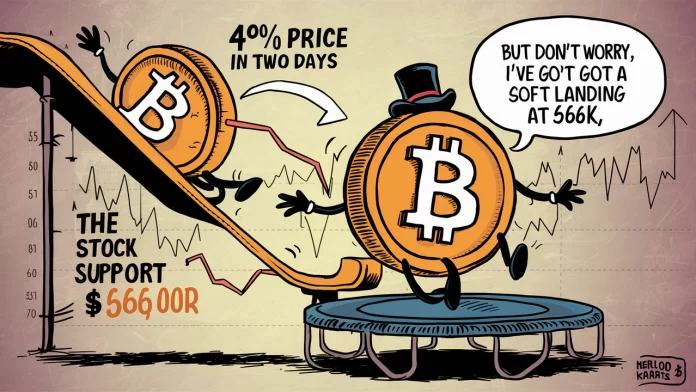

Bitcoin Bitcoin -0.88% The Bitcoin market has been on a big downward development since reaching $70,300 on Could 27. Presently hovering round $67,500, Bitcoin has fallen 4% in simply two days. Regardless of this drop, the assist degree of $66,000, which has held agency since Could 17, provides some reduction to bullish buyers who should not but cautious of this correction.

Nevertheless, some worrying knowledge is popping out of the Bitcoin derivatives market: As of Could 29, the variety of Bitcoin-equivalent leveraged bets, or open curiosity, reached a 16-month excessive. This raises questions in regards to the stability of the market, particularly since open curiosity typically displays leveraged betting positions and will result in a pointy drop in a correction.

Traders are transferring away from bond positions and favoring Bitcoin's efficiency. Macro developments are having a serious influence on Bitcoin.

The S&P 500 is presently simply 1.2% under its all-time excessive of 5,342 set on Could 23, signaling a sturdy inventory market. Moreover, the five-year Treasury yield has risen to 4.63% from 4.34% two weeks in the past, suggesting merchants are exiting bond positions. This shift was particularly notable after weak demand on the Could 28 Treasury public sale, pushing the benchmark yield to ranges that involved inventory buyers.

On Could 29, whole open curiosity in Bitcoin futures reached 516,000 BTC, the very best since January 2023 and up 6% over the previous week.

Chicago Mercantile Change (CME) leads the market with a 30% share, adopted by Binance with 22% and Bybit with 15%. This large open curiosity, value $34.8 billion, is a double-edged sword for the market. Excessive open curiosity signifies bullish sentiment and will sign sturdy demand for Bitcoin futures. Nevertheless, if bulls rely too closely on leverage, a typical 10% market correction might set off cascading liquidations, exacerbating the value decline.

Notably, Bitcoin costs have proven resilience since regulatory pressures eased within the U.S. Constructive developments on the regulatory entrance embody the approval of a spot Ethereum exchange-traded fund (ETF), the Senate vote to repeal the Securities and Change Fee's proposed SAB 121 accounting rule, and Congress' passage of FIT 21 reforms that may deal with most cryptocurrencies as commodities and permit them to be regulated by the Commodity Futures Buying and selling Fee (CFTC). These elements are collectively favorable to Bitcoin bulls.