- The United Arab Emirates secured second place amongst GCC nations when it comes to crypto funding returns in 2023.

- The rise of $204 million places the UAE in thirty eighth place out of the highest 50 nations.

- Bitcoin is taken into account the preferred cryptocurrency amongst home traders.

A latest report revealed vital development within the United Arab Emirates (UAE) crypto sector over the previous yr. In keeping with a report by Chainalysis, the UAE recorded a major capital achieve of $204 million in crypto investments in 2023.

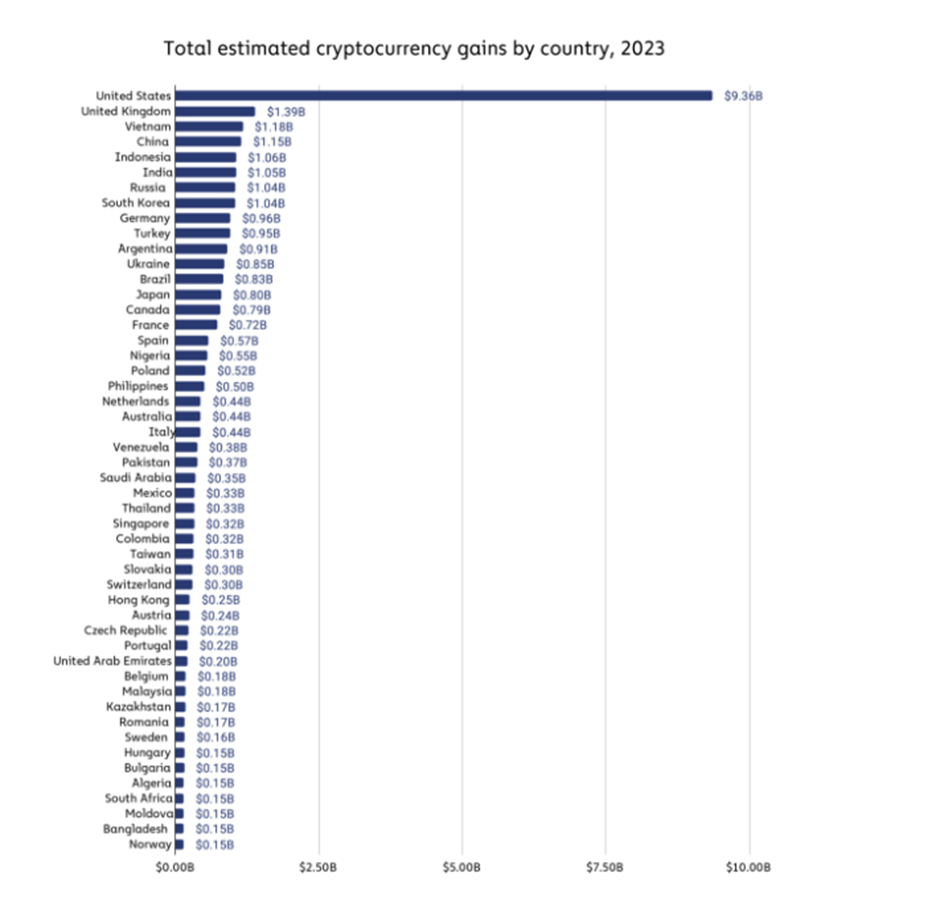

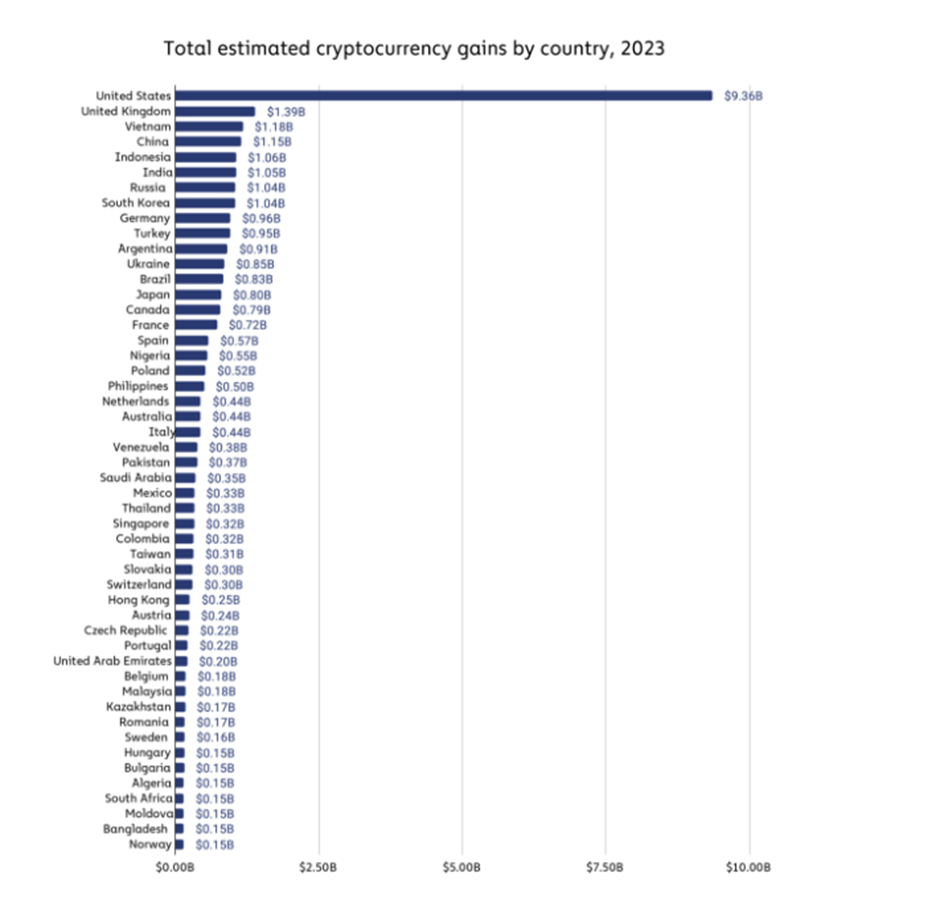

Though the UAE solely ranked thirty eighth among the many prime 50 nations with vital features from crypto investments, it secured second place amongst GCC nations. Saudi Arabia gained her $351 million in earnings and took the primary place within the GCC nations and her record of 26 nations.th Ranked within the prime 50 nations. Different GCC nations weren’t included within the record.

Notably, the USA led the rise with a complete achieve of $9.36 billion. The UK secured second place together with her $1.39 billion revenue. Higher and decrease center revenue nations reminiscent of Vietnam, China, Indonesia and India adopted go well with, with will increase of $1.18 billion, $1.15 billion, $1.96 billion and $1.05 billion, respectively. grew to become.

The report additional highlighted that Bitcoin is probably the most most popular cryptocurrency by UAE traders. “This asset class delivered robust outcomes for UAE traders, accounting for 70% of complete earnings final yr,” Chainalysis mentioned. Ethereum and Ripple's XRP secured second and third place among the many hottest cryptocurrencies within the UAE. Kim Grauer, Analysis Director at Chainalysis, mentioned:

The extraordinary reputation of Bitcoin and Ethereum reveals the maturity of UAE traders. The neighborhood favors established digital property with secure, confirmed efficiency over extra speculative cryptocurrencies.

Moreover, the report revealed international crypto traders' earnings totaled $37.6 billion in 2023. “2023 proved to be a yr of robust restoration for the worldwide crypto market, with asset costs and market sentiment recovering positively after the earlier turmoil,” Chainalysis mentioned. Yr. “

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version shouldn’t be answerable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.