- Bitcoin is buying and selling close to $110,100 after BlackRock reportedly bought 18,000 BTC value $2 billion.

- The Fed’s 25bps fee minimize was a disappointment as Chairman Powell’s tone dampened danger urge for food throughout cryptocurrencies.

- Analysts have warned that if help at $109,000 fails, there will likely be a much bigger pullback, concentrating on $106,000.

Bitcoin costs, buying and selling round $110,100 right now, fell following stories that BlackRock bought about 18,000 Bitcoins value $2 billion in response to President Trump’s new commerce cope with China. The sell-off coincided with renewed weak point within the total crypto market, as merchants reacted to the Federal Reserve’s smaller-than-expected 25bps rate of interest minimize and Chairman Powell’s much less dovish tone.

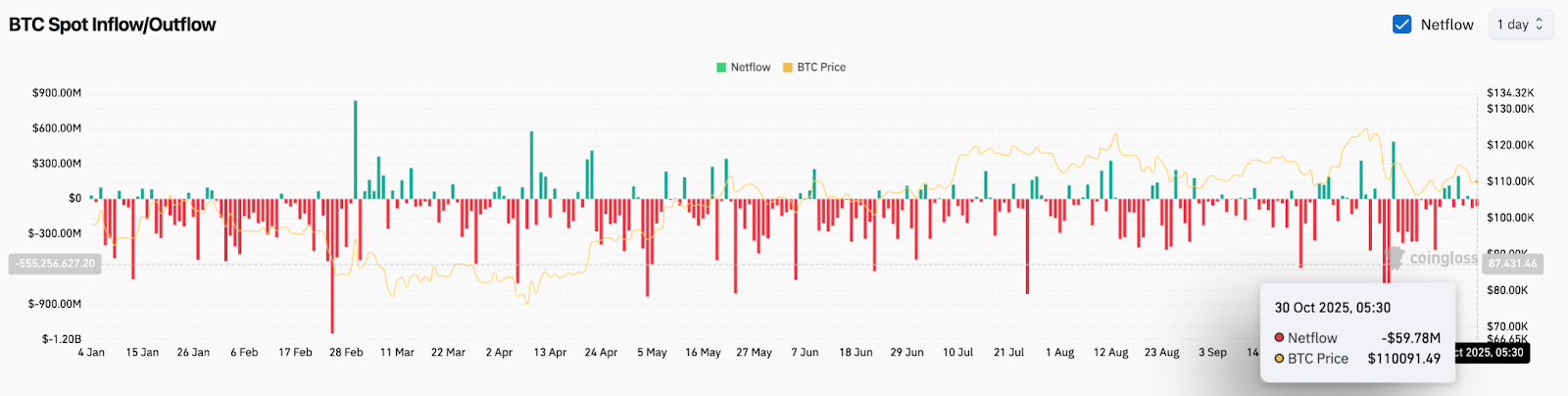

The transfer comes as monetary establishments turn into extra cautious. In accordance with Coinglass spot buying and selling information, internet outflows had been $59.7 million on October 30, persevering with the decline in liquidity for 2 weeks. Analysts say this mix of revenue taking and macro uncertainty has set the stage for a brand new take a look at of key technical help round $109,000.

BTC assessments triangle help as momentum cools

On the 4-hour chart, Bitcoin stays trapped in a big symmetrical triangle sample that stretches out from mid-October. The decrease certain of this construction is positioned close to $109,000, with resistance matching the 100-EMA close to $113,000-114,000. The 20, 50, and 100 EMAs are clustered between $111,900 and $112,200, forming a congestion zone that continues to reject any makes an attempt to maneuver increased.

Associated: Zcash Value Prediction: Zcash rally widens as open curiosity reaches yearly excessive

A clear break under $109,000 might set off a transfer in the direction of $106,800, a stage that additionally coincides with the downtrend line from early October. A break above $114,000 can be the primary sign of recent power and open room for $117,500. For now, value motion suggests a consolidation bias with a downward slope.

The RSI close to 38 highlights waning momentum and weak demand, per merchants benefiting from macro uncertainty. Momentum stays impartial to bearish until the index rises above the 50 mark.

Fed fee cuts trigger volatility, not reduction

The Fed’s 25 foundation level fee minimize didn’t raise sentiment because the market was pricing in a extra aggressive stance. FG Nexus CEO Maja Vujinovic stated the response was not stunning. “The cuts had been anticipated and it appeared very clear to me. Many in my cryptocurrency dialogue had been anticipating a modest rebound, however the market continues to fall,” he famous, including that Powell’s remarks lacked the readability that merchants had been searching for on future coverage strikes.

The lackluster response highlights how liquidity expectations, not simply rate of interest ranges, are driving Bitcoin’s near-term route. Danger belongings are struggling to draw sustained bids as Chairman Powell has signaled there will likely be no additional fee cuts anytime quickly.

BlackRock sale places strain on institutional sentiment

A viral put up by market commentator @CryptoNobler revealed that the BlackRock pockets offloaded 18,000 BTC in latest periods. The commerce has been tracked for a number of hours and is likely one of the largest institutional purchases since mid-year. The timing, on the heels of President Trump’s signing of the China commerce deal, has heightened hypothesis about capital reallocation to conventional belongings that profit from the geopolitical thaw.

Though not confirmed by BlackRock, on-chain information is per a rise in gross sales quantity from giant wallets. The scale of the trades, mixed with an already cautious macro place, weakens confidence in near-term value stability.

Technical Outlook: Will Bitcoin Rise?

For now, Bitcoin value predictions stay cautious. Market construction favors consolidation inside the present triangle, however there’s draw back danger if help can’t be maintained. If the closing value is confirmed under $109,000, losses might speed up in the direction of $106,000 earlier than the bull market resurfaces.

Associated: Cardano value prediction: ADA danger breakdown as $25 million outflow collides with Laios milestone

For sentiment to vary, Bitcoin must regain $114,000 and shut above the 100-EMA with clear quantity affirmation. This indicators renewed curiosity from institutional buyers and can probably push it again to $118,000. With out this restoration, markets might proceed to say no as merchants ease their publicity to world uncertainty.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be answerable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.