- Bitcoin Value has built-in close to the $120,800 resistance and targeted on $124,500 if breakout power is retained.

- On-chain knowledge exhibits web outflows of $83 million, signaling accumulation regardless of a blended September stream.

- MicroStrategy’s $77.4 billion Bitcoin holdings strengthen institutional belief and increase market sentiment.

Bitcoin costs in the present day are buying and selling at $119,996, and after an explosive rally, they merged their $120,800 resistance cluster from $111,000. This restoration has introduced BTC again to its highest stage in a couple of weeks, however it faces important testing with a 0.786 Fibonacci retracement and a descending trendline.

Bitcoin costs face resistance at Fibonacci stage

On the each day charts, Bitcoin levels a speedy rebound from the $111,300-112,000 zone, collaborating with a 0.236 Fibonacci retracement and long-term ascending trendline help. The worth is at present buying and selling at practically $120,800, with the 0.786 Fibonacci stage crossing the higher restrict of the downward channel.

The sustained close by above this ceiling paves the best way for a bullish continuation and retesting the peak of the earlier cycle, $124,500. On the draw back, instant help is $117,900 and $115,900, however there’s a danger that deeper retracement will rethink $111,000.

Momentum indicators stay constructive. The RSI was pushed into bullish territory with out getting into the over-acquired phrases, however the MACD histogram is a constructive inversion, suggesting that the the wrong way up strain is restoring its power.

Associated: Ethereum Value Forecast: Analysts Predict Breakouts as U.S. Tax-Free Improves Belief

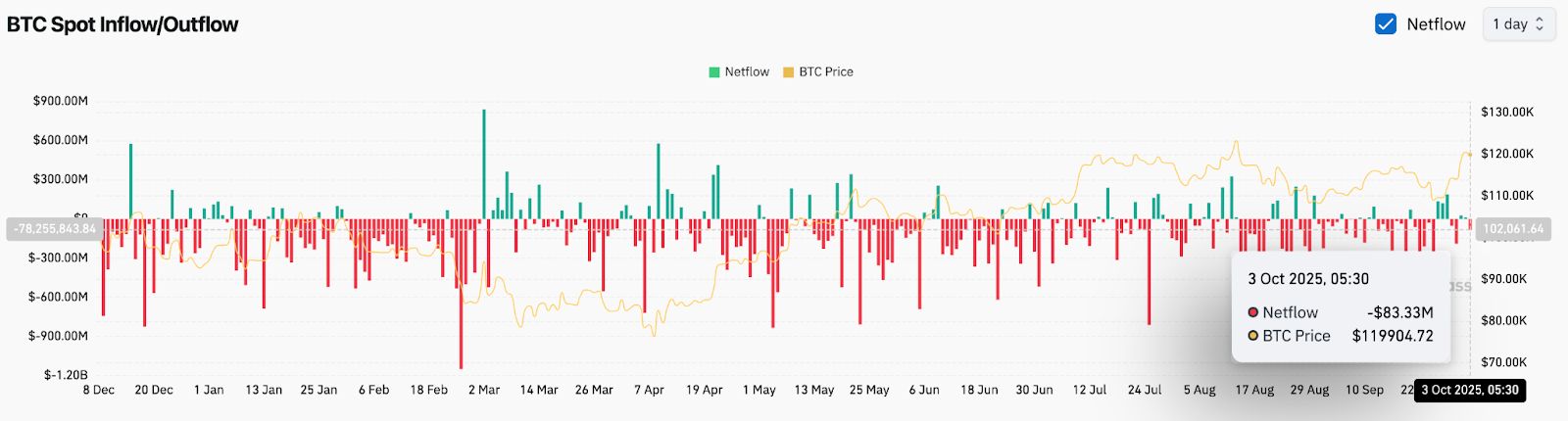

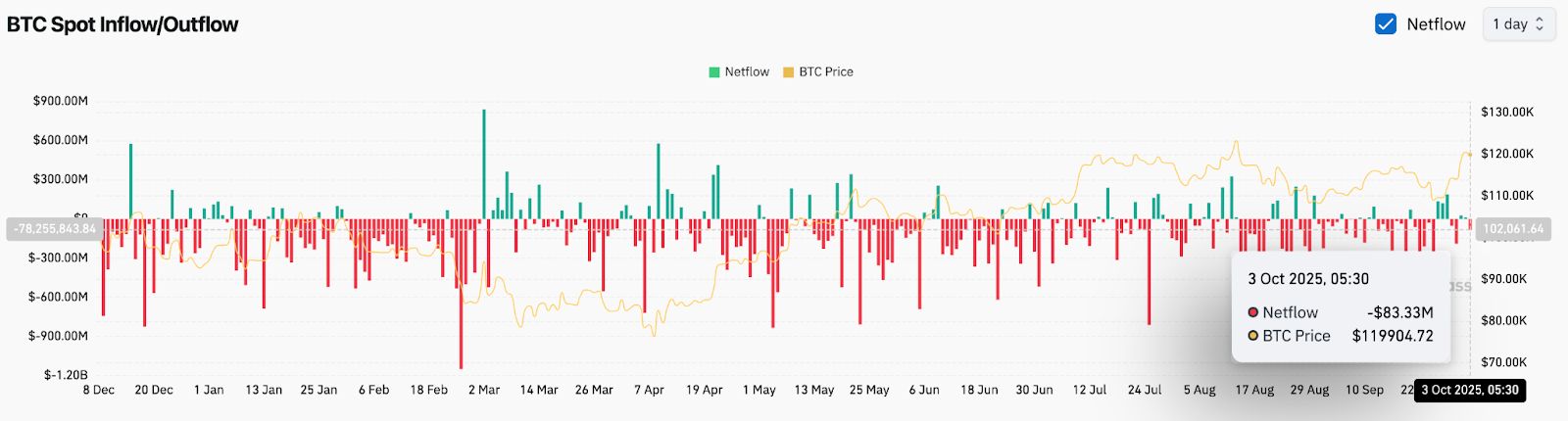

On-chain stream exhibits $83 million outflow

Change Movement knowledge highlights the location of buyers behind this rebound. On October 3, Bitcoin recorded a web leak of $83 million, marking one of many stronger each day withdrawals in latest weeks.

Outflows at rising value ranges usually point out accumulation as cash transfer to chilly storage quite than buying and selling venues. This coincides with latest spot value rallies, with merchants nonetheless positioned for additional rise regardless of their volatility. Nevertheless, the stream stays inconsistent, with alternating inflows and outflows in the beginning of September, reflecting cautious convictions amongst massive holders.

MicroStrategy Holdings Gives Institutional Coccyx

MicroStrategy’s report disclosure of Bitcoin web asset worth of $77.4 billion has created a significant basic catalyst. The corporate’s long-standing Treasury allocation has grown into one of many largest company crypto jobs in historical past, strengthening its institutional belief within the long-term worth of Bitcoin.

This growth offered an necessary tailwind for market sentiment. It highlights the rising position of listed firms in legalizing Bitcoin as a strategic reserve asset. Merchants are much like earlier cycles through which firm recruitment acts as a catalyst for larger rankings.

Associated: Shiba INU Value Forecast: Shibubulls Goal Breakout $0.00001271

Technical outlook for Bitcoin costs

Bitcoin’s technical roadmap is a effective stability between breakout potential and retracement danger. The important thing ranges are outlined as follows:

- Upward goal: If momentum continues, will probably be $120,800, $124,500, and $127,000.

- Disadvantages help: Key defence zones: $117,900, $115,900 and $111,300.

- Trendline Help: $107,200 for a deeper structural flooring.

Outlook: Will Bitcoin go up?

Bitcoin’s path to development depends upon whether or not patrons can decisively break the $120,800 barrier. Chain knowledge exhibits a wholesome outflow supporting accumulation, however MicroStrategy’s $77.4 billion holding amplifies institutional reliability.

Analysts are cautiously optimistic. A breakout above $124,500 might spark momentum at $127,000, however if you cannot maintain $117,900, your focus might doubtlessly return to a $111,000 base. For now, Bitcoin’s cycle outlook stays the identical so long as it exceeds trendline upward help.

Disclaimer: The data contained on this article is for data and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version shouldn’t be accountable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.