- Bitcoin value is holding close to $113,800 right now, with patrons defending the assist at $112,000 as volatility tightens.

- The Fed’s coverage determination relating to the tip of QT may inject liquidity, and a dovish consequence is seen as bullish for Bitcoin.

- Progress in commerce negotiations may carry BTC towards its $118,000 goal, and the Trump-Xi summit may achieve momentum.

Bitcoin value is buying and selling round $113,800 right now, exhibiting delicate weak spot after a quick rebound from final week’s correction. Markets stay nervous forward of Wednesday’s Federal Reserve coverage determination and the Trump-Xi summit, each of which may form near-term liquidity developments throughout danger property.

Consumers defend $112,000 zone as compression intensifies

On the every day chart, Bitcoin value motion is hovering across the 20, 50, and 100 EMA cluster between $112,400 and $112,800, and this zone has served as an essential pivot since early October. The decrease Bollinger Band close to $111,600 coincides with horizontal assist and is the idea for this consolidation.

The 200-day EMA is close to $108,300, reinforcing the broader uptrend construction. A sustained shut above $114,500 would verify a break from the short-term downtrend line and expose the highest of the Bollinger Bands close to $118,600. On the draw back, a decline under $111,600 may set off a retest in the direction of $108,000, the place patrons had been beforehand actively intervening.

This compression section has seen volatility scale back and merchants are positioning for a breakout as soon as macro catalysts subside. For now, Bitcoin value volatility stays subdued, however it’s poised for enlargement as a significant liquidity occasion unfolds midweek.

Fed’s QT suspension might reignite danger urge for food

The following Federal Reserve assembly is the important thing macro occasion of the week. Policymakers are more likely to finish quantitative tightening (QT), successfully halting steadiness sheet drains, based on JPMorgan Chase & Co. (NYSE:JPM) and Goldman Sachs Group (NYSE:GS).

If confirmed, this determination would inject new greenback liquidity into the system, supporting each shares and crypto property. Bitcoin has traditionally proven a robust correlation with liquidity cycles, and the tip of QT may set off new demand in each spot and derivatives markets.

Conversely, if the Fed maintains QT or tempers expectations for charge cuts, liquidity situations may tighten once more, placing strain on speculative property. Merchants can even be intently watching Chairman Jerome Powell’s tone for any indicators of how lengthy the coverage pause will final.

RELATED: Dogecoin Value Prediction: $812M Choices Surge Market Prepares for Breakout

On this context, Bitcoin value prediction continues to be tied to macro liquidity sentiment. A dovish result’s more likely to strengthen bids above $112,000, whereas a hawkish stance may pull the market again towards assist at $108,000.

Trump-Xi summit provides geopolitical dimension

Past financial coverage, the Trump-Xi summit has added one other layer to this week’s volatility. A report from U.S. Treasury officers stated the 2 leaders had been shifting nearer to extending the commerce ceasefire and had made “very optimistic” progress.

An settlement would possible enhance international danger sentiment, weaken the greenback and enhance flows into different property comparable to Bitcoin. Traditionally, durations of decreased geopolitical friction have coincided with durations of stronger crypto efficiency as buyers transfer towards higher-yielding property.

If negotiations stall or rhetoric turns into adverse, danger urge for food may quickly decline, demand for the greenback as a safe-haven asset would enhance, and speculative curiosity in cryptocurrencies may decline. This dynamic makes Thursday’s assembly a possible inflection level for near-term Bitcoin value developments.

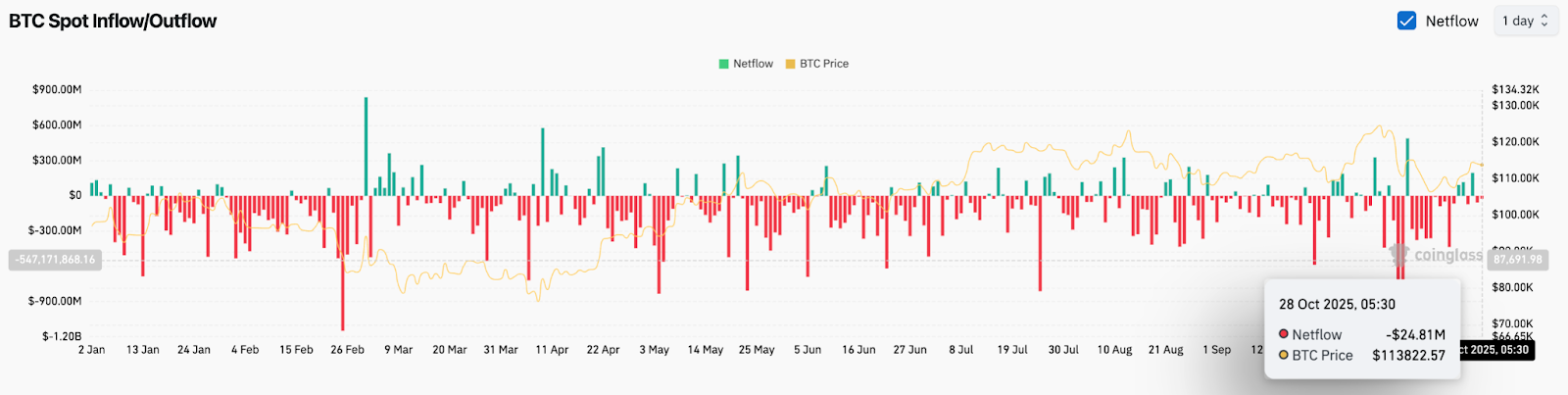

Foreign money flows present slight outflows

In accordance with information from Coinglass, web flows on spot exchanges on October 28 totaled roughly -$24.8 million, indicating average BTC outflows from exchanges. Though not important, the change means that holders are progressively shifting cash into vaults, an indication that confidence is enhancing after final week’s panicky sell-off.

Over the previous month, outflows have persistently exceeded inflows, totaling greater than $500 million. This regular withdrawal sample helps a constructive backdrop, as provide declines on exchanges typically precede value stabilization or a section of gradual restoration.

Nonetheless, general sentiment stays cautious. Funding charges and open curiosity have but to rise, reflecting merchants’ reluctance so as to add leverage forward of the Fed’s determination. Confirming a change in near-term momentum would require inflows to return meaningfully to lengthy positions.

Outlook: Will Bitcoin Rise?

The near-term outlook for Bitcoin costs will rely on liquidity cues from the Federal Reserve and the end result of the Trump-Xi summit. A dovish QT pause mixed with upbeat buying and selling headlines may push BTC in the direction of $118,000, signaling a resumption of the broader uptrend.

If policymakers delay liquidity easing or the summit disappoints, Bitcoin may revisit $108,000 earlier than patrons tighten management once more.

For now, Bitcoin value predictions stay cautiously bullish above $112,000. Merchants are watching to see if there’s a confirmed breakout or rejection from the compression zone that outlined October buying and selling. A decisive transfer in both route this week may set the development for volatility in November.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be liable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.