- Bitcoin Worth right this moment holds $113,298 after a denial of practically $114,850, with $113,000 serving as key assist.

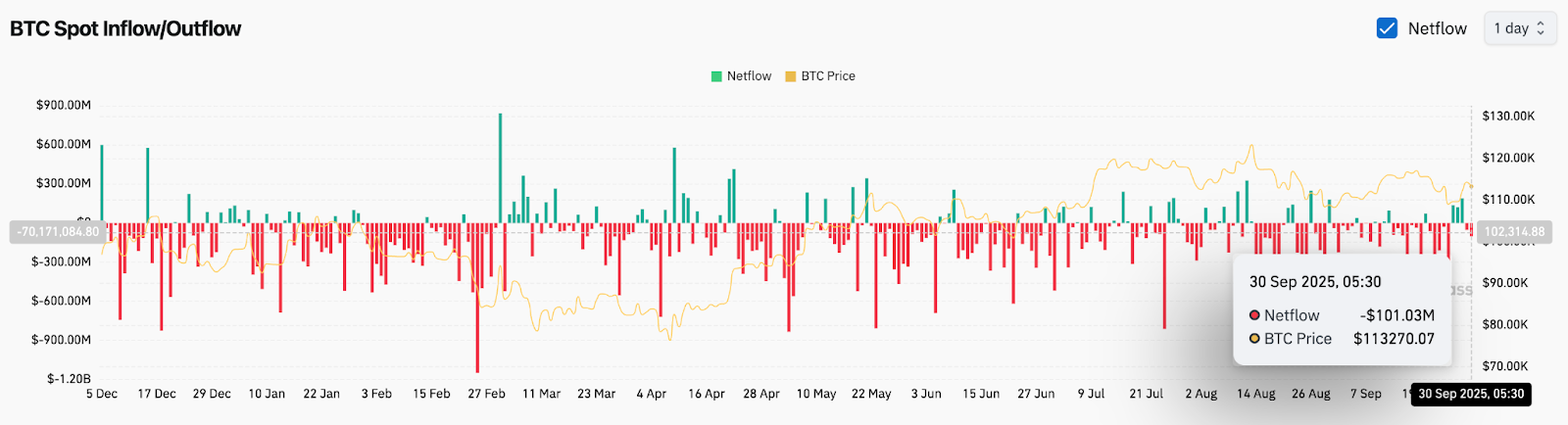

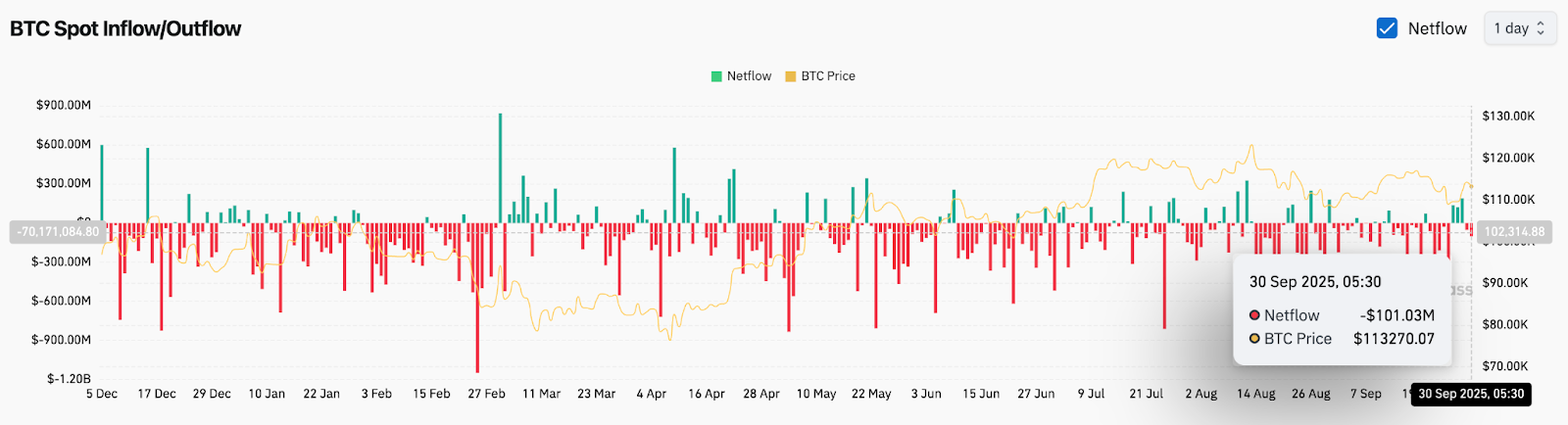

- The whale spill exceeded $110 million on September 30, exhibiting weak demand regardless of wider channel assist.

- Analysts have resistance ranges of $116K and $120,000, and if breakouts are retained, the upward goal will likely be prolonged to $125,000.

As we speak’s Bitcoin value is buying and selling at $113,298, slipping after a denial of practically $114,850 and holding assist for over $113,000. The market focus is whether or not consumers can recapture $116,000 and retest the $120,000 ceiling, or whether or not everlasting alternate spills can weigh momentum.

Bitcoin Costs retain channel assist

Bitcoin value motion stays locked inside the upward channel that has led the development since March. The each day chart exhibits roughly $111,800-$113,000 assist for 50 days of EMA and channel-based converging.

Associated: PI Worth Prediction: PI is going through stress as governance allegations place emphasis on sentiment

Resistance is stacked at $116,000 and near $120,000, the latter being marked as weak heights. The $113,365 20-day EMA is at the moment being examined, with the decisive proximity above this line opening a move as much as $118,000. On the draw back, if you cannot maintain $113,000, you would be uncovered to deeper assist ranges of $108,000 and $106,400.

The momentum indicator stays impartial. The RSI is medium distance and the MACD is flattened after the pullback in September. This means the combination part the place breakout affirmation determines the following leg.

Whale spills present weak demand

On-chain information highlights a cautious perspective from whales. The spot alternate development on September 30 confirmed internet outflows of over $110 million, extending the sustained withdrawal development throughout September. Outflows normally sign accumulation, however the lack of constant inflows left value motion depending on weak demand.

Open curiosity in futures stays steady, suggesting that merchants are ready for a vital break earlier than including danger. Analysts be aware that convictions are more likely to stay stifled till Bitcoin costs safe a clear closure of over $116,000.

Emotions from basic approval are boosted

Market sentiment surged after Younghoon Kim, a public determine acknowledged for her mental achievements, declared that she transformed all her belongings into Bitcoin and referred to as them her solely hope for the financial system of the longer term. Amplified by Bitcoin Journal, the assertion attracted widespread consideration and promoted optimism on social platforms.

Associated: Shiba inu Worth Prediction: Analysts monitor reversal of resistance over volatility in October

Such assist can stimulate retail participation, however analysts emphasize that institutional flows will proceed to be the dominant driver. As soon as the inflow has settled and ETF-related headlines develop into quiet, the opportunity of a Bitcoin rally relies upon not solely on social sentiment however on technical affirmation.

Technical outlook for Bitcoin costs

Brief-term Bitcoin value forecasts spotlight key ranges. Upside’s targets are $116,000, $118,000 and $120,000, which matches past the $120,000 ceiling gross sales room to $125,000. The unfavorable aspect dangers are deep within the $113,000, $111,800, and $108,000 to $106,400 if assist is damaged.

Trendline assist is over $111,000, retaining the broader bullish channel intact. For those who do not defend this zone, sentiment will likely be bearish and you will reopen your liquidity pockets for $101,000-$104,000.

Outlook: Will Bitcoin go up?

Bitcoin outlook for October is determined by whether or not consumers can regain the $116,000 stage earlier than sellers push the value again to $111,000. Knowledge on the chain exhibits a steady whale outflow, however sentiment is strengthened by well-known assist.

Associated: Cardano Worth Forecast: ETF Accepted Odds attain 91%, Analyst Affect

So long as Bitcoin costs right this moment exceed $111,800, analysts count on the broader upward development to stay. A clear breakout of over $116,000 will bolster the case of pushing to $120,000, doubtlessly $125,000. Conversely, should you lose $111,000, your focus will return to a assist band that’s between $106,000 and $108,000. For now, Bitcoin stays in built-in mode inside the bullish cycle.

Disclaimer: The data contained on this article is for info and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version will not be responsible for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.