SLRV 30D SMA reached its highest degree since July 2021 as Bitcoin value exceeded $43,000. This peak represents a continuation of the constructive uptrend that started on November 14, 2023, when the SLRV 30D SMA exceeded his 150D SMA.

The SLRV 30D SMA reaching a 2.5-year excessive signifies a big enhance in short-term buying and selling exercise in comparison with long-term holdings. This may be as a consequence of a myriad of various elements, however is normally the results of value fluctuations. Elevated short-term buying and selling quantity usually correlates with heightened market hypothesis as traders and merchants rush to make the most of value actions. This may occasionally point out that the market is being pushed by bullish sentiment or that there’s elevated speculative curiosity spurred by latest market actions.

The introduction and adoption of spot Bitcoin ETFs within the US seemingly performed a key position. This extremely anticipated buying and selling product propelled Bitcoin into the mainstream, bringing institutional and superior traders into the market by means of tradfi. These ETFs not solely have a psychological influence in the marketplace and enhance investor confidence in BTC, but in addition present liquidity to Bitcoin. This elevated liquidity will permit traders to maneuver out and in of Bitcoin positions extra rapidly by means of the ETF, which may enhance buying and selling quantity and lead to a spike within the SLRV 30D SMA.

The rise within the SLRV 30D SMA is just not the one indicator of a change in market sentiment. The sustained place above the 150D SMA since mid-November signifies not solely a spike in short-term buying and selling exercise, but in addition sustained greater ranges over the long run.

The persistence of this development, which is about to enter its third consecutive month, signifies that market exercise is a extra entrenched sample of conduct amongst traders fairly than a short lived speculative burst.

Traditionally, short-term SMAs above long-term SMAs have been used as a technical indicator to point constructive momentum and potential bullish developments in varied property, together with Bitcoin. A chronic interval wherein the SLRV 30D SMA is above the 150D SMA may point out a broader market transition from risk-off to risk-on, with traders actively taking part in speculative investments or You'll begin allocating a big portion of your portfolio to Bitcoin.

The publish Bitcoin hits $43,000 as short-term buying and selling quantity peaks appeared first on currencyjournals.