- Bitcoin traded close to $105,000 on October seventeenth, with quantity growing by about 36%, indicating aggressive repositioning.

- Technical analysts have mapped a potential retest between $88,000 and $90,000 earlier than pushing in the direction of new highs.

- If the weekly shut exceeds $125,000, the draw back map might be invalidated and the trail to a report might be open once more.

Bitcoin traded at round $105,000 on October 17, after falling 5% per day and eight% week on week. Gross sales rose by about 36% throughout main exchanges, suggesting merchants rotated danger somewhat than exiting utterly.

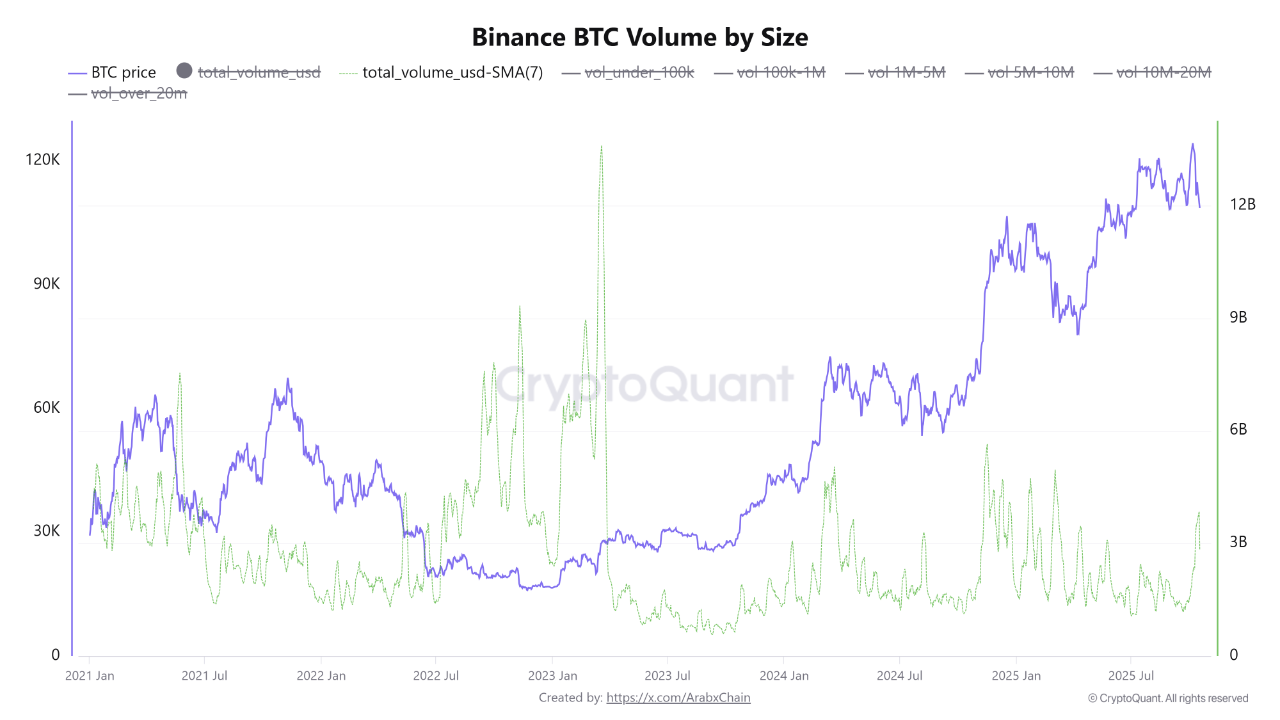

In keeping with Binance information, seven-day common quantity is close to its highest stage since March and at present hovers round $3.68 billion, in line with re-accumulation when costs soften and exercise picks up. On this setup, the following directional determination is ready within the $100,000 to $105,000 zone as merchants observe how bids take in provide.

Associated: $4.0 trillion market, $1.8 trillion P/E, $5.1 trillion spot: Q3 2025 units new excessive for cryptocurrencies

Fourth quarter efficiency snapshot and key ranges

On the weekly chart, the ascending channel that has guided the uptrend since early 2023 is maintained. Resistance is centered round $124,000 to $125,000. Main assist is ready at $100,000 and the mapped danger zone is ready at $88,000 to $90,000 alongside the decrease channel boundary.

Analysts body $88,000 as a state of affairs somewhat than a name, anchored by imply reversion in the midst of the development and a earlier demand node. If the spot regains $112,000 and closes the week above $125,000, the map will change, momentum might be reaffirmed, and we’ll see a brand new all-time excessive.

BTC Value Evaluation: Between Help and Resistance

stage

Bitcoin is at present close to the midpoint of this channel, hovering round its 20-week transferring common. The RSI is at 47.7, indicating impartial momentum, whereas the MACD histogram means that the bullish energy is fading, however no reversal has been confirmed but. Chaikin Cash Circulation (CMF) stays barely optimistic, indicating regular inflows into the market.

A break under $102,000 will increase the probability of a sweep in the direction of $88,000 to $90,000, the place the decrease channel, decrease Bollinger Band, and pre-acceptance converge. In the event you keep above $105,000, $112,000 after which $124,000 might be performed as a restoration goal.

momentum

The weekly RSI is hovering round 48, a impartial worth that reveals neither a breakdown nor a resumption of the development. The MACD histogram has softened, however no definitive bearish crosses are seen within the weekly body. This mixture is suitable with stiffening tapes the place the momentum is cooled whereas the construction stays intact.

Liquidity and on-chain information

Overseas alternate reserves stay close to cycle lows, which limits short-term provide on the vendor facet, supporting the interpretation of re-accumulation ought to volumes rise and weaken. Funding charges have eased and open curiosity has narrowed from latest peaks, decreasing the danger of a chaotic liquidation transfer whereas leaving room for stress if spot rises to $112,000.

Though ETF web flows have slowed, secure taker exercise was seen in spot venues, permitting the market to soak up the draw back with out disruption.

macro driver

Macro liquidity has tightened this week as rising short-term funding prices within the US weighed on danger property. Futures positioning normalized after the preliminary leverage build-up, eradicating some gasoline from quick strikes in both course.

With alternate provide restricted and long-term holders holding regular, the trail to This autumn will rely on consumers defending $100,000 on the push and pushing via $112,000 on energy.

Associated: Is the altcoin shakeout coming? Arthur Hayes helps tokens with actual demand

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version shouldn’t be answerable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.